Ireland’s economy seems to be getting back onto its feet. After a fourth-quarter contraction, GDP grew at a 2.7% clip in the first quarter. Home prices are rising again. And unemployment continues to decline steadily, though it remains higher than 11%.

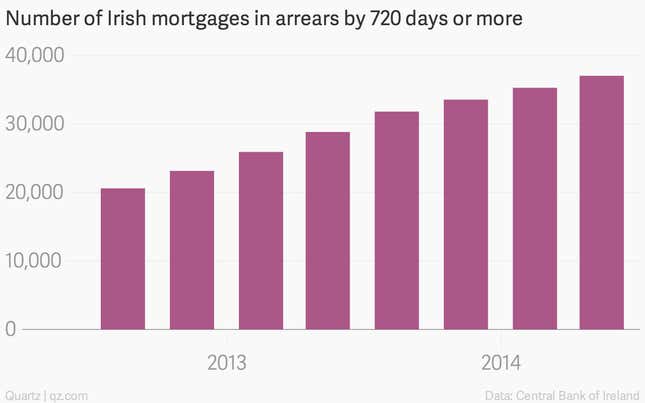

And yet Ireland hasn’t come close to sorting out the housing woes that brought down its banking system and, in 2010, sent the country in search of a financial rescue package from its European neighbors. The latest sign of this: the number of people in owner-occupied homes who are more than two years behind on mortgage payments is still on the rise.

In the second quarter, the number of homeowners in this bucket climbed 5% from the first quarter, to 37,066. In a small country like Ireland, that amounts to 5% of all mortgages on owner-occupied houses. (By value, the share of mortgages two years behind on payments is even bigger, at 7.5% of the total.)

Now it should be said that arrears overall—including short- and long-term delinquencies—are starting to decline slightly: 16.5% of all mortgages on principal residences in Ireland were in arrears in the second quarter, down from 17.3% in the previous quarter. But that’s still insanely high by international standards. Consider that a few months back, Fitch Ratings forecast that mortgage bonds from Spain—which is in an even worse economic situation than Ireland—would end the year with roughly 3.4% of loans more than 90 days in arrears. For Ireland, the same number was about 19%.

Why the giant gap? As we’ve written before, for deep-seated historical reasons, repossessions and evictions remain anathema in Ireland. They almost never happen. And that’s why why mortgage payments remain, for the moment, pretty much optional.