We have to say it. The US economy is really roaring forward at the moment. All the data tells the same story.

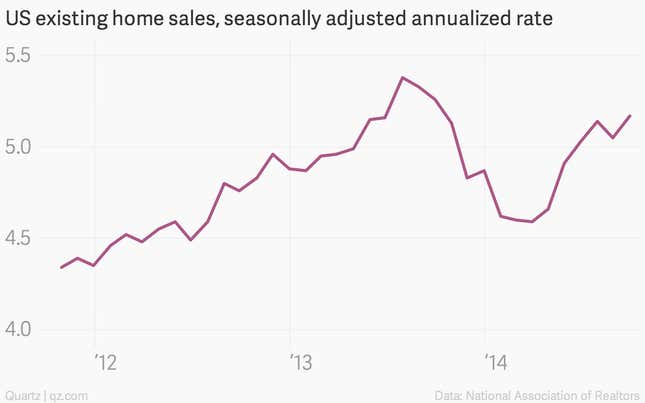

Sales of previously owned homes just hit the highest level in a year.

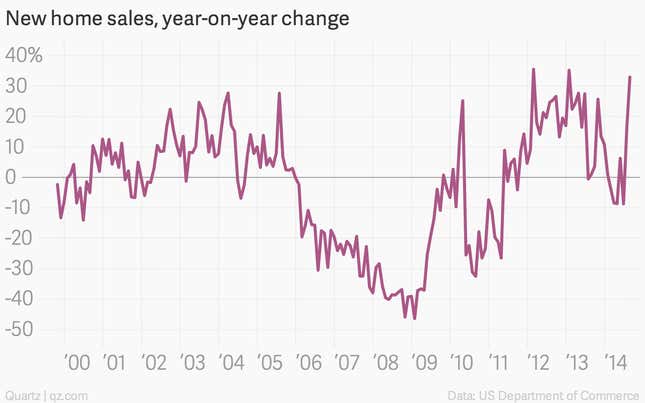

The latest numbers show new home sales surging August, when they hit their highest level since 2008.

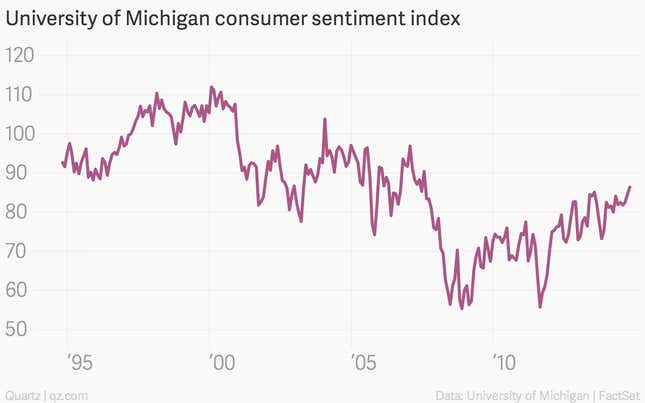

Consumer sentiment is hitting its highest levels since the crisis.

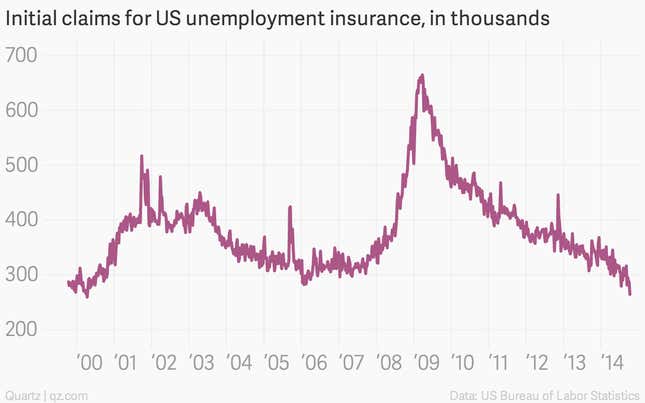

Claims for unemployment benefits hit the lowest level in 14 years.

