The big monthly US jobs report will be released tomorrow (April 5) at 8:30am. Along with most of Wall Street—economists expect 200,000 jobs were created—we’re pretty optimistic.

True, the margin of error on the US job report is ridiculously large—roughly 100,000, meaning that if the Bureau of Labor Statistics (BLS) reports that 200,000 jobs were created last month, the real figure could be anywhere between 100,000 and 300,000. In other words, we could get a disappointing number tomorrow even if the economy is actually doing quite well. (It’s the trend over several months that matters.)

Still, the markets will likely ignore a mildly disappointing number a bit, since it doesn’t square with the lion’s share of other recent readings. Here’s why everyone is so excited.

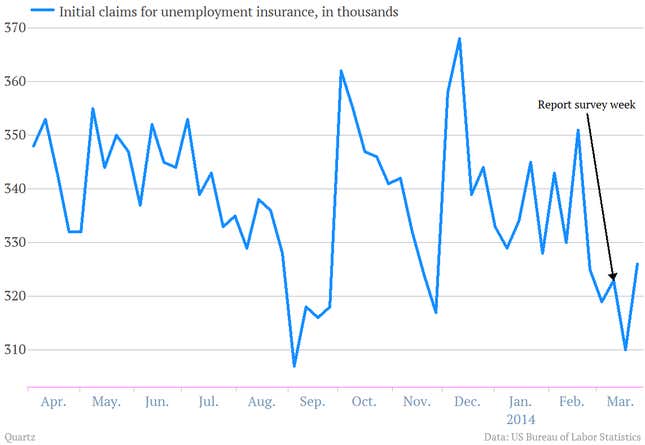

Jobless claims

Weekly unemployment insurance claims for the “reference week” in March—the week on which surveys for the jobs report are based—were pretty low at 323,000. That means the job market was probably in pretty good shape. Jobless claims spiked to 368,000 during the reference week back in December, and for that month only 84,000 new jobs were created. Morgan Stanley economists write that jobless claims are at “a level that historically has been associated with payroll job gains well over 200,000.”

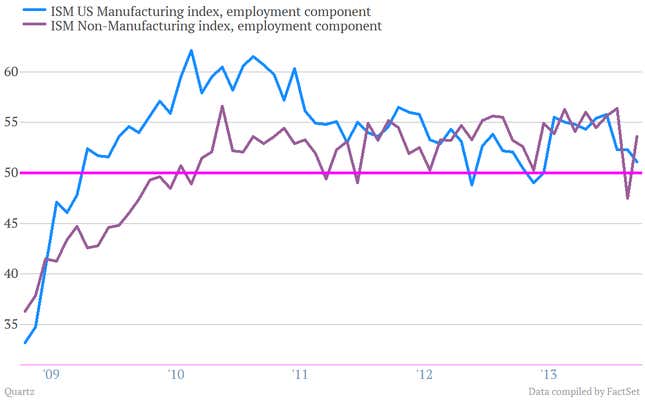

March ISM surveys

Definitely a plus. The employment components for the Institute for Supply Management’s survey of both manufacturers and non-manufacturers are in positive—above 50—territory. After the non-manufacturing reading dipped below 50 in February, this is very good to see, since services account for a much larger share of US jobs than manufacturing.

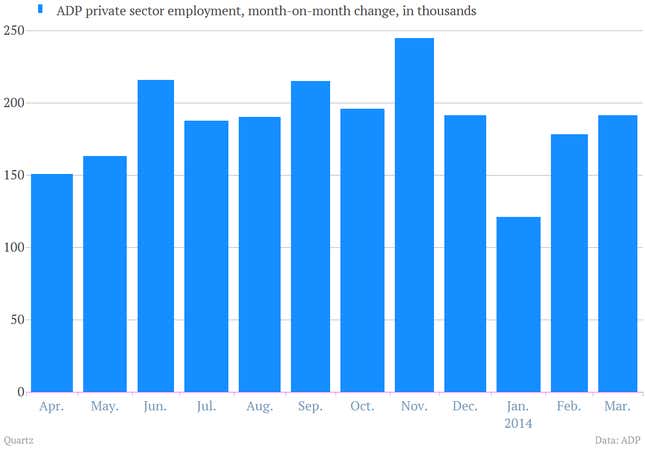

ADP’s private-sector jobs gauge

ADP’s own estimate of jobs created, which always comes out two days before the official BLS report, doesn’t do a great job of predicting the exact number of jobs created. (How could it, when the BLS itself has a 100,000 error margin?) By itself the ADP reading of 191,000 is no reason to be wildly bullish. But it is worth looking at as a gauge of the general trend, and it improved in March, consistent with the improving tenor of economic data elsewhere.

