Much time is being spent discussing the attempt by OPEC producers, especially Saudi Arabia, to drive higher-cost US shale drillers out of the oil game. The theory is that because OPEC cartel members can drill at dirt-cheap prices, they can inflict despair on the lightly defended shale patch. In the end, US drillers will have wave the white flag and shut down.

The trouble with that theory is that OPEC actually has higher costs, by a wide margin.

The difference boils down to definitions. When you are talking about how much it costs, say, the Oklahoma-based company Continental Resources to drill in North Dakota, it’s roughly $40-$50 a barrel, judging by average outlays. That takes into account all the costs strictly associated with drilling, and suggests how much Continental probably has to earn in order to break even.

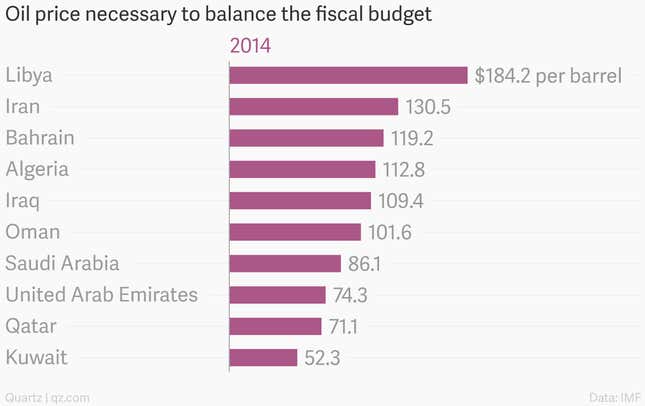

Things become more complicated when you turn to Saudi Aramco and its production at, say, the supergiant Ghawar oilfield. Western experts say that Saudi production costs average $10-$20 a barrel, give or take a few dollars either way. Of course, there are no hard public numbers when it comes to most Saudi oil data, only estimates from industry experts.

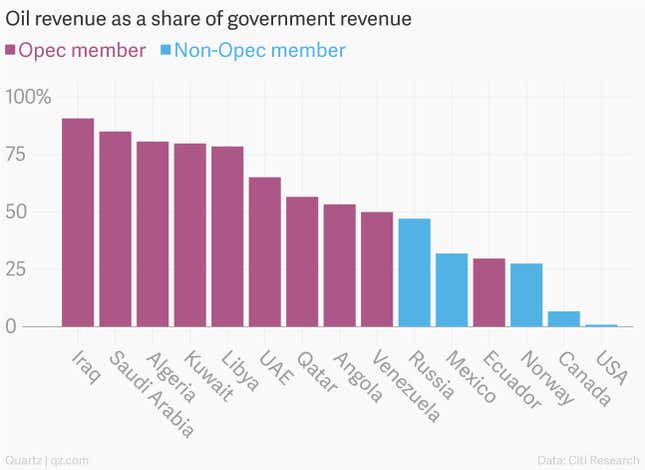

But Saudi Aramco is only superficially comparable to Continental Resources. It is an arm of the Saudi government; the oil that it drills funds roughly 80% of the palace budget, which by extension covers Saudi education subsidies, low-priced energy, housing allowances and other benefits, not to mention lavish support for the lives and schemes of every royal family member. Here is how this works across the oil patch.

When you add all that up, Saudi Arabia’s production cost is at least $86 a barrel of oil, or double Continental’s at the low end. The social costs can’t really be considered separately from those of the actual oilfield, because they are the mechanism by which various regimes stay in power; one is inextricably linked to the other. Saudi Aramco—like its brothers across OPEC—must earn those break-evens or eventually risk a collapse.

Here are the varying reliances on oil for OPEC members in the Middle East.

So why do analysts persist in describing the opposite juxtaposition? Because Saudi has socked away roughly $750 billion from the days when prices were high, including the average $106 a barrel that it earned for the three years prior to the current price plunge. The richest cartel members—Saudi Arabia, Qatar, Kuwait and the UAE—can test shale’s mettle not because their oil is cheap, but because they are willing to draw down on their tens and hundreds of billions of dollars in the bank.