As skeptical as analysts are about the quality of Chinese economic data, the numbers all seem to be telling the same story lately. China looks pretty darn weak.

Now it’s true that this morning’s “flash manufacturing” purchasing managers’ index stayed at least above 50, the level that indicates growth or contraction. (Observers were expecting far worse.) But a parade of other data points have painted a pretty clear picture of economic weakness in the People’s Republic. Note that some have gaps for periods in which data wasn’t reported.

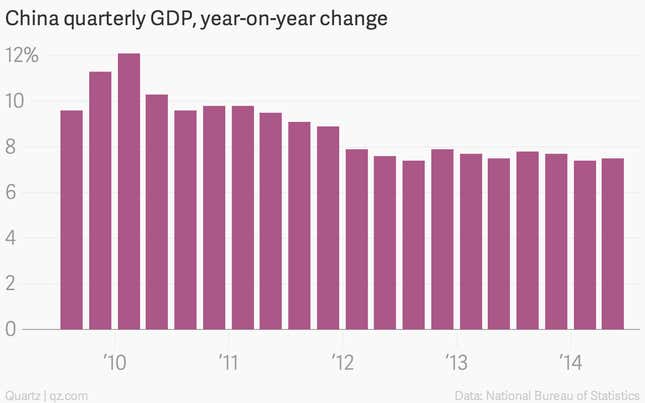

GDP has been stagnant

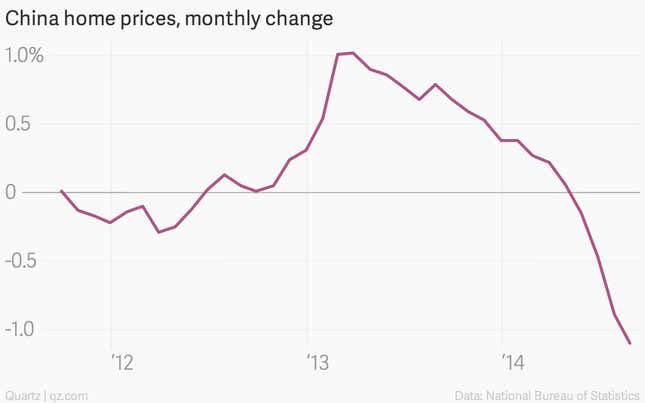

Chinese home prices have started to roll over

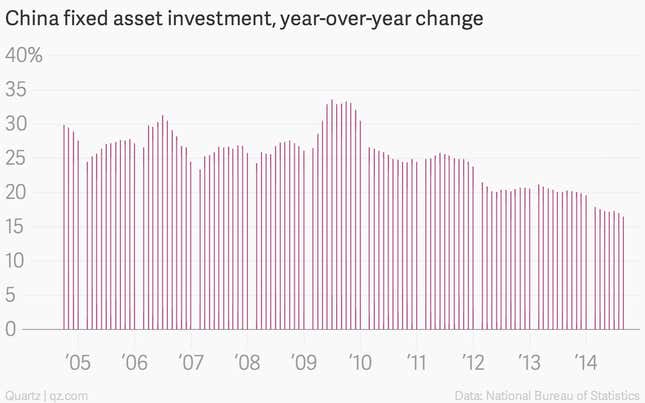

Investment growth has been slowing markedly

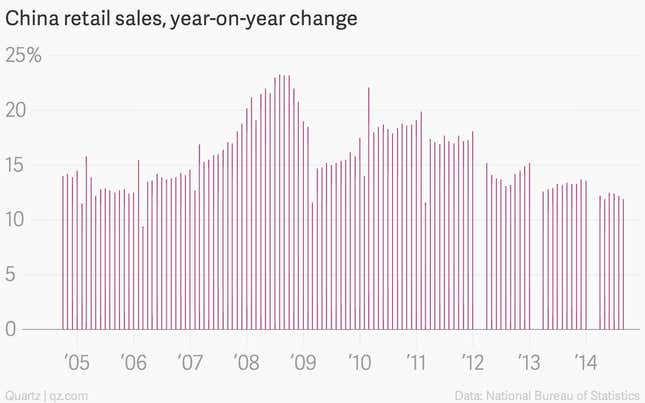

As has growth in the retail sector

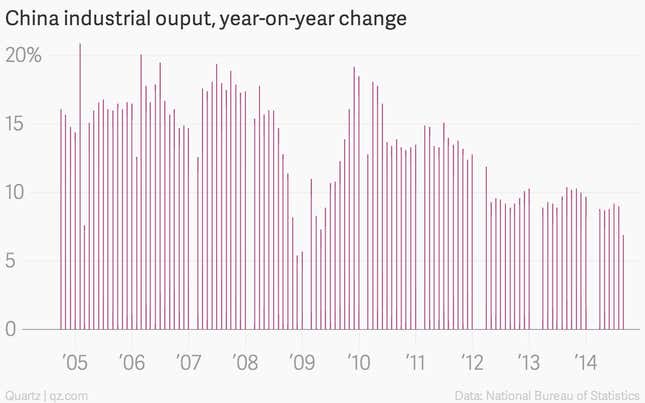

Growth in industrial production has hit a six-year low

Electricity production, a good economic indicator, has gone negative, too

Of course, there are those who’ve wanted to read all this bad news as good news. They’re the ones who expect the Chinese government to swoop in with a magical plan to prop up growth. But besides pumping money into the banking system, there seems to be precious little indication that a broad-based push toward massive stimulus is in the offing.