Bank of America isn’t digging too deep to into its pocket to cover its new, $17 billion legal tab.

Hours after the bank made its most significant strides to date to resolve its mortgage headache, Bloomberg reports that Charlotte, North Carolina-based BofA is preparing a $4.5 billion bond offering. Observed with a jaundiced eye, the debt issuance seems like an easy way to bankroll its massive fine with help from bond investors. The bank has said it expects to suffer a $5.3 billion hit to its third-quarter pre-tax earnings after agreeing to its latest multibillion-dollar settlement with the US Department of Justice over loans that contributed to the housing bust.

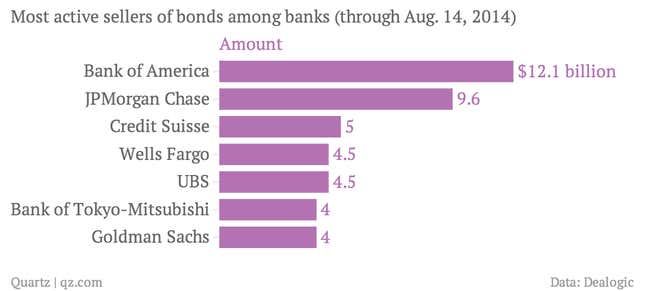

It’s hard to fault BofA for turning to the debt markets. Financial institutions are on pace to raise the most money via bonds sales since 2007, according to the Wall Street Journal. Investors trawling for better-than-average returns have been attracted to bonds promising richer yields than US Treasurys. In that sense, BofA is just playing to the market’s appetite—something it’s been doing more than any other big banks this year, as the chart below shows: