US oil companies plan a massive campaign in the coming months to persuade president Barack Obama to overturn a ban on the export of crude oil that has held since the Arab embargoes of the 1970s. Their motivation is understandable enough: profit.

Crude oil exports are opposed by the US chemical and refining industries, which earn more if American oil stays at home. And some politicians argue that oil is a strategic commodity the US should not squander by shipping it abroad.

But the industry campaign is boosted by outside heavyweights who say that American oil could deliver a geopolitical dividend: if exports push down oil prices, that could hurt Russian president Vladimir Putin, whose economy depends hugely on oil and gas revenues. Former US treasury secretary Larry Summers says that oil exports will lower US gasoline prices. In the New York Times, Tom Friedman writes that they will undermine both Putin and the Islamic State.

In reality, even without exports, the US oil boom is already driving down prices and affecting geopolitics. If not for a surge in US oil production the past couple of years, the global economy would have probably plunged back into recession since—given the disruptions in Libya, Iran, Nigeria and elsewhere—oil prices would have gone through the roof.

Yoo-hoo–the US is already exporting oil

The US Energy Information Administration said this week that American oil production will reach a 45-year high next year at 9.5 million barrels a day, up about 1 million barrels from 2014. Combined with a “remarkable” plunge in the growth of global oil demand, noted by the International Energy Agency, the American supply surge is principally behind a plummet of oil prices this week below the psychological threshold of $100 a barrel.

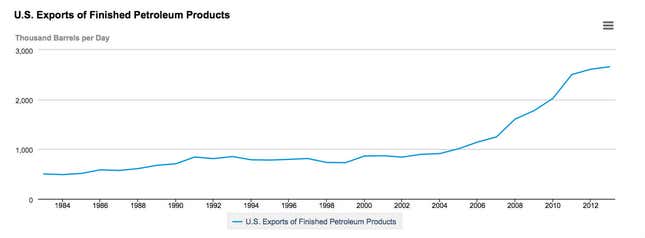

The US boom is having this impact for two reasons: the US needs and imports less oil, leaving more to slosh around the global system. And the US does in effect export oil—about 3.7 million barrels a day in the form of products like diesel, plus a small volume (385,000 barrels) of crude oil that can be legally shipped to Canada. This chart shows just the exports of products.

The surge is so large that—at least for now—it has finally overwhelmed the roiling geopolitics of the Middle East and former Soviet Union. “In past Middle Eastern conflicts, like the Gulf War, we would see oil prices spike, putting the economy on the brink of recession. Yet this is not happening because of US oil production,” oil trader Phil Flynn wrote on his blog.

In short, the question to export or not to export is germane if you are concerned with oil company revenue. Not so much for everyone else.

Will lower prices drive down production and create a vicious circle?

Even if exports are not generally relevant, there is one interesting point, and it is raised by Michael Levi of the Council on Foreign Relations. In a snarky post targeting Friedman, Levi argues that, if the US does legalize all crude oil exports, they will have negligible and possibly no impact on oil prices. He asserts that, even if oil prices do plunge as Friedman suggests to $75 a barrel, they will do so only temporarily because drillers will pull back unprofitable supply, thus neutralizing the export impact. Prices will rise again because the supply will go back down.

That would be true if the cost of oil production is too high at fields that comprise a sufficient part of the global oil supply. But what if such costly fields make up only a marginal part of the supply pool? A volume smaller than the exports? If they did, they would undermine Levi’s argument.

That is what Citi argues. With a few tiny exceptions, global oil overwhelmingly can break even at $70 a barrel, the bank says. US shale oil specifically breaks even in a range of $50 to $80 a barrel. Given this price equation, the question is not whether exports will have an impact on prices or geopolitics, but whether the US oil boom will become larger.

If it does, all things being more or less equal elsewhere, Putin will be in more trouble.