With the fiscal cliff spurring all this talk of deficit reduction in the US, you might think the government hasn’t been reducing the deficits it accumulated fighting the 2008 recession, not to mention the two wars of the last decade and the costs incurred by the country’s structural imbalance between revenue and spending. But you’d be wrong.

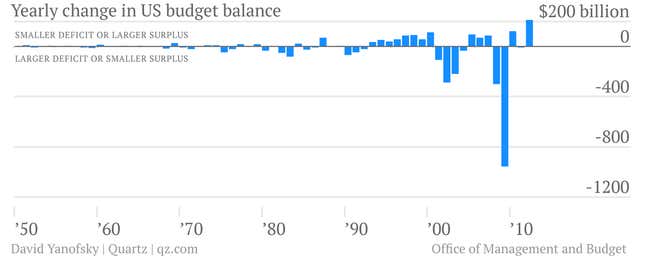

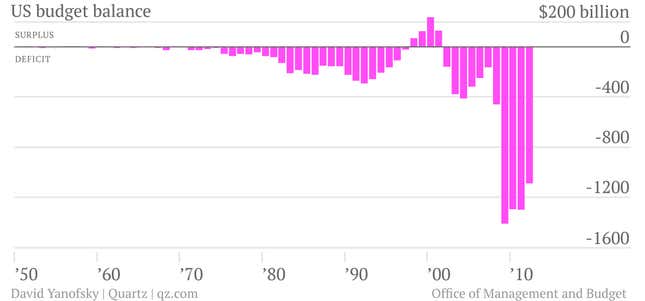

The chart above shows the yearly change in the federal budget balance since 1950. In 2008, the deficit ballooned to nearly $300 billion, and nearly $1 trillion after that in 2009 with the introduction of the fiscal stimulus bill. That year the deficit hit its crisis peak of $1.4 trillion, as the chart below shows. Since then, however, deficit reduction has been the norm. In 2010, the deficit shrank by $120 billion, held steady the next year at $1.2 trillion, and will shrink by another $210 billion this year, for a forecast deficit of $1 trillion.

Now, of course, a $1 trillion deficit is still huge. And because the deficit is huge, America’s overall debt is still growing. (We were going to include yet another chart to show that too, but you get the point.)

It’s also worth acknowledging that the main reason the deficit is now currently shrinking exceptionally fast is that, before this, it was growing exceptionally fast. The stimulus at a time of economic contraction made the deficit explode. Now the economy is growing, there’s less stimulus spending, and some of what was spent to prop up banks got paid back.

Nonetheless, the fact remains that this year’s $210 billion reduction in the deficit represents the fastest year-over-year fiscal consolidation since World War II. And as Investor’s Business Daily points out, the deficit has shrunk by 3% of GDP over the last three years, slightly more than it did between 1995 and 1998, when the economy was growing much faster than it is now.

The main point to draw from this, though, is a reminder that the fiscal cliff is something of a manufactured crisis. It was designed to solve a disagreement about how fiscal consolidation—shrinking the deficit by means of either tax hikes or spending cuts—should occur, not to enforce debt reduction as a priority. If anything, the challenge before Washington now is not to cut the deficit faster; it’s to do it more slowly than the fiscal cliff would, to avoid the risk of hurting economic growth.