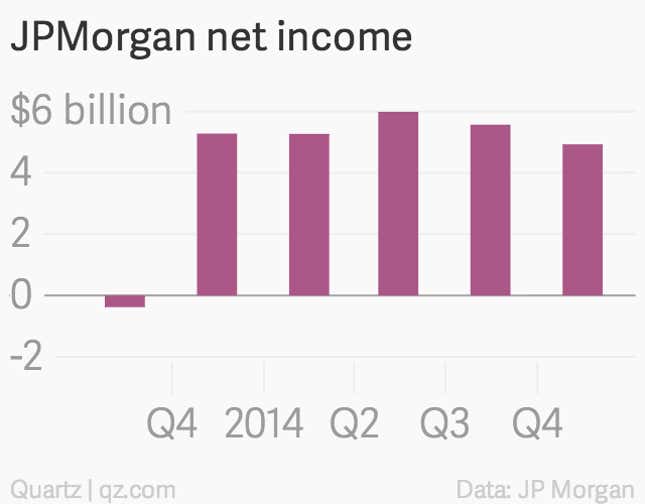

The numbers: Crummy. Profits fell 6.6% to $4.93 billion in the fourth quarter, compared to the prior year. The bank shelled out more than expected to pay for legal costs and socked away larger-than-expected reserves for loans that could go bad. Revenue dropped 2.8% to $22.51 billion.

The takeaway: The largest U.S. bank by assets kicked off what’s expected to be a ho-hum bank earnings season marked by lower trading and underwriting revenue. JP Morgan’s revenue from trading bonds dropped 23% from the year before. But results were shored up by its recovering mortgage business and investment banking fees.

What’s interesting: JP Morgan cut compensation by 3% from the year before, while shedding 12,000 employees from last year. (Headcount is down by 32,000 since the end of 2011.) Still, the cost-cutting wasn’t enough to make up for the $990 million in legal costs ($1.1 billion on pre-tax income) the bank paid as the Justice Department investigates its foreign exchange trading activities and the $840 million it had to set aside for credit loss provisions.