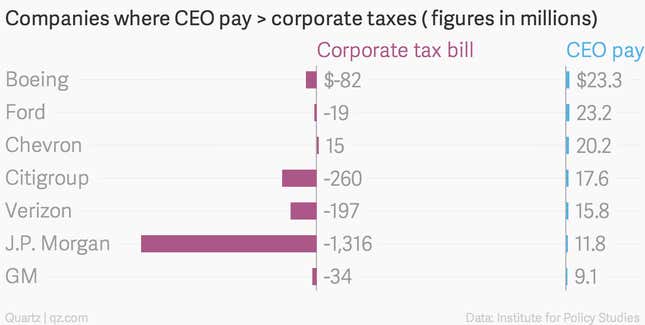

The corporate tax rate in the US legally ranges from 15 to 35%. Many companies end up paying far, far less. In a report released today, the Institute for Policy Studies found (pdf) that seven of the country’s 30 largest companies by revenue paid out more to their chief executives than they did in corporate taxes in 2013, despite the fact that pre-tax incomes for those companies totaled more than $74 billion. Six of the 7 companies received tax refunds:

Overall, these seven companies received a total of $1.8 billion in tax refunds, and paid out $121 million to their CEOs.

It’s worth noting that companies pay many other taxes—state, property, and payroll to name a few—which likely raises their total tax bill. Verizon contested the report’s characterization in a statement to Reuters, and other companies stressed other taxes they pay, at home and abroad.

Companies arguably have a duty to shareholders to do what they legally can to reduce their tax bill. In that sense, the benefits companies derive from both subsidies and tax loopholes is to some degree be inevitable, if off-putting.

Those who disdain a tax system prey to tax havens and corporate largesse might consider a change of venue; change isn’t on tap.