At the best of times, Brits find it hard to talk about much beyond house prices and the weather. But the country’s turbo-charged property market, particularly in London, has pushed grumbling about the rain out of casual conversation of late.

In fact, when the Bank of England’s governor, Mark Carney, presented the bank’s latest biannual Financial Stability Report today, the housing market was only topic of conversation. The recent surge in prices was pushing “the limit of our tolerance,” Carney said.

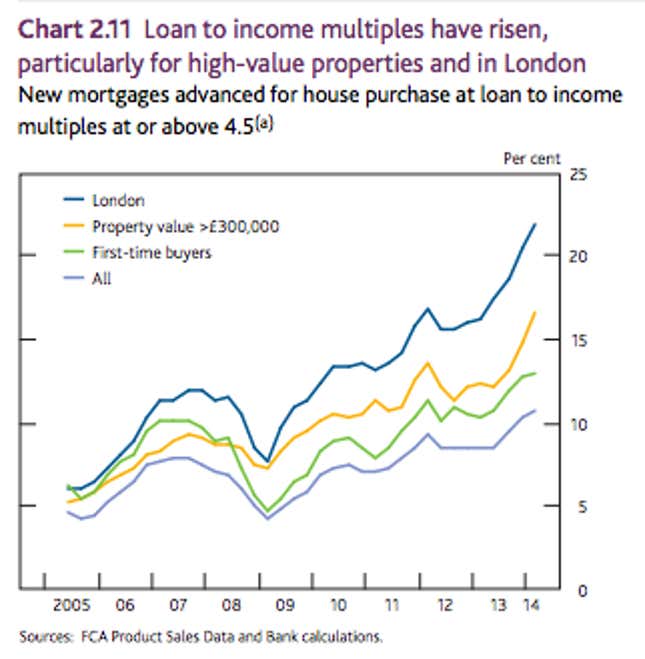

In response, the bank unveiled new measures to limit mortgage lending, most notably that banks must cap their share of the riskiest sort of loans. Starting later this year, no more than 15% of a bank’s new loans can be worth more than 4.5 times a borrower’s income, and these mortgages will also be excluded from government subsidy programs. Similar rules to limit indebtedness, with some success, have been applied in Canada, Hong Kong, New Zealand, and elsewhere, the bank noted.

However, only around 10% of new mortgages in the UK are currently over the loan-to-income limit (see chart), so the changes will bite only after house prices rise some more. The bank expects the average British house to gain 20% in price over the next three years, versus a 10% gain over the past three years.

The gains in London have been much bigger than this, so the new rules will have the biggest impact there, especially for first-time buyers with lower incomes. (Sorry, 20-something Londoners!) But while the new measures will eventually crimp some of the riskier home loans in London, the very top of the market is driven by cash purchases, so the loan limits won’t make much difference there.

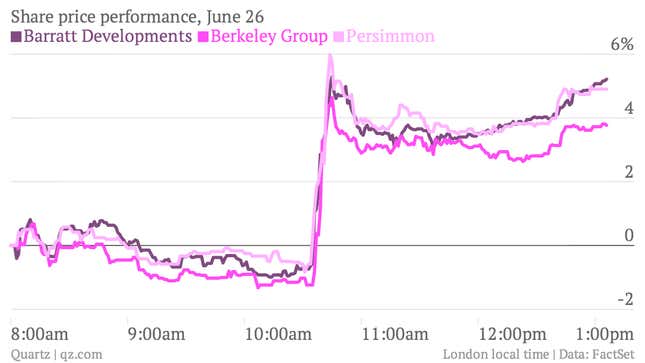

Overall, then, it seems that British officials are comfortable giving the country’s property market more room to run. And investors in some of Britain’s major property developers evidently took the governor’s remarks to mean that the party is far from over: