As the West applies sanctions on Moscow, the Russian oil giant Rosneft appears to be scrambling for cash to cover a canceled loan-for-oil, according to a leading oil analyst. In piecing together how Rosneft’s situation has deteriorated over the last month, oil analyst Philip Verleger estimates that the company is sitting on a hole of up to $10 billion needed to cover repayments of loans next year.

The immediate cause of the cash shortfall appears to be that two Swiss trading houses are putting a squeeze on Rosneft. But the story goes back a bit further, to Rosneft’s $55 billion deal last year to buy TNK-BP, a Russian-based joint venture between BP and four Russian oligarchs. The transaction turned the company into the world’s largest publicly traded oil producer.

In transforming itself into an international player, Rosneft had to go into the market to borrow some $40 billion. Among the largest lenders were Vitol and Glencore, two of the world’s largest trading houses, which together provided Rosneft $10 billion in cash as an advance payment toward some 280,000 barrels of oil a day for five years.

But on July 14, the US and Europe slapped sanctions on Rosneft (among other Russian entities) that forbid loans longer than 90 days in duration. Rosneft CEO Igor Sechin said the sanctions would not hurt the company because it had $20 billion in the bank, including the advance payments from Vitol and Glencore plus other pre-payments from China. Sechin said this money would cover (paywall) $20 billion in loan repayments due by the end of 2015. Yet, just a month later, on Aug. 14, Sechin went public with a request that the Kremlin lend the company $42 billion in what he described as help to cope (paywall) with the sanctions.

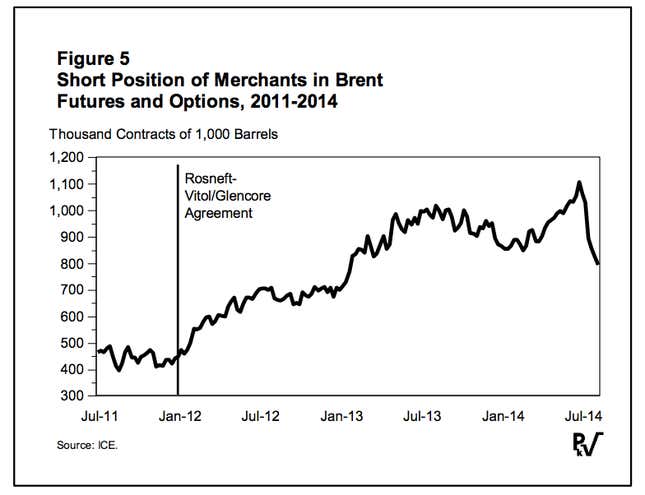

Verleger thinks he knows what happened during that month. He recalls watching the Intercontinental Exchange (ICE) when Vitol and Glencore originally hedged the loan last year. “The short position of the merchant trade category shot up from 700,000 contracts to 1 million contracts,” Verleger told me in an email exchange. “The increase was clearly tied to the Rosneft deal.”

Now, looking at the latest ICE reports, Verleger is seeing similarly dramatic movements and, combining it with Sechin’s request for the $42 billion loan, thinks the trading action is again related to Rosneft. “Rosneft is panicked,” he says, which he attributes to Vitol and Glencore having likely exercised a right to cancel the loan and demand the money back.

In Verleger’s chart below, you see the plunge in short positions that he noticed on ICE right around the time of the sanctions.

He also observed a steep drop in the number of available oil futures contracts (about 300,000 fewer) in April and December 2015. In other words, having no further need for the hedge, Vitol and Glencore were rapidly unwinding their joint short position. “Declines in open interest in forward contracts of such magnitude are very unusual,” Verleger writes. Going back almost three decades, Verleger said he recalls only two similar plunges.

“A firm liquidating its loans to Rosneft would want to close its hedge,” he wrote in his note to clients. “It would do so by purchasing futures.”

Of course, the loan itself is not exposed directly to the sanctions since the contract was signed last year, and the sanctions affect only future lending. But Verleger said Vitol and Glencore are watching the direction of events and fear more sanctions that could threaten their money. From his email:

I think the deal is being undone because the buyers are worried that they may be unable to take delivery of the oil in the future if further sanctions are imposed on Russia. The last thing you want to have is a large short position in a futures contract if you cannot get your oil. Vitol and Glencore could see the [oil] price go up, requiring large margin payments, while they are unable to sell the oil they are offered.

A Vitol spokesman declined to comment. Glencore did not respond to an email.

Oil prices will drop further

One consequence of the liquidation has been to prop up the price of oil futures, Verleger says. But over the coming few weeks, Vitol and Glencore will finish their liquidation, thus removing the price support. Oil prices already have been dropping fast because of a global supply glut, with Brent crude plunging to $101.79 today. Now they will drop further, Verlerger said.

In need of cash, Rosneft is likely to turn to the Chinese for help. A deal last year with China National Petroleum Corporation provides Rosneft with about $63 billion in advance payments by 2018. It is not immediately clear how much of that will arrive by the end of next year, but confirming the sum presumably has been on Sechin’s to-do list.