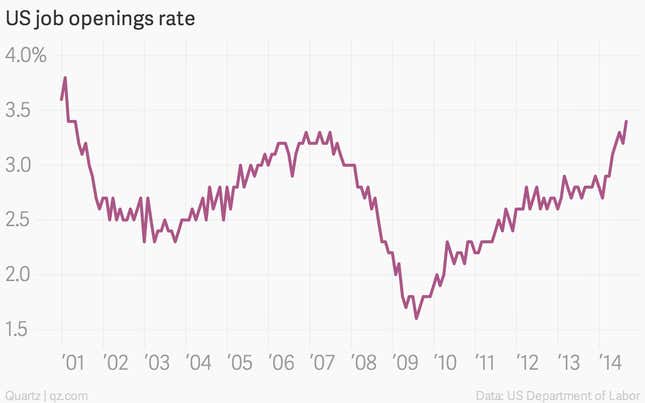

Job openings are surging, hitting their highest levels since 2001.

And the US is on track for its best year of job growth since the late 1990s.

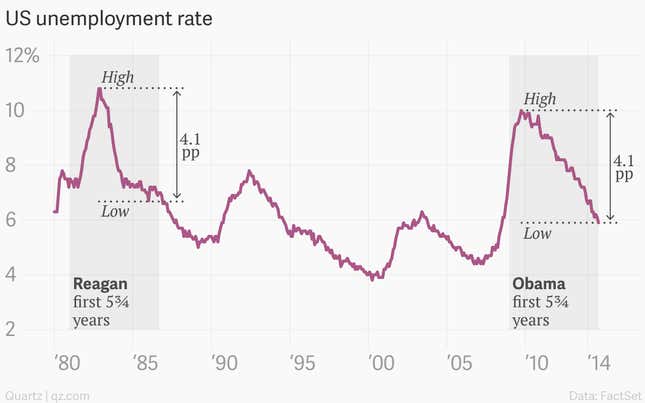

In fact the unemployment rate has fallen as much under Obama, as it did under Reagan, at this point in his presidency.

