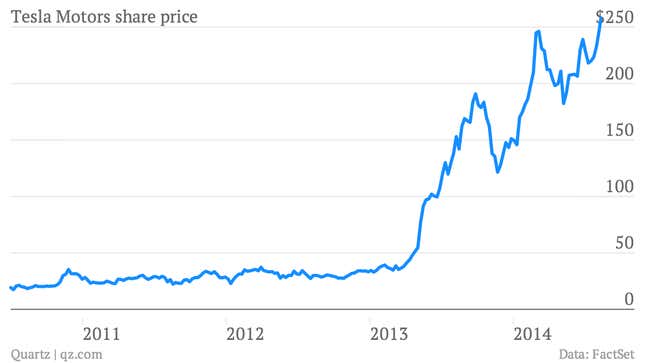

Tesla shares closed at a record high on August 12.

What’s more, the stock reached that record level after a widely followed US consumer ratings magazine, Consumer Reports, detailed a number of “problems” and “glitches” in the company’s flagship electric vehicle, the Model S.

In a rational world, you’d expect such news take a bit of optimism out of the shares.

But we’re not dealing with rationality. We’re dealing with a high-growth, stock-market darling that is anything but your traditional company.

For one thing, Tesla has very little in the way of earnings. It lost $62 million in the three months that ended in June, the fourth straight quarter that it’s been in the red.

So clearly Tesla’s stock market surge—up more than 70% so far this year—isn’t about any near-term earnings potential. In that sense, it really doesn’t matter whether the current Tesla Model S is a dud or not. (Although producing an out-and-out clunker would damage the company’s hard won reputation for technological savvy.) And while the cheaper Model 3, which is expected to go on sale in 2017, could be the product that takes Tesla mainstream, that really isn’t the point either.

No, the more important point is that Tesla is much more than a car company. Analysts at Morgan Stanley recently said Tesla could be generating as much as $2 billion a year in revenue from energy storage by the end of the decade. Other analysts have written that the lithium-ion batteries that will eventually be produced at Tesla’s $5 billion “gigafactory” could find uses in many other areas, such as drones and consumer electronics.

Whether those assumptions prove accurate remains to be seen. But the market certainly seems to be buying into Elon Musk’s vision.