Help wanted ads are still solid

The Conference Board’s reading of online help-wanted advertisements did decline slightly in March, but it’s still hovering around the highest levels of the recovery.

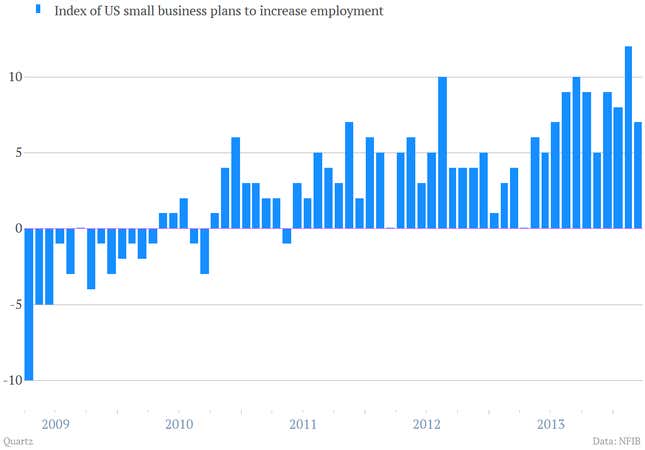

Small business softness

Another piece of economic data that’s less encouraging: The index of small business hiring plans by small-business lobby group NFIB slipped in March. But we wouldn’t worry too much about that. It hit a post-crisis peak in February, and March was still a very healthy reading by recent standards.

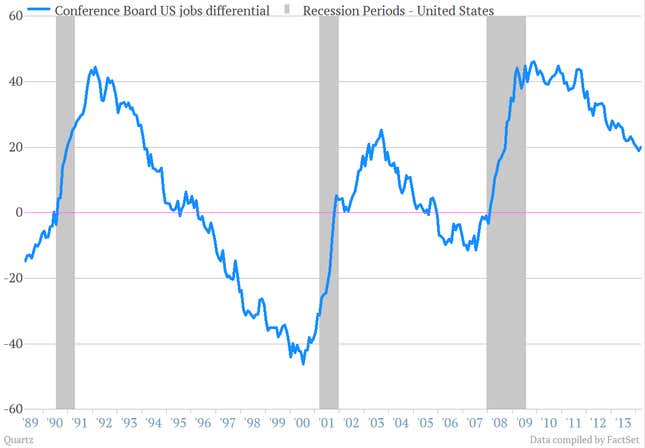

The jobs differential

Here’s one trend that’s not super optimistic. The jobs differential is basically the difference between the number of people who said jobs were “hard to get” and those who said jobs were “plentiful” in a monthly survey by the Conference Board. It’s considered a pretty good indicator of the job market’s health. The reading has been falling—a good sign—pretty steadily for months, and in February it dropped below 20 for the first time since the collapse of Lehman brothers in 2008. But in March it rose again a bit. And while we’re still a long way from worst moments of the recession, people still feel jobs are about as hard to get as during the worst of the “jobless expansion” of the early 2000s.

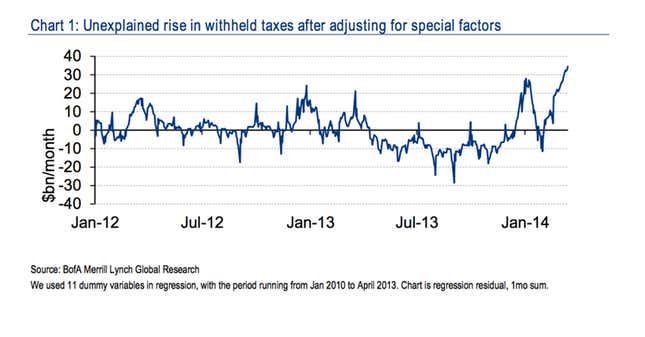

A suspicious rise in US payroll tax witholdings

We spotlighted this before, but one of the reasons people are so optimistic is a surge in the amount of money US authorities pull out of paychecks—for Social Security, Medicare and federal income-tax withholdings—because it’s a sign the paychecks themselves got fatter. Bank of America analysts wrote “the underlying increase in wages and salaries indicates either an increase in the numbers of employed persons, or an increase in cash compensation rates.” Since wage growth has been relatively muted, we’re betting additional hiring is the reason behind this.