Among the many businesses in Alibaba’s empire is Aliyun, its cloud-computing service. (“Yun” means “cloud,” though it also happens to be Alibaba founder Jack Ma’s first name in Chinese.) The company has expressed ambitious plans for it: Even as both IBM and Amazon unveiled cloud services in China last December, Alibaba said that it was taking its cloud business global, with its sights set on either the US or Southeast Asia. But up to now, little else has been known about how much firepower Aliyun brings to the rapidly intensifying battle for the cloud.

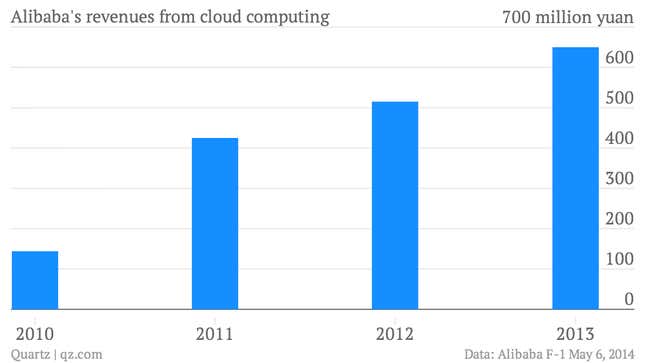

Now we have a few more clues. The picture gathered from Alibaba’s IPO filing, which it submitted yesterday, is of a still-small business that’s growing pretty fast. It claimed more than 980,000 “direct and indirect” cloud computing customers. Its cloud business contributed 650 million yuan ($105 million) of revenue in the year ended March 2013—a 26% increase on the previous year, though a drop from 2.6% to 1.9% of Alibaba’s total revenue.

Direct comparisons are hard to draw because other companies aren’t very transparent about their cloud businesses. Amazon made $3.7 billion in “other” revenue in 2013, which includes its cloud division, Amazon Web Services, but also other things. This also makes it hard to tell how fast those businesses are growing. All the same, it’s clear that Aliyun is a relative minnow; specialized cloud service Rackspace reported $1.5 billion in revenue for 2013.

It’s also unclear whether Aliyun is profitable. Though Alibaba recorded 8.7 billion yuan in net income in the year ended March 31, 2013—an 85% increase on the previous year—it didn’t break down profits by business division.

But shriveling margins are a fact of the business. In the grander cloud conquest, we’re currently amidst a price war, as Quartz recently reported, and the incumbents are putting market share before profitability. For instance, Amazon—the market leader by a mile, with five times more capacity than the next biggest 14 competitors combined—has slashed cloud prices 42 times since its launch.

If Alibaba’s knack for shrewd pricing strategies (paywall) is any guide, it can still be a contender. It said in the filing that it “will continue to invest heavily” in its cloud-computing platform. But pricing or technology won’t be the only things Aliyun can use to its advantage; trust is a factor too. While some Western firms may view it with suspicion—remember the scares about Chinese government influence over Huawei and ZTE—it has a huge and growing potential clientele of Chinese companies that, like Alibaba itself, are expanding abroad. In the wake of Edward Snowden’s revelations last year about US government surveillance, they may prefer a homegrown cloud provider.