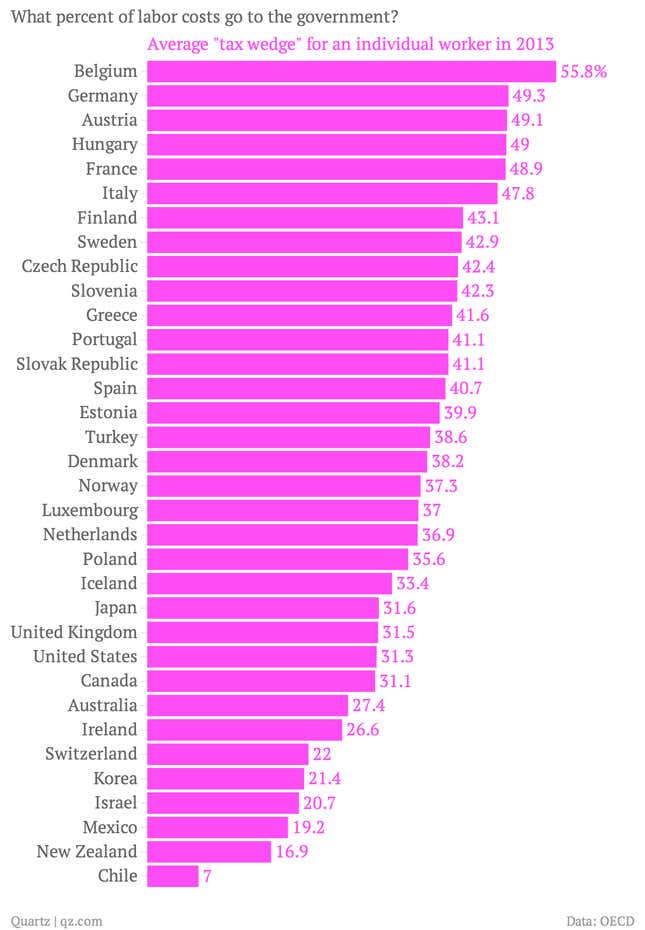

Belgium skims the biggest share of labor costs for its public coffers among the wealthy countries, snapping up more than half. Chile takes the least, at 7%, while the US weighs in with a below-average 31.3%:

These are the findings of a new OECD report on wages. The top-line number, the so-called “tax wedge,” is the difference between the total labor costs paid for a worker by an employer (including benefits) and how much the government collects. The latter portion includes what the worker has to pay—income tax and social security contributions, broadly defined—but also what the employer has to pay for social security. That means the percentages above will look slightly higher than what is actually taken out of the average paycheck.

While we typically care most about how much money is coming out of our paychecks, it’s important to keep track of total employer costs too, because they affect hiring decisions—that’s why the United States briefly cut employer social security contributions to spur hiring after the financial crisis. But keep in mind that while the tax wedge is part of the hiring question, it’s not independent of the rest of the economy: In nations with higher costs of living, people seem to expect more generous public benefits, which means governments ask for more tax revenue.

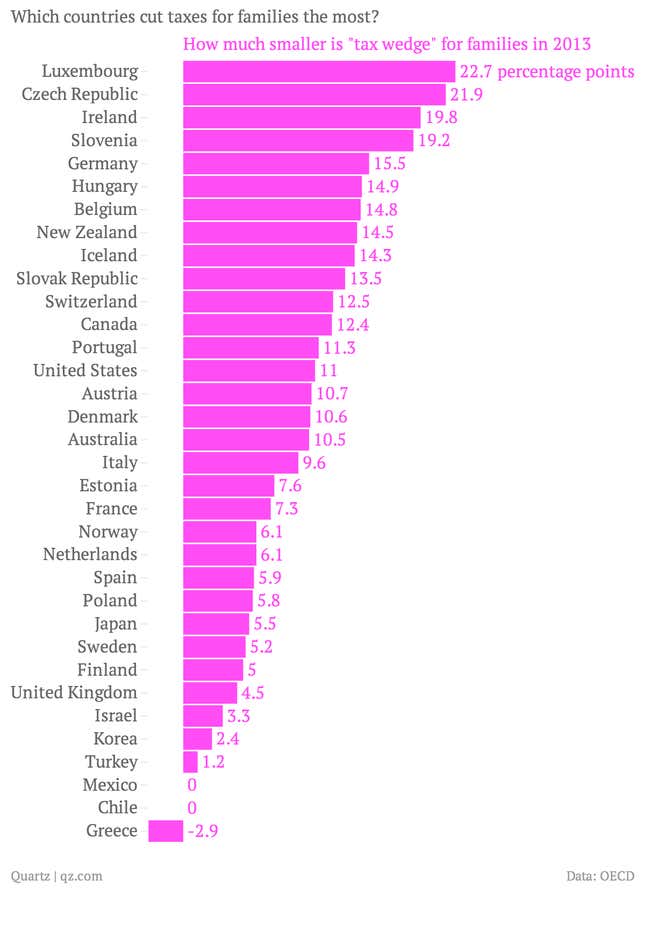

One other bit of data revealed by this report is which countries offer a reduced tax wedge for families, as compared to individuals. Luxembourg treats families the best, giving them a nearly 23-percentage-point break on their labor tax burden, but Greece goes the other way, and actually charges families more: