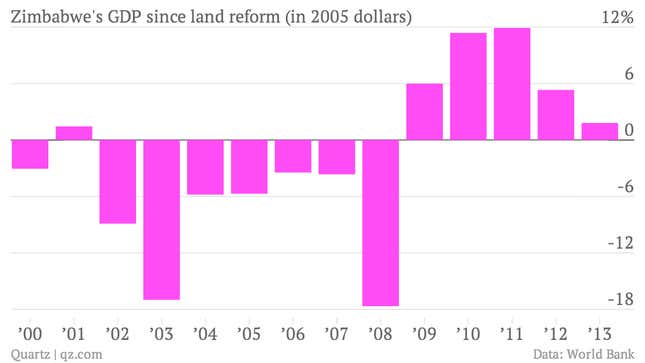

Between 2000 and 2001, about 3,000 mainly white farmers were evicted from their properties in Zimbabwe as the autocratic president Robert Mugabe sought re-election and implemented a populist land reform that gave the land to black farmers. That led to 18 people dying in the farm invasions that followed, which led to the country’s export-based economy collapsing. Hyperinflation kicked in, and reached 231,000,000% in the summer of 2008. The nation became a political pariah. Now, those farmers may finally get compensated through a process backed by the World Bank.

The international lender is mediating the process and is looking to issue Zimbabwean bonds backed by its Multilateral Investment Guarantee Agency to compensate the farmers for their losses, the World Bank’s country manager and the farmers’ union told Bloomberg. “Compensation bonds is only one of a variety of methods that have been used in other countries which have experienced large-scale land reforms,” the World Bank said.

Land in Zimbabwe has a complicated history due to the colonial rule under the British. In 1890, blacks were forced from their own land in what was then Rhodesia by white settlers, and then a law in the 1960s gave whites almost 40% of the land. Upon independence in 1980, whites owned 45% of the country’s land—despite being 2% of the population.

As well as compensating farmers, the International Monetary Fund is also re-opening its office again in Harare after 10 years—all signs that Zimbabwe is trying to end the international isolation. “Having an office in Zimbabwe will be helpful because it will allow us to have a continuous presence and help Zimbabwe to tackle its major challenge, which is to normalize relations with all the creditors,” the IMF’s deputy director for Africa, Roger Nord, told the Standard.

The Zimbabean economy has recovered sharply since 2009 to grow but is slowing again. The African Development Bank describes the state of the economy as “fragile,” mainly due to the lack of capital available. Restoring ties with the two biggest multinational lenders should jumpstart the process of Zimbabwe normalizing relations and coming in from the cold.