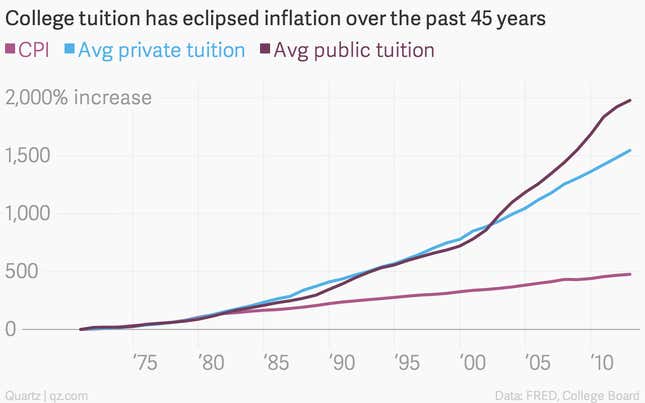

It’s no secret that getting a college education in the United States is massively expensive, and costs continue to rise year after year. If you’ve paid much attention to the growing cost of college, you’ve likely seen some version of this chart, which shows just how dramatically tuition costs have outpaced inflation (with inflation represented here by the US Consumer Price Index):

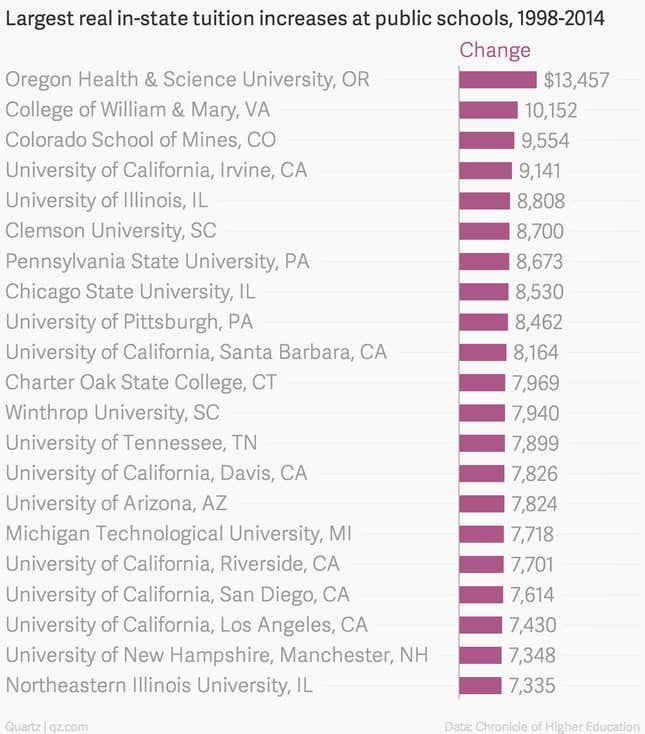

Almost every school has raised tuition over time. But some have increased it far more than others. Using data from The College Board compiled by the Chronicle of Higher Education, we’ve pinpointed the public and private schools where the cost of tuition has shot up the most over the last 15 years.

Warning: these price spikes may shock and alarm you. They also might help explain why US student debt, currently at about $1 trillion, keeps growing.

In all of these charts, colleges are ranked by the largest increases in 2014 US dollars, after adjusting for inflation. (In some categories, schools reported data going back to 1998, in others the data dates back to 1999. For each category, we started with the oldest data available.)

Where locals get gouged

Here are the four-year public universities where in-state tuition has risen the most since 1998. This list includes top state schools like the University of Illinois at Urbana-Champagne, where the real price of tuition has more than doubled from $6,212 to $15,020 (in 2014 dollars) in less than two decades.

Where it hurts to cross state lines

These are the four-year public schools where out-of-state tuition increased the most. This list includes seven schools in the University of California system that cost an average of $17,442 more (in 2014 dollars) than they did in 1999.

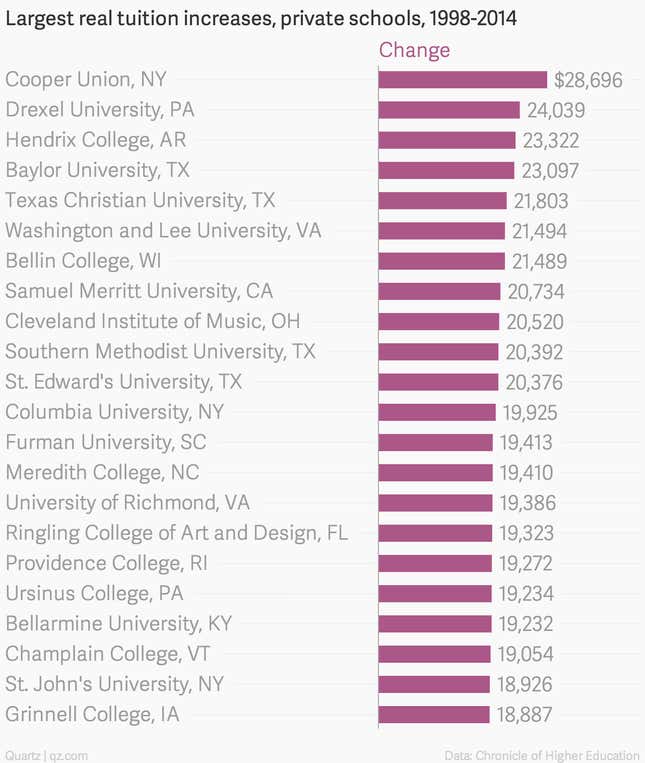

Where private schools are getting even more expensive

These are the four-year, non-profit private schools where tuition increased the most since 1998.

It’s worth noting that at Cooper Union, the leader on this list, offered every student at the school a full-tuition scholarship until 2013. They now give every student a half-scholarship or more—so although the listed cost of tuition has increased greatly, no student actually pays more than 50% of the official cost.

Officials in higher education are always quick to point out that these are effectively sticker prices. Not all students pay full freight. In fact, research from the College Board, via the Brookings Institution (pdf), suggests that while average private tuition rose roughly 25% to $41,000 over the last 10 years, the average net tuition—what students actually pay—has stayed steady at roughly $23,000. That’s because many schools, particularly highly selective ones, have more generous need-based financial aid policies that accompany higher tuitions.

So how do you find out what the real price of attending a particular college or university for someone of your family’s income level?

It’s no easy task. Colleges are now required by the US government to post a net-price calculator on their web sites. That sounds good, but another recent Brookings Institution report (pdf) found that these calculators are pretty useless because they’re hard to find and near impossible to complete without delving into family tax documents. The US Department of Education’s College Scorecard has some net price information, as does the Education Department’s College Navigator site. Unfortunately, the Brookings report suggests that the numbers just aren’t right. (“The reported prices that these institutions charge to low-income students based on data from the College Navigator cannot be accurate,” the report said.)

In short, more needs to be done to promote real price transparency. Given that the entire US higher education infrastructure floats on an ocean of direct government loans to students, the government arguably has a fiduciary duty, if not a moral obligation, to make that happen.