India’s public sector banks are struggling.

Striking employees, spiraling non-performing assets, deteriorating asset quality and a clutch of other factors have forced India’s state-owned banks to steadily lose ground to their private sector counterparts.

Yet, these public sector banks form the backbone of India’s banking sector, reaching millions of households nationwide and holding 70% of all assets in the country’s banking system.

Based on the data from the finance ministry, here are the best and the worst of India’s public sector banks (except the Bhartiya Mahila Bank), assessed across four parameters—profit after tax, capital adequacy ratio, return on assets and profit per employee.

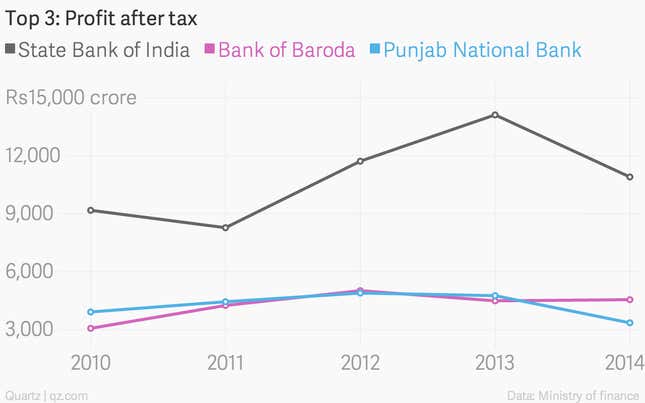

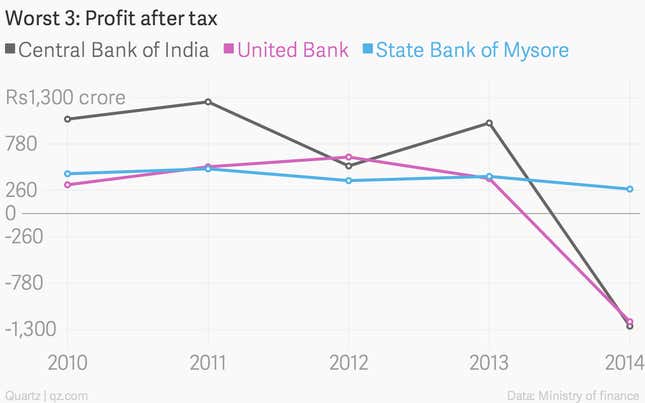

Profit after tax

Last year, India’s public sector banks saw a 27% decline in their net profit, and their combined profit stood at Rs37,017 crore ($5.96 billion). State Bank of India, with a customer base of more than 200 million, was the most profitable among the 28 public sector banks, and it had more than double of Bank of Baroda’s net profit for the year.

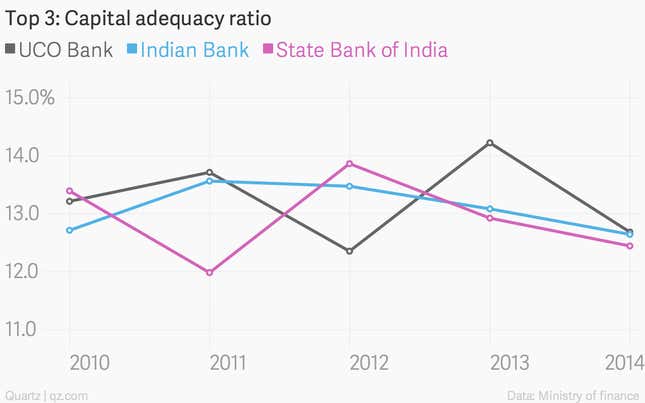

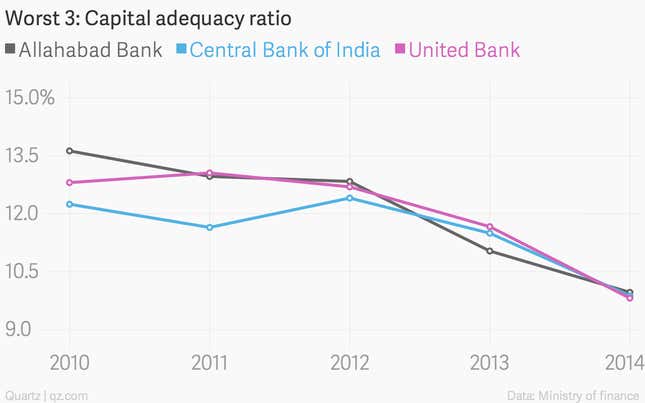

Capital adequacy ratio

Capital adequacy ratio (CAR) is the ratio of a bank’s capital to its risk—and the Indian government mandates a minimum CAR of 9%.

