It’s time somebody said it. More than a half decade after the official end of the Great Recession, the US economy is the best we’ve seen in years. Allow us to offer you a chart-based, whirlwind tour.

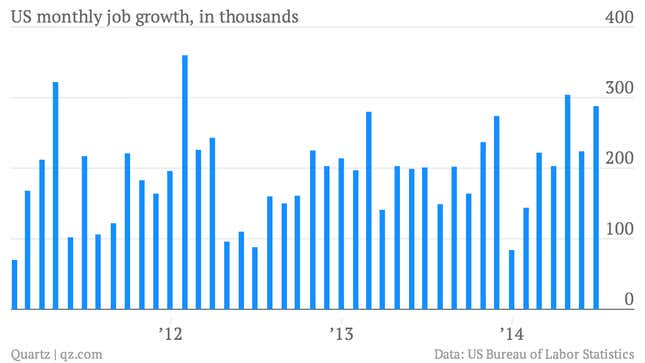

Jobs

The US has strung together five consecutive months of more than 200,000 new jobs, something the economy hasn’t done since the late 1990s.

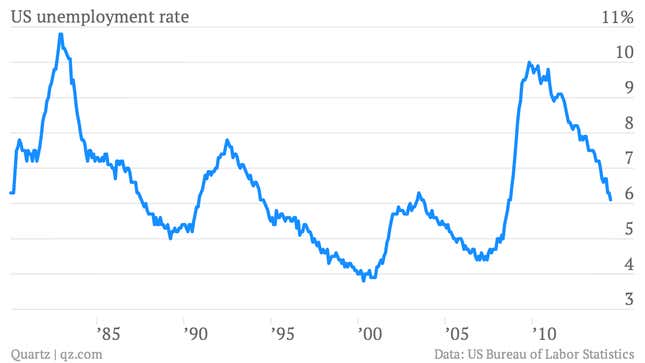

Unemployment

The jobless rate has fallen sharply in recent months to 6.1% in June. The decline occurred even amid large growth in the labor force. In other words, the rate is falling for the right reasons.

Job openings

There are a lot more jobs available too. The monthly JOLTs reading on the number of job openings hit a seven-year high of 4.6 million in May, the most recent available data.

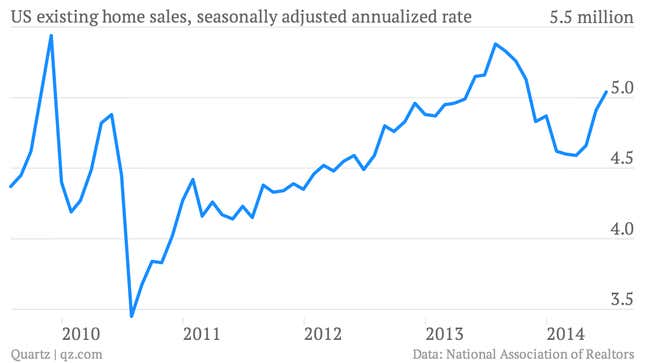

Housing

After a sharp slowdown earlier this year, US home sales are picking up again. Sales of new owned homes hit 5.04 million in June—the highest point since October.

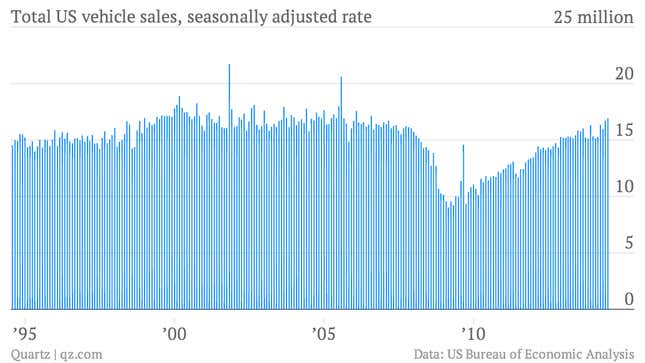

Autos

Car sales have surged to fresh post-crisis peaks, as financing remains cheap and easy and consumer sentiment improves. (Although some have suggested getting a bit too easy to borrow to buy a car.)

Consumer sentiment

The mood of America’s consumers isn’t ebullient. (It’s far lower than pre-crisis levels.) But both the University of Michigan and Conference Board June showed some of the best sentiment readings since the recession hit.

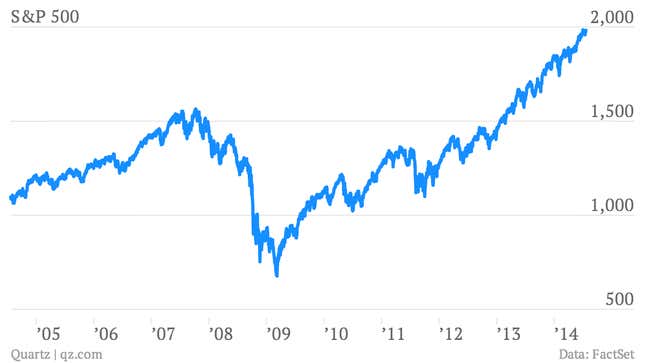

Stocks

Against the predictions of many—including me—the US stock market continues to climb. The S&P 500 now appears to be setting up for a record run at 2000. Given that the stock market is typically viewed as a leading indicator for the economy, this bodes well.

Now, are we witnessing a golden age of perfectly equitable capitalistic progress? Hah. Of course, not. For example wage growth—adjusted for inflation—has been nonexistent over the last year. But still, the economy is by far in the best shape of the last five years, and all indications are that more improvement is in the offing.