According to an analysis by research firm Equilar, the idea that CEO pay is linked to performance is mostly mythology. There are few better examples of that than Larry Ellison, the CEO of database giant Oracle.

He’s the founder of the company, and it has done very well under his stewardship. But even when performance has been mixed, Ellison has gotten massive payouts every year—and that’s despite already owning about 25% of the company’s shares, worth more than $40 billion.

For the past two years, however, fed-up investors have voted against Ellison’s pay package. The votes are advisory and non-binding, but seem to have given Oracle’s board the nudge they needed to cut the number of shares (paywall) it will grant Ellison this year to 3 million, from 7 million. The shares are still worth an estimated $46 million, but that is a substantial drop from the recent past, where awards have approached and often cracked $70 million.

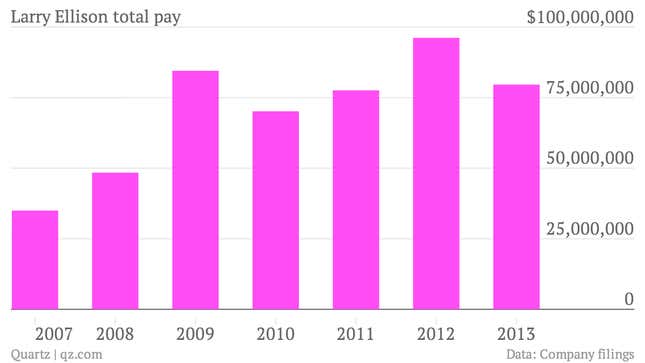

Here’s Ellison’s total awarded pay (which includes option grants) as estimated each year in the company’s proxy statement. He was the highest-paid CEO in America last year, and in 2012:

The company argues in its SEC filing that calculating pay by accounting value, as the SEC requires, may overstate its value–Ellison won’t be able to profit from these 3 million options, or even many of the 7 million he received last year, for some years to come.

But for one of the richest men in the world, additional pay is essentially meaningless in terms of encouraging retention or driving performance. A 69-year-old founder with billions already tied up in company stock isn’t likely to jump to a competing company, regardless of salary.

Shareholders are demanding better justification for awards closer to nine figures than eight than the board’s “subjective evaluation” of executive performance—couched in statements such as ”the board believes that our executive compensation program is performance-driven and results-aligned,” and “we believe that stock options are powerful incentives that have in the past successfully motivated, and continue to motivate, our senior management to improve our financial performance and grow our stock price over the long term.”

Oracle declined to comment on Ellison’s pay package.