There are a few big new players in Silicon Valley’s funding frenzy.

Large institutional investors like Fidelity, T. Rowe Price and BlackRock are an increasingly appearing alongside the venture capital firms that traditionally bet on promising young tech entrepreneurs.

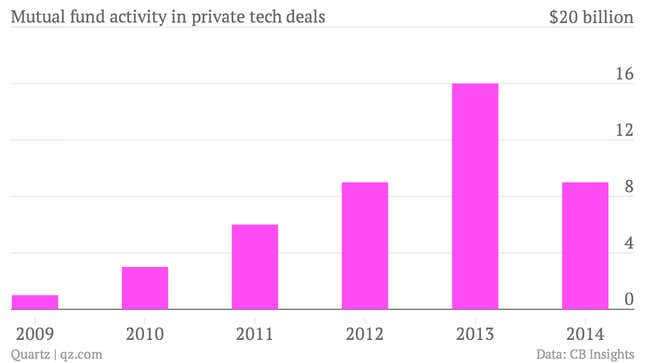

In the first three months of the year, mutual fund companies, which typically invest in tech deals when they debut in the stock market through initial public offerings, have poured $9 billion into private tech deals. That puts them on pace for a blockbuster amount of activity in 2014. Last year, they invested a total of $16 billion in such deals, according to CB Insights, a data provider on venture capital deals.

Earlier this month, traditionally staid investors like T. Rowe Price and Fidelity were among the entities reportedly considering pouring money into Airbnb, the popular online home-rental service. According to earlier reports, Airbnb had been in discussions to raise $400-$500 million (paywall).

T. Rowe and Fidelity have been some of the most visible institutional players on the scene. T. Rowe’s New Horizons and Growth funds made early investments in Twitter. Managers at the firm have trained their sights on lesser-known companies, like business-focused software company ODesk, online retailer Wayfair and cloud-based business data platform Domo. (A T. Rowe spokesperson declined to comment on the fund’s deals via email.)

Meanwhile, Fidelity last year led a $225 million funding round for social media scrapbook Pinterest, reportedly valuing the company at $3.8 billion. BlackRock, another big investor that manages mutual funds for average folk, recently led a $250 million round for online storage company Dropbox, which is eyeing a public offering of its stock sometime soon.

What’s going on here?

Well, venture capitalists and bankers say companies seem to be waiting longer before offering shares in the public markets. That means they tend to have bigger pre-IPO operations, and need more cash to keep running. ”It’s pretty easy to see that companies are staying private longer than they used to,” said Andrew Boyd, head of global equity capital markets at Fidelity. ”We’re seeing that there’s a big gap in funding being filled by investors that are willing to take the risk of a pre-IPO investment.”

But the big funds are likely also motivated by good old-fashioned greed. Sam Hamadeh, founder of financial data firm PrivCo, says it’s a worrying sign of the bubble-like fervor around the tech sector. “Mutual funds investing in startups pre-IPO may be another sign of frothiness in the market,” Hamadeh noted.

And the excitement around the tech sector—albeit tempered by a recent sell-off—might increase the risk of investors betting on the next big thing. For instance, T. Rowe and Fidelity both invested in app creator Slide in 2008. But when the company was eventually sold to Google, the returns for the funds were nothing to write home about.

Of course, the money mutual funds risk losing on these bets is small compared to their overall portfolios. But making bad investments can still harm their reputations, and their injection of even more money into the tech sector could help inflate the bubble further. For its part, Fidelity says it tempers the risks by focusing on companies that are in later stages of development. That probably minimizes potential returns, but also cuts the risks. ”We’re not in a garage with a guy with an idea on a napkin,” Boyd said.