Indian banks have, on an average, seen their CAR fall over the past few years and public sector banks have been the worst hit among them. Between 2008 and 2014, CAR at public sector banks fell from 13.5% to 11.2% as bad debts mounted, triggered by the turmoil in India’s—and the global—economy.

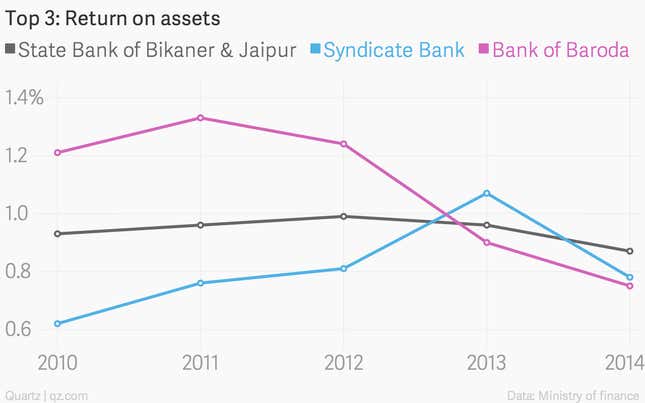

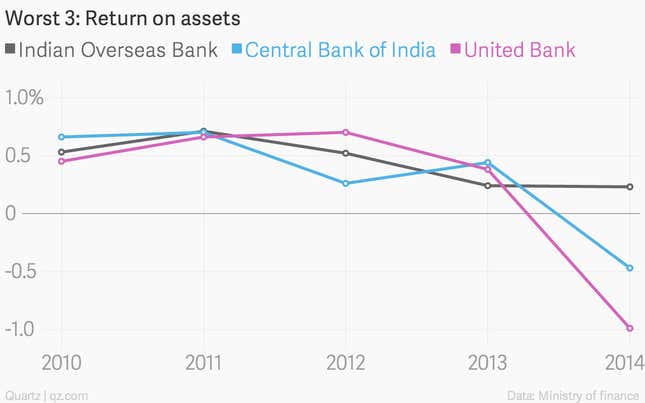

Return on assets

Return on assets, which measures the annual earnings of a company relative to its total assets, is an indicator of the profitability of banks.

Central Bank of India and United Bank, the two biggest loss-making public sector banks, also have the worst return on assets, while the nationwide leader is the State Bank of Bikaner & Jaipur.

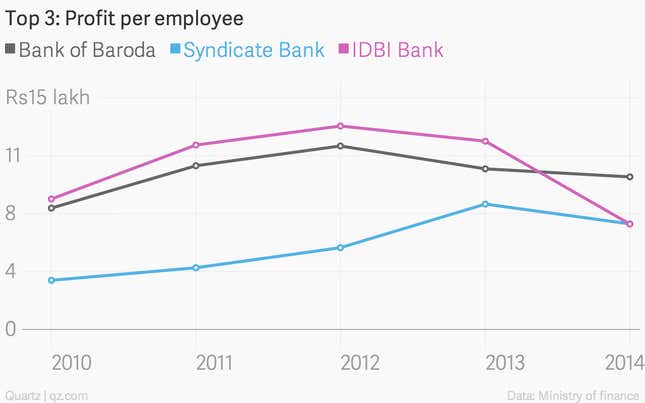

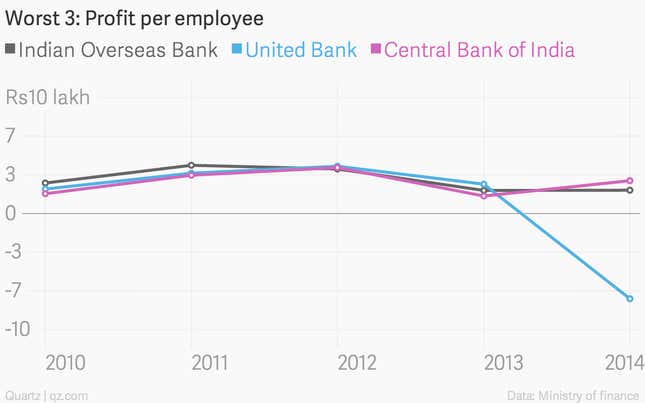

Profit per employee

In February, more than 1 million employees of public sector banks are expected to go on strike if the Indian Banks’ Association—representing the management brass of banks—does not increase the wages of public sector bank employees in the country.

But within state-run banks, the measure of personnel productivity varies widely; profit per employee is the average of the total profit by the number of employees in the group. Bank of Baroda—also the second most profitable bank in India—has a highly profitable workforce, while at the Kolkata-headquartered United Bank, it’s quite another story.