A new report shows that Americans are less and less likely to be able to walk to a branch of their banks. Large financial institutions in the first quarter of this year continued to deemphasize bank branches, in light of customers increasingly relying instead on their smart phones and online banking for transactions, and using cash less.

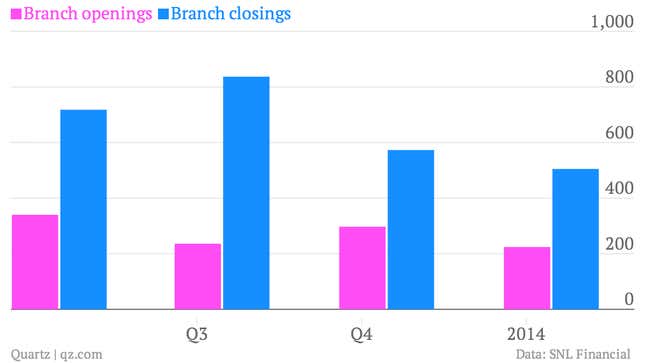

We’ve talked about the disappearance of brick-and-mortar branches before, and the trend continues. Banks closed a total of 281 branches in the US in the first three months of 2014, according to research from SNL Financial. The reduction represents roughly 2% more total closures in the bank branches than last year, according to SNL.

Branch closings play a major role in banks’ strategic thinking about dealing with customers. “People effectively carry a branch in their pocket,” Bank of America CEO Brian Moynihan, said during the firm’s most recent call to discuss results with analysts. Moynihan made similar comments last quarter when he noted that “the definition of a branch is changing from what you’d traditionally think.”

SNL’s report indicated that more customers are seeing their financial needs met online, rather than at brick-and mortar branches.

Bankers and analysts say that more customers every quarter get more of their banking needs met online or via mobile devices and, as a result, fewer walk into physical branches. That provides banks reason to downsize or close underperforming branches.

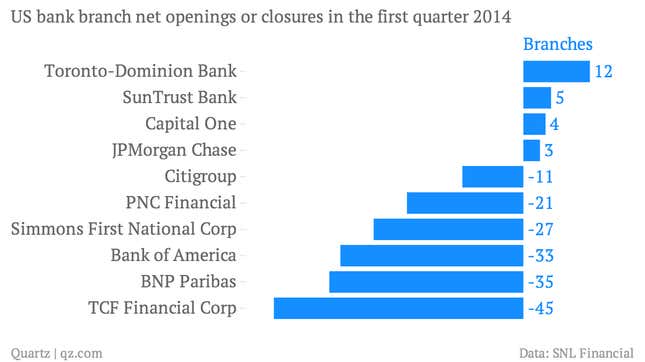

That realization seems to be at play at JPMorgan Chase, which has been reducing the physical size of its bank branches. Bank of America saw one of the highest number of net branch closures (i.e. more closures than opening of new branches) among the major banks, with 33 branches closed. Other smaller banks closed branches, while some banks (JPMorgan, Capital One, Citigroup and Canada’s Toronto-Dominion Bank) bucked the trend by opening a handful more bank branches in the first quarter.