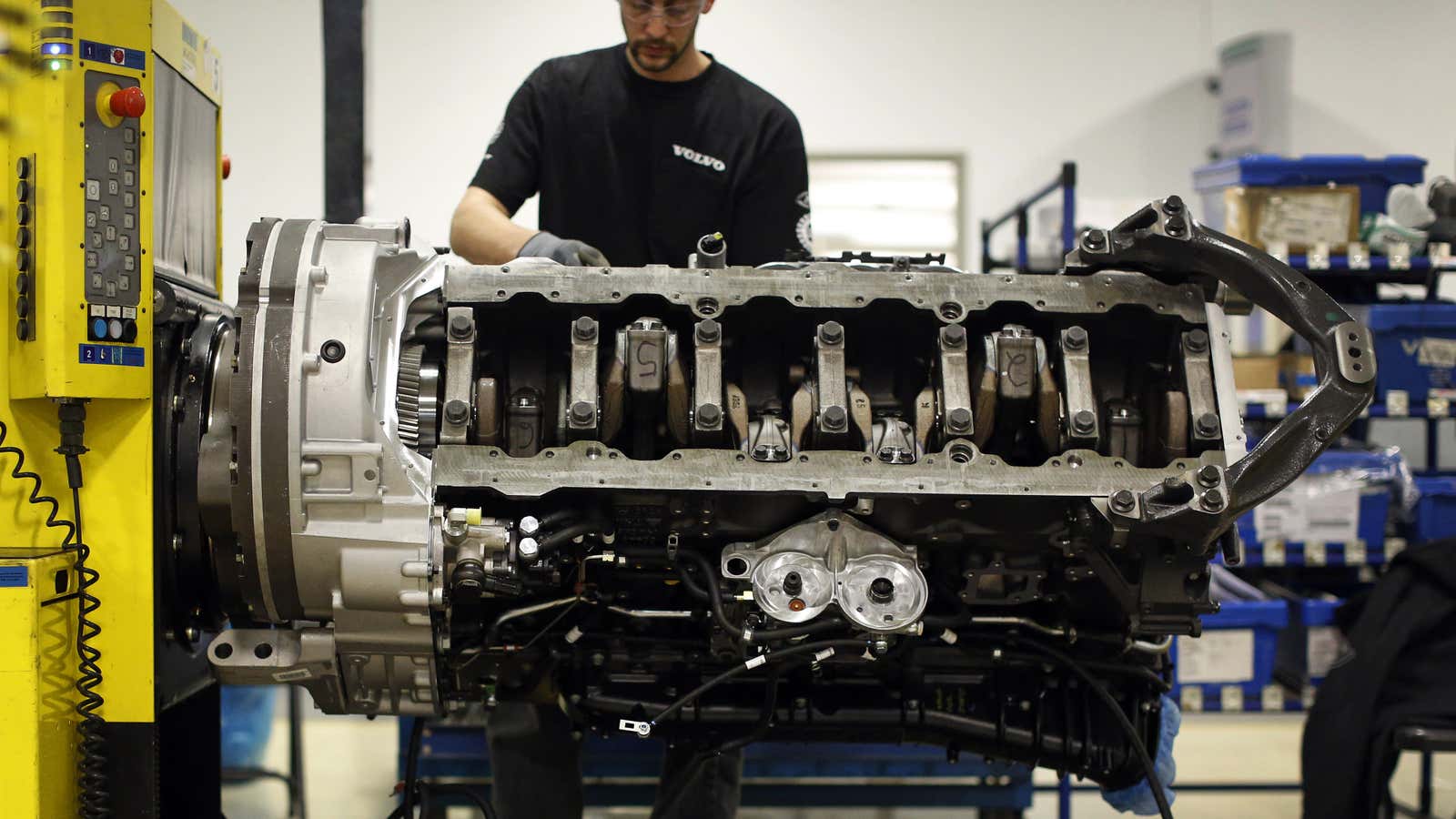

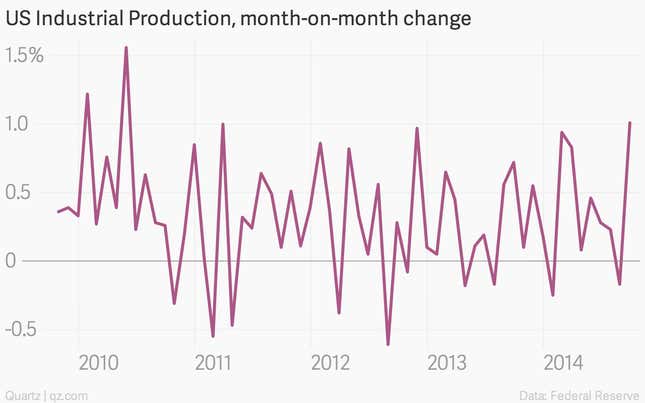

Industrial production just saw its biggest month-on-month gain since 2010.

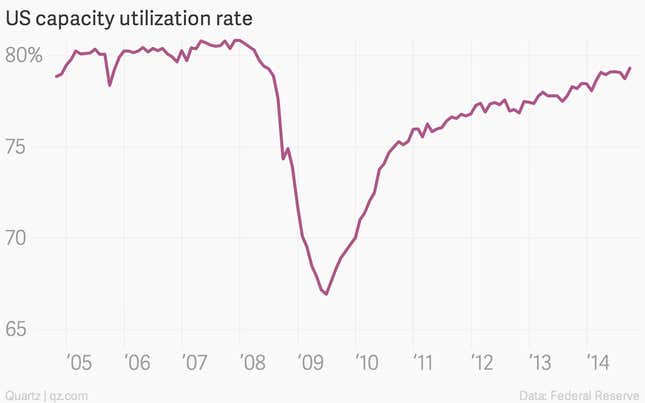

And capacity utilization hit a post crisis high.

Meanwhile, inflation remains almost nonexistent, by historical standards.

Consumer borrowing costs are falling.

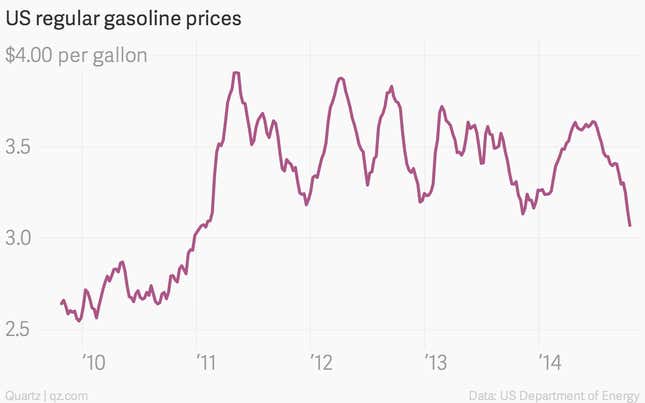

And so are gas prices.

So are we about to enter an era of broadly shared and ever-increasing American prosperity? Of course not! We’re talking about the American economy not the American populace. There’s always a giant difference between the health of the overall economy, and how the fruits of that economy are parceled out to the different members of society. The short version is that the US economy is doing pretty well. It’s just the overwhelming majority of the people who rely on it who are having problems.