The long-simmering issue of economic inequality in the US got moved to the front burner yesterday, with Federal Reserve head Janet Yellen noting in a speech that the effects of income and wealth disparity “greatly concern” her.

One key distinction in the debate is whether economic inequality is transient or permanent. Rising income inequality may be a temporary phenomenon, where skilled people earn high compensation without permanently distorting the distribution of wealth in the economy. But economists like Thomas Piketty worry that these super high-earners could catalyze a cycle of accelerating inequality.

Now, a working paper released this month by Gabriel Zucman and Emmanuel Saez (economists at the London School of Economics and the University of California, Berkeley, respectively) shows that growing income inequality is fueling a commensurate disparity in total wealth. The two economists used tax data to build the most complete picture to date of US wealth. Their findings are worrisome.

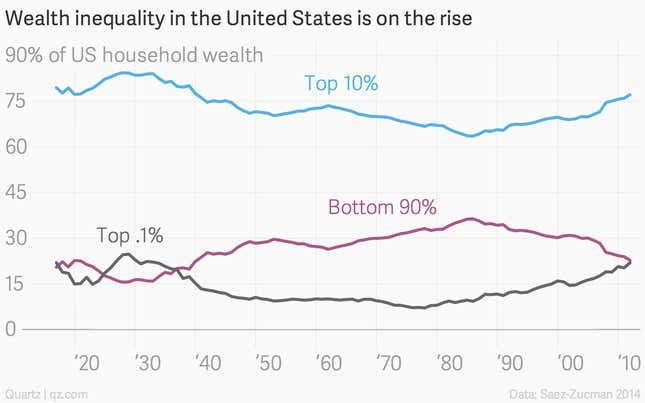

Today, the top 0.1% of Americans—about 160,000 families, with net assets greater than $20 million—own 22% of household wealth, while the share of wealth held by the bottom 90% of Americans is no different than during their grandparents’ time.

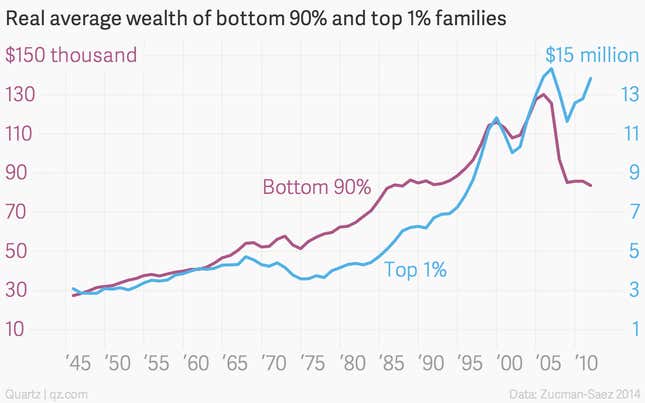

What does this look like at the household level? Perhaps the most striking chart produced by the economists’ efforts to measure US wealth is the one below, which shows that after a long march upward, and then a steep decline, the “average real wealth of bottom 90% families is no higher in 2012 than in 1986.” Meanwhile, the top 1% of wealthy families has almost completely recovered from the ill effects of the financial crisis.

People in the bottom 90% were hit especially hard by the financial crisis because of this particular downturn’s major feature: a housing bust. For those outside the ranks of the richest Americans, a greater proportion of wealth tends to come in the form of home equity. The wealthy, meanwhile, have a significant portion of their assets in securities, which has allowed them to benefit disproportionately from the recent bull market.

The findings underscore the disconnect between US economic data pointing to a recovery and the disappointment felt by many Americans in the country’s economic policy.