There’s a lot of scary noise out there about US student loans, which now account for the largest chunk of non-mortgage consumer debt in the US. And yes, student debt is rising.

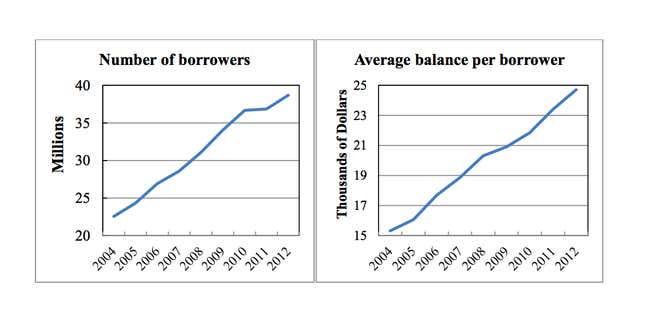

Between 2004 and 2012, the number of US student borrowers rose by 70%, from 23 million borrowers to 39 million. The average amount they each borrowed also increased by 70%, from $15,000 to $25,000. And when you exclude the people who had no debt at all, the average owed on graduating with a bachelor’s degree in 2012 was $29,400. (That’s according to the National Postsecondary Student Aid Study, which is conducted every four years by the US Department of Education. Data from the study is analyzed by the New America Foundation here.)

Sure, debt of close on $30,000 sounds like a lot. (Vox.com notes that that’s a monthly payment of $312 on a 10-year payment plan.)

But those are averages. And averages, as everybody knows, mask wide variations. Moreover, that $29,400 debt is just the average among those that had debt. While nearly seven out of 10 bachelor’s graduates do, that figure doesn’t represent the financial position of more than 30% of those graduates. (If we’re considering the future of an entire generation, the fate of nearly a third of the group is worth considering.)

The New America Foundation included a percentile breakdown of total debt among all those receiving bachelor’s degrees in 2012 (i.e., including those with no debt). The median debt load—which mutes the impact of very large and very small borrowers—was $16,900 in 2012, which looks a heck of a lot more manageable than $29,400.

This also gets at a larger issue in the student debt debate: A relentless fixation on high-debt horror stories. The fact is, very high levels of debt in the multiple hundreds of thousands of dollars are quite rare: A new report on student debt from the Federal Reserve Bank of New York has this to say on the subject:

Of the 39 million borrowers, about 40% have balances of less than $10,000. Approximately another 30% owe between $10,000 and $25,000. Only 3.7% of borrowers have balances of more than $100,000, with 0.6%, or roughly 230,000 borrowers nationwide, having more than $200,000 of debt.

The real problem in the world of student debt isn’t these stories of outrageous debt loads. After all, the biggest borrowers are typically those preparing to be doctors, lawyers and other professionals who make some of the best salaries and are best able to pay off their loans.

No, the larger issue is those who borrow more modest sums, but can’t complete their degrees. They can face much worse financial strains. By and large, even though it’s getting more expensive, student debt is still worth it, if you get a degree. If you have to drop out, that’s when debt becomes really scary.