Just a year ago, one of the few things the world could agree on was that we were running out of oil. We had to develop non-fossil-fuel energy sources, and fast, or else fall victim to resource war, economic collapse, and a breakdown in our way of life.

Today there’s a different narrative: By 2020 or so, it is said, a flood of new oil and gas production will begin to wash over the world. Rather than general economic mayhem, there will be an economic shift: some rich countries will weaken, and hitherto marginal nations will take center stage.

Under this new scenario, oil prices could average $80 a barrel, compared with $110 for Brent benchmark crude today. Gulf monarchs untouched by the Arab Spring could face unrest, as shrinking oil revenues limit their scope for giving handouts. Mozambique—yes, Mozambique—could become one of the most important petro-states on the planet. China could more congenially assume a top rung among global powers. And the US could untether itself from some tyrants.

This vision of energy abundance stems from a series of new finds. Already, a natural gas revolution is under way in the US, where drillers armed with the new technology of hydraulic fracturing, or “fracking”, are pumping enormous volumes of natural gas from dense shale rock. America, on the verge of a gas deficit a few years ago, now has a century-long supply of the fuel. And fracking has now spread to shale oilfields. In states like North Dakota and Texas, it has brought an astonishing boost to US petroleum production.

But shale is only the beginning. There has been a flurry of discoveries and new production elsewhere—in Canada’s oil sands, the deepwater Gulf of Mexico, the Equatorial Margin of eastern South America, in offshore Brazil, deepwater Angola, west and east Africa, the eastern Mediterranean waters offshore from Cyprus and Israel, and more. Some of these new reserves may not start producing oil and gas until the 2020s, but when they do, they could spark the types of geopolitical disruption described above.

Yet the bears have not vanished. In a Sept. 10 note to clients, Bernstein Research declared that scarcity continues to govern the oil and gas patch. Rather than a new day of cheaper oil, Bernstein said, the world should prepare itself for a serious rise in prices starting the middle of the decade, and surpassing $150 a barrel by 2020. In an Aug. 30 report, Barclays forecast $180-a-barrel oil by the end of the decade.

The bears explain their stance thus: None of the new production expected by 2020 will make up for the combination of surging Chinese demand and a decline in output from older oilfields. Though the current high prices have prompted some gains in efficiency—people are buying cars that guzzle less fuel and making fewer long trips—these will vanish when prices drop and people return to their old habits, making prices go back up. Of course, on this thinking, if oil prices do rise above $150 or $180 a barrel, demand will fall at the same time that higher-cost fields become economic, thus leading to a new decline in prices and abundance, to be followed again by lower production and renewed scarcity—a vicious circle of price swings.

But a closer look at the arguments of both camps suggests that they are not so far apart. The scarcity scenarists generally forecast only through 2020, while the abundance advocates typically talk longer range—through 2030 and beyond. I emailed Oswald Clint, lead author of the Bernstein report, to ask whether the scarcity scenario holds after 2020, when Russian, east African and South American oil and gas volumes begin to reach market. “If Russia works and the Arctic and Kenya, etc. etc., then it may not be the case that our $150-per-barrel (projection) in 2020 keeps inflating higher,” Clint replied. “The scale of Russia could be sizeable, but we will get data and answers on this in the next 2 years, which will help us think about the next decade.”

In other words, even if the bears are right for now, there might be a different story after 2020. And if they are wrong? Early signals of the geopolitical impact of energy abundance are already apparent in Russia and Europe, suggesting that it is worth watching for its effects elsewhere as well. Here’s a look at five of the potential geopolitical impacts that we are looking for as part of our obsession.

1. China changes its energy diet and shakes up the world

On current industry forecasts, global energy consumption should rise by some 39% by 2030, and China alone will account for about 40% of the jump. But two things could change China’s energy consumption enough to alter the geopolitical status quo.

One, according to Bernstein, is if the Chinese economy weakens so much that GDP growth drops below 4.5% (though it hasn’t been even close to that low in more than 20 years), and oil consumption drops with it. Second, China could simply change its fuels mix. Right now it burns a lot of coal, and will account for two thirds of the global growth in coal-burning through 2030, according to the BP Statistical Review. But the country is already shifting towards gas-burning power plants, and that could happen faster if gas gets cheaper, as it very well could. Asian liquefied natural gas (LNG) is the most expensive in the world by far—$17 and more per 1,000 cubic feet compared with about $3 in the US. A vast new natural gas supply will flow into Asia in the 2020s from east Africa, and possibly the United States, Cyprus and Israel. That could push down Asian gas prices, and be a tipping point for China to cut its use of coal much faster.

Domestic politics could especially motivate China to embrace this cheaper gas. Public protests have been growing over air and water pollution, in part caused by the burning of coal and oil. On current trends, that pollution is going to get considerably worse, and so might the unrest. The Communist Party first decreed a reduction of emissions in 2005, partly because of the political fallout. Now, China’s rulers are doing “everything they can” to reduce CO2, among other pollution, says David Fridley, a scientist in the China Energy Group at Lawrence Berkeley National Laboratory.

The impact of China’s reducing its oil consumption and CO2 emissions would be far reaching. The OPEC countries would weaken, as would their rulers’ grip on power. The global economy would surge, as energy-consuming countries right their balance of payments thanks to lower energy prices across the board. And slower-growing CO2 emissions are a geopolitical impact in themselves, since global warming affects the economics, the way of life and even the very survival of certain nations.

2. OPEC’s influence plunges

Currently, the cartel of mainly Middle Eastern and African countries satisfies about 35% of the world’s 89 million barrels a day of oil consumption. Russia is the next biggest center of gravity, with a little over 10 million barrels a day. But under abundance forecasts, North and South America (excluding OPEC member Venezuela) will produce up to 25 million barrels a day by 2020. The rest of Africa will pump a lot too, with oil and gas discoveries just this year in Mozambique, Tanzania and Uganda—Wood Mackenzie forecasts production of 7.5 million barrels of oil a day from Sub-Saharan Africa by 2020, in addition to the natural gas equivalent of 1.9 million barrels a day of oil by 2030. Combined, these rising giants will seriously undercut the central status OPEC has held since the 1970s in the global economy.

3. Russia’s economy suffers a severe pinch

Even now, Russia, reliant on oil and gas export earnings for some 60% of state revenue, is in trouble. In its core market, Europe, a dozen countries get 100% of their gas from Russia; but Europe as a whole is consuming less gas, demanding lower prices, and organizing competing supplies to challenge Gazprom’s market dominance. Russia has spent years trying to pivot East, but so far Moscow and Beijing have failed to agree on a price for the gas. On Sept. 8, