Fresh reports today that the ranks of Goldman Sach’s “partners” slimmed down by 31 people over the last nine months are yet another sign that the world of American finance is ever-so-slowly returning to its boring roots. Goldman had 483 partners at the end of 2011. That number is down to 407 in its latest filing, a decline of 16%.

A partnership at the gold-plated investment bank has long been one of the top spots on Wall Street. The New York Times’ Susanne Craig, one of the best chroniclers of life at the Vampire Squid, writes that “it can take years to reach this level and is a reward typically reserved for the firm’s top producers. Most partners make a base salary of $950,000 and their bonuses can run into the millions of dollars.”

The decline in partnerships underscores how Goldman and other investment banks have been shrinking worldwide as a result of tougher market conditions and regulations. UBS just unveiled plans to axe roughly one-sixth of its workforce and essentially wind down its bond-trading operation. In London’s financial center—the City—employment is expected to drop 100,000 from its peak of 354,000 back in 2007, by the end of this year. On Wall Street, official estimates suggest New York lost roughly 20,000 securities industries jobs since 2007.

Now, it’s important to highlight the fact that there are differences between different kinds of bankers. Wall Street investment bankers buy and sell companies, help corporations raise money by selling bonds and act as a sales force of sorts for financial institutions that want to flog more complex products such as “derivatives.” On “main street,” bankers are people who take money from depositors and then lend it out to—hopefully credit-worthy—consumers and companies.

Investment bankers were hot shots in the years before the financial crisis. But there’s been something of a resurgence of old-fashioned bankers, i.e., people with the ability to find and make profitable loans. American Banker reports that amid a dash for talent, compensation for loan officers has jumped sharply higher in recent months.

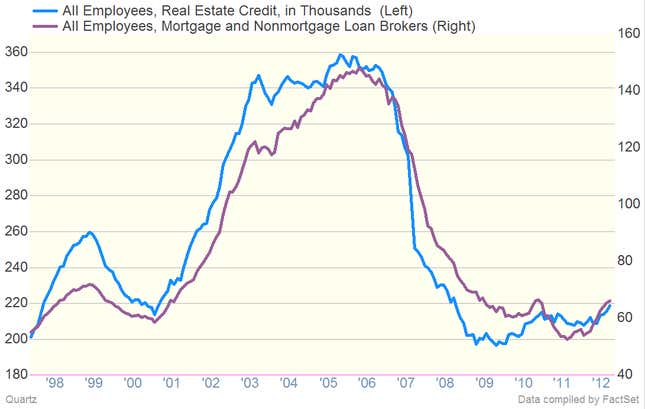

And as we’ve told you before (here and here) US banks continue to rehire mortgage makers. Here’s the latest update on job growth through September in categories that cover mortgage lending.

Morgan Stanley mortgage market analysts note that through September, job growth in the mortgage origination sector is up about 8.7%, much faster than the broader financial services sector, which has only seen jobs increase 0.8% during the same period.

This should give us some pause, as over-zealous mortgage lending was what caused the financial crisis. But it’s important to keep in mind that the production of sub-par loans during the housing boom that preceded the crisis was driven largely by the insatiable appetite of the trading machines that bundled and sold packages of such loans on Wall Street. Today, the only loans that are getting bundled are the plain vanilla mortgages eligible to be guaranteed by US housing agencies Fannie Mae and Freddie Mac. And that means the US is in very little danger of going on a wild lending boom any time soon.