People are starting to notice: The bad boy of the digital currency world is losing its mojo.

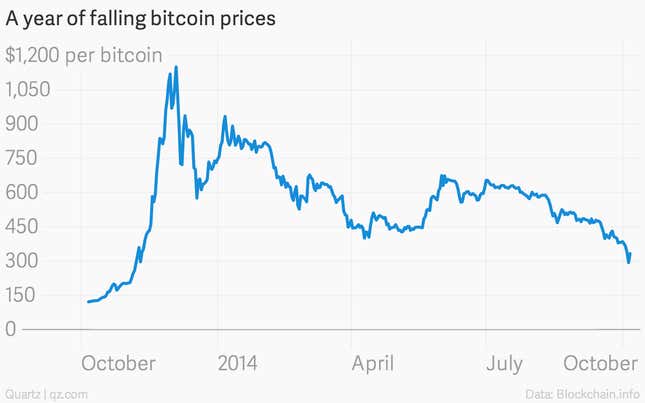

Which is to say, bitcoin prices in US dollars have been heading south, hovering at just under $350 after peaking at more than $1,100 just a year ago. At one point, bitcoin was the worst performer of nearly any asset class.

It’s not a coincidence, either, that bitcoin hasn’t really been in the news of late, as the currency was during last year’s explosion. The crypto-currency is remarkably sensitive to media coverage, and one of the main dynamics of its rise has been the hype cycle of successive rounds of excited investors piling into the currency, much to the benefit of early adopters. For bitcoin, even bad news—like the October 2013 downfall of Silk Road, the bitcoin-driven market for a whole world of dubious goods—became good news as exposure lead to greater knowledge of the digital currency.

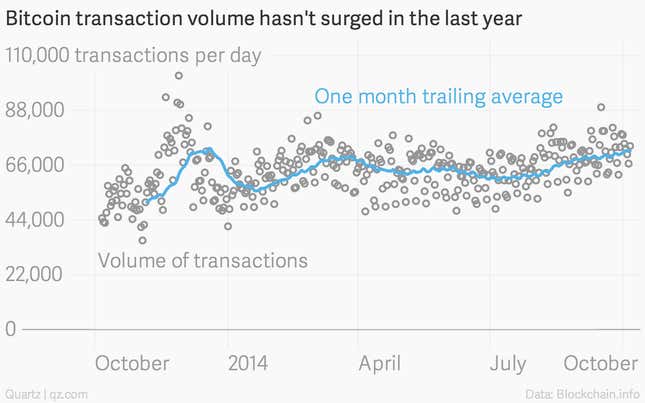

But the real chart that should spell worry for bitcoin investors is this one, which shows that, despite the hurly burly—and more than $100 million poured into bitcoin start-ups by venture capitalists—actual use of the currency hasn’t really increased. Recent gains in transaction volumes have coincided with a falling price; that is to say, people are selling.

There are three stories bitcoin’s proponents tell about what bitcoin technology could potentially do for the world: That bitcoin will become a currency used by many people to purchase goods; that it will be a superior method to store value over time; and that it can form the basis of a highly secure and efficient payments system. The volatility of the price chart suggests that storing value, at least so far in its young life, isn’t bitcoin’s strong suit. And the transaction chart suggests that people aren’t really using bitcoins more often, and efforts to market easy-to-use payments programs to merchants and consumers haven’t meaningfully expanded bitcoin use. If people aren’t using it, and its value is falling, any currency is sunk.

But it’s far too early to make that call about Satoshi Nakamoto’s electronic money. Many bitcoin startups aiming to take the technical innovation underlying the currency mainstream are still getting their products off the ground. And, as erstwhile bitcoin investor Timothy Lee notes, even though people were skeptical of bitcoins selling for $200 each in April 2013, anyone who bought then is still comfortably in the black.

What does seem clear is that bitcoin, as a currency, has yet to provide real competition to the all-mighty dollar.