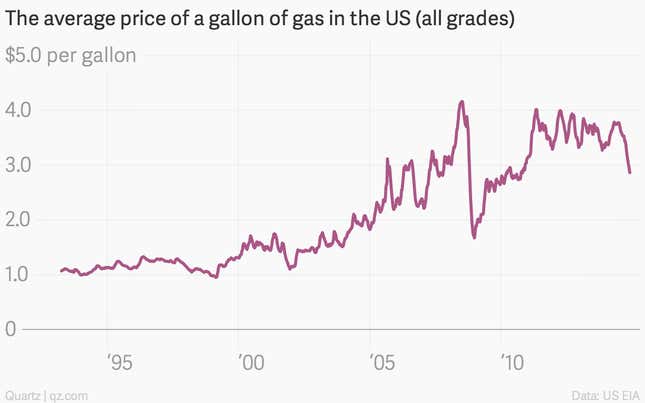

US gasoline prices are reaching their lowest levels since 2010, and we can expect them to keep falling in the near future as oil prices continue to slump—which makes this a fantastic time to raise the US federal gas tax.

Currently, the federal gas tax is 18 cents a gallon. With state gas taxes added, the average tax is 23 cents. The last time the US raised the federal gas tax was in 1993, more than 20 years ago. With the tax unchanged and cars becoming more fuel-efficient, the US hasn’t been able to pay enough into the Highway Trust Fund to adequately maintain US transit infrastructure in 13 years. That has left the US facing billion-dollar annual shortfalls and crumbling bridges.

The challenge is that raising taxes on gas is politically unpopular and easy to notice every time a potential voter goes to the pump. It’s also fairly regressive, affecting poor people who spend a larger share of their income on consumption than the wealthy. But with gas prices falling, many experts are arguing that a gas tax increase—ideally, linked to inflation so we won’t have to do this again five years down the road—wouldn’t cause so much pain to consumers who were paying around 50 cents more a gallon as recently as this summer.

Beyond the dollars and cents, there’s another reason this policy makes sense: There’s a fear that cheap gasoline will reverse some of the gains made in reducing carbon emissions through increased efficiency and less demand. A higher gas tax would help put a floor on falling prices, ensuring there is still market pressure to move away from fossil fuels. These temporarily low prices might be good news for your pocketbook, but sooner rather than later their real cost will be felt in the air.