This article has been updated.

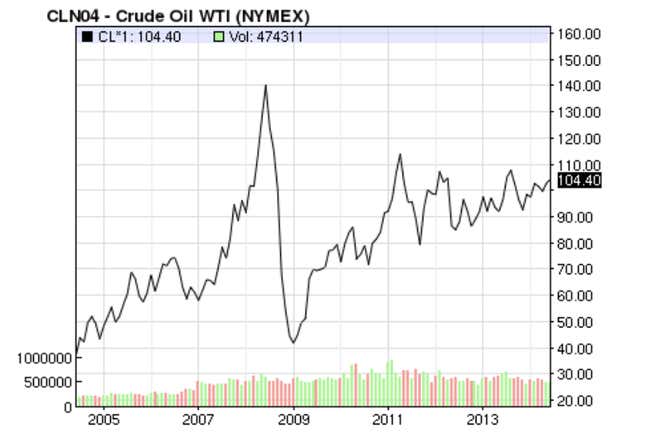

The upheaval in Iraq threatens to exacerbate a three-year-old trend in which unusual geopolitical disruptions have become the new normal. A key impact—high oil prices when analysts say bulging new supplies should be sending them far lower.

That is because much of the geopolitical turmoil has been in or involved oil-producing countries. “We are witnessing the failure of the petro-state,” Citigroup’s head of commodity research, Edward Morse, told Quartz.

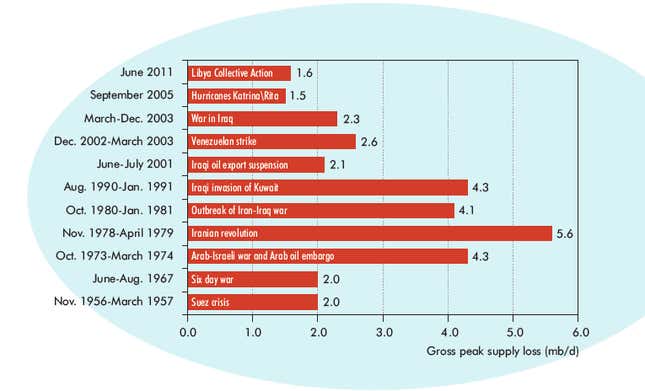

Up until 2011, an average of 500,000 barrels of oil a day was off the market at any one time for maintenance and other reasons, a volume that triggered no perceptible price volatility. Temporary aberrations like Hurricane Katrina took 1.5 million barrels off the market in 2005, and the 2003 attack on Iraq removed 2.3 million barrels a day.

But starting in 2011, the disruptions often began to exceed 2 million barrels a day. Among the culprits were the Arab Spring and follow-on uprisings, the chaos in Nigeria, Iran sanctions and of course Russia president Vladimir Putin’s crypto-invasion of Ukraine.

Then last July, Libyan militants stormed oil export facilities and shut them down. As of now, the country pumps just one-eighth of the 1.6 million barrels of oil a day it produced before Muammar Qadhafi’s ouster in 2011. All in all, about 3.5 million barrels of oil a day have been off the market around the world since last fall. Those barrels have offset a 1.8 million-barrel-a-day surge of supply from the US.

As a consequence, oil prices have continued to soar. And this increase has been exacerbated recently by China’s record-setting hoarding of oil.

If it wasn’t for the disruptions, many analysts say prices would decline well below $100 a barrel.

Morse said Citigroup bakes 3 million barrels a day of disrupted oil into its forecasts as a matter of course. It is hard “to predict the challenges making for state failure,” he said, but he expects the new state of play to last a generation.

Oil research firm IHS’s analyst Jamie Webster believes the level of oil disruption will gradually tail off over the coming decade or so, settling at a still-elevated norm of 1 million to 1.5 million barrels a day off the market.

The direction of events in Iraq suggests reinforcement of this trend. Militants from an al Qaeda offshoot known by its acronym ISIL appear to be marching on Baghdad (paywall) while also working their way into a possible battle with autonomous Kurdistan. (Kurdish peshmerga forces today took control of Kirkuk, the Kurdish capital, as the Iraqi army fled, setting the stage for a possible clash with ISIL.) Baghdad has been requesting US bombing raids to push them back and the Eurasia Group says that the Shiite-dominated south—home to the majority of Iraq’s oilfields—is likely to put up a far fiercer fight than Mosul. Though that means ISIL may not actually capture the fields, the danger of disruption (paywall) remains.

Correction/update: An earlier version of this article referred to the al Qaeda offshoot in Iraq as ISIS, which was then changed to ISIL, for the Islamic State in Iraq and the Levant. In fact, the group is referred to by both names. A reference was also added to the Kurdish takeover of Kirkuk.