Chinese pork producer WH Group pulled a much-anticipated $1.9 billion IPO this week, citing “deteriorating market conditions.” What this really means is “we couldn’t raise the money we expected,” and now the recrimination and finger-pointing has started.

How is it possible that a well-regarded company that produces pork, a product China can’t seem to get enough of, couldn’t go public in Hong Kong, a market where a number of Chinese companies have been successful?

The aborted IPO had a record-breaking 29 banks and brokerages signed up as underwriters, so there is a lot of blame to go around. The banks “were too confident, and even a bit arrogant,” one WH Group insider told the South China Morning Post. Bankers were “were worried to tell the truth to the company and just said what the client wanted to hear,” someone briefed on the deal told The New York Times.

While Morgan Stanley, UBS, Bank of China, and Goldman Sachs took the lead role, all 29 bankers were talking up the deal in the weeks beforehand, causing confusion, investors said. “I am getting calls from different banks for the same deal,” a Hong Kong-based hedge fund manager told Reuters a week before the IPO was scheduled. “Do I place my order with one of you guys or eight of you guys? That’s one of the reasons why I also haven’t really placed an order. I am not sure what to do here.”

Hiring a sprawling teams of banks for an IPO is increasingly common, particularly among Chinese companies listing in Hong Kong. China Galaxy Securities had 21 when it went public last May, for example. These banks say that they can bring additional investors to the table, and convince them of a company’s bright prospects as a publicly-traded firm. This means that the newly-listed firm will raise more money in the IPO and benefit from a robust, rising valuation in subsequent trading.

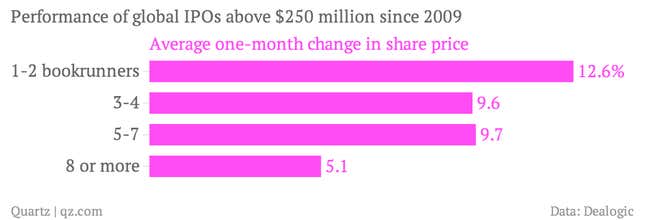

But there are diminishing returns to adding more advisers to an IPO team, according to Dealogic data. In recent years, companies with fewer advisers (also known as bookrunners) have performed better one month after going public:

It turns out the more bankers you add, the worse your share price performs shortly after an IPO. WH Group is considering coming back to the market when conditions improve, bankers say. Next time, it probably won’t ask for so much advice.