After years of massive growth in the US, Vodka sales are slowing, despite distillers increasingly desperate attempts to make their drink go down easier with customers. Flavored variants, a common marketing ploy for brands under pressure, are losing their appeal.

The first mass-marketed flavored vodka was Absolute Peppar, released in 1986. There’s now a bewildering array, more than 30 from Smirnoff, the most popular brand in the US. The past few years have inflicted upon American drinkers such flavors as marshmallow, pumpkin pie, and cookie dough.

This tactic worked for a while, holding vodka sales up. Flavored vodka made up less than 10% of sales in 2003 according to Euromonitor; in recent years, they have accounted for nearly a quarter of vodka sales. Pinnacle, a flavor-focused brand launched in 2002 and acquired by Jim Beam is America’s fifth most-popular vodka brand.

But flavors like whipped cream and buttered popcorn suggested companies were starting to scrape the bottom of a previously very productive barrel. It looks like they were:

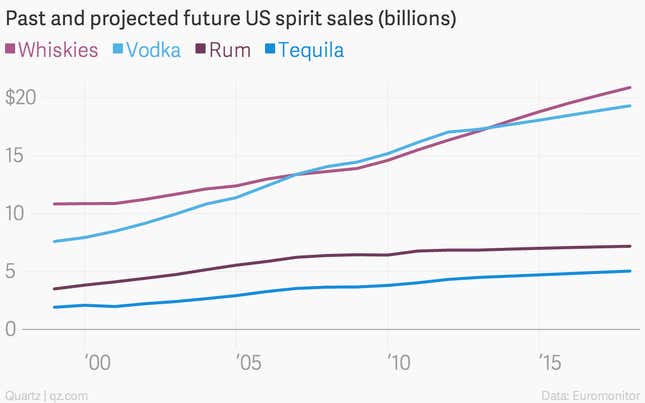

In 2012 at the height of the brand-extension craze, 122 of 171 new vodka product releases were flavored. New flavored releases began declining significantly in 2013. And now, after years at the best-selling spirit in the country, vodka is projected to lose out to whiskey this year, for the first time since 2006, according to historic and projected data from Euromonitor:

According to Euromonitor analyst Spiros Mandrankis, any remaining growth of flavored vodka is just eating away at already stagnating sales overall. Mandrakis says in a blog post that “flavor cannibalization has, alas, already begun”

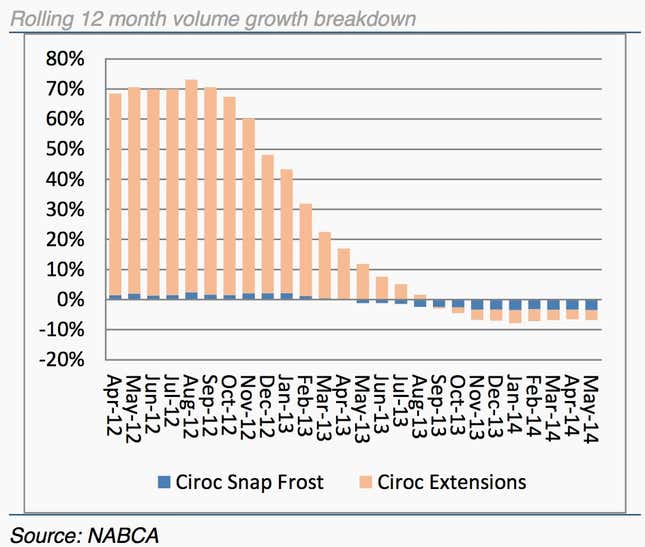

Extreme flavors have become so ubiquitous that they’re more likely to prompt eye-rolls than drive new sales. Consider Ciroc vodka sales last year, which show extensions have gone from a sure thing to a drag, according to Credit Suisse:

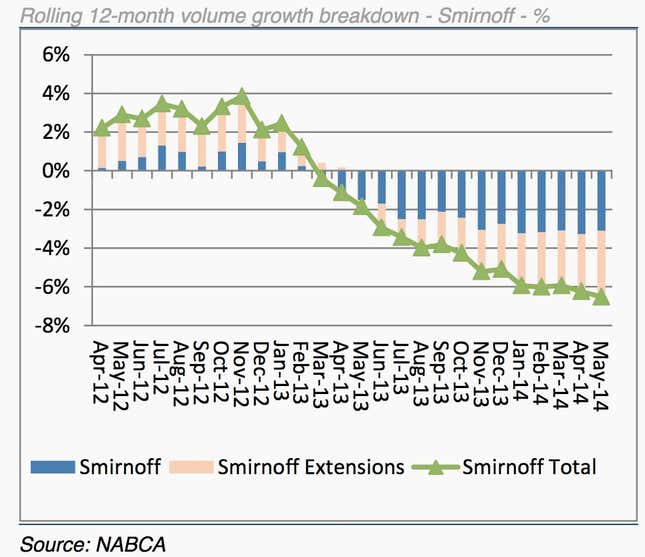

Smirnoff is having a similar, if less dramatic experience: