The era of middle-aged baby boomers living out their youth fantasies by riding Harley-Davidson motorcycles appears to be drawing to a close.

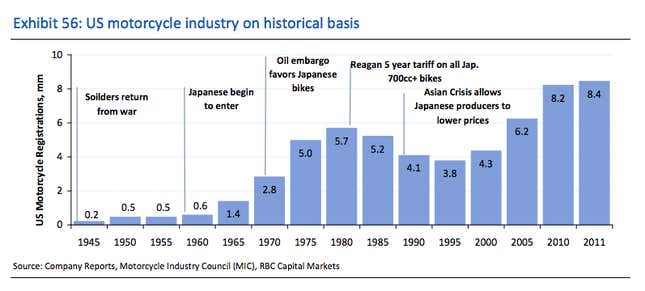

The iconic motorcycle manufacturer, which has been around for more than a century and found its footing as a supplier to the US military during the World Wars, has been a terrific investment since its IPO in 1986, rising by nearly 16,000% and easily outperforming the broader stock market. In many ways, the Harley is one of the ultimate symbols of the baby boomer generation (and of the midlife crisis).

But now, demographic shifts could lead to a secular decline in motorcycle ownership, which poses a challenge for the company.

RBC Capital Markets put out a detailed note on Harley-Davidson this morning, arguing that a combination of aging among baby boomers and less desire in younger generations to buy motorcycles could present a risk to future sales.

Despite making relatively expensive bikes, Harley is the dominant player in the US motorcycle industry, with about a 36% share of the overall market and more than a 50% share in the heavyweight (601+ cc) market. But the demographics look stacked against the company, going forward: According to RBC, 65% of the company’s revenue came from white men aged over 35 last year. While those customers are extremely loyal (80% of them signaled an intent to buy another Harley in the future), they are also shrinking much faster than the rest of the population.

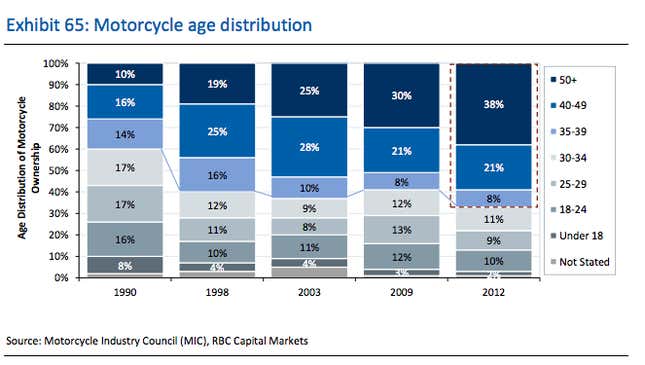

Overall, motorcycle owners are getting older.

The boomer generation’s population is expected to decline by as much as 20% by 2030. Older boomers are going to be less likely to afford motorbikes, let alone ride them. There are fewer Generation X Americans than boomers, and all younger generations are more financially challenged, so even if they were to consider buying a motorcycle, it might be a cheaper model from one of Harley Davidson’s competitors.

The company has an outreach and advertising program, seeking to appeal to younger, non-white, female, and urban consumers. ”There are plenty of young adults out there with gas and oil in their veins,” Michael Lowney, the company’s outreach director, says on the brand’s website. “We set out to completely change their perception of Harley-Davidson, while still delivering everything they expect from the brand.”

As to whether those efforts can defuse the ticking time bomb of demography, RBS analysts have some doubts: “It remains unclear if Gen X (or even future generations) are as predisposed to motorcycles as baby boomers,” they write.