This post has been updated.

What types of loan applicants are the most likely to repay in India? Are the most successful entrepreneurs risk-takers, innovators, or optimists?

A great challenge lenders in India face is in assessing the risk involved in extending loans to micro, small and medium enterprises (MSMEs). Such companies are a large part of India’s industrial landscape—85% of Indian manufacturing happens in companies with less than 49 employees. And yet, such enterprises, especially the smaller ones, often don’t have continuous documentation of banking and credit histories and other records or good quality collateral that traditionally help lenders assess risk.

Our organization, the Entrepreneurial Finance Lab (EFL), solves this problem by helping lenders adopt a different approach—assessing risk by creating a psychometric profile of a borrower. Our data and experience around the world show unambiguously that personality is a pretty good predictor of how likely a person is to repay loans.

Our partners across India have administered our psychometric credit assessments in over 15 Indian states. We have analyzed over 10,000 applicants’ characteristics in relation to default behaviour specific to the local lending market that caters to the MSME segment. This allows us to define some characteristics of what makes a good borrower in the Indian MSME market.

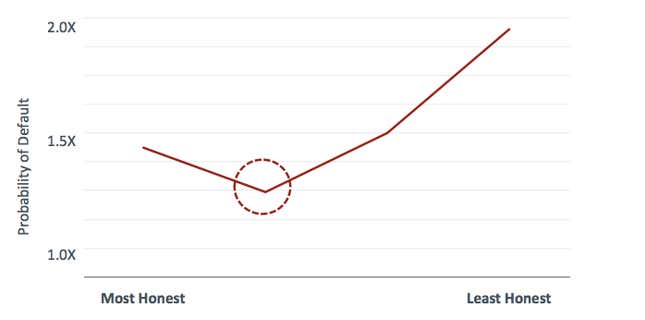

The most honest borrowers are not necessarily the best borrowers.

Honesty is measured through a series of indirect questions like “What percentage of employees steal from their managers?” EFL gauges an applicant’s level of honesty by better understanding the applicant’s perception of his/her surrounding environment. In general, we find that honest applicants believe they are living in an honest world whereas dishonest applicants believe they are living in a dishonest world.

Data shows that applicants who are largely honest, but have a small level of dishonesty are least likely to default. While being honest implies that a borrower cares about repaying, a small degree of dishonesty ensures that the borrower is not exploited while running his/her business.

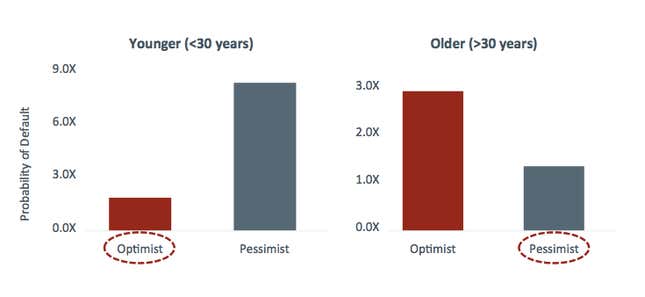

Younger optimists and older pessimists have the lowest default risk.

Data shows that younger optimists and older pessimists are least likely to default. Young business leaders likely need an optimistic outlook to persevere through the challenges of entrepreneurship while older self-employed individuals who are more skeptical and realistic about the market challenges are more successful.

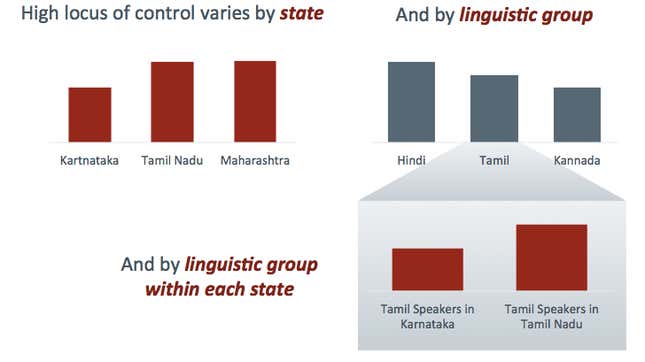

Local culture matters.

Levels of psychometric characteristics that are directly related to default vary by state, linguistic group, and linguistic group in each state. In order to best understand an applicant in India, a lender must consider that borrower within the context of their state, linguistic group, etc. We have found that “locus of control”, a concept we use to indicate how strongly a borrower sees himself as responsible for future outcomes, is a strong predictor of credit risk. Across India, having a strong locus of control means you have a low credit risk profile.

However, the absolute range of locus of control varies by population. For example, a high level of locus of control in Karnataka would be considered a low level of locus of control within Tamil Nadu. This example is only meant for illustration. EFL does not factor in location or language into its scores.

Lenders who analyze a borrower’s character are best equipped to succeed in acquiring new clients with the highest potential and lowest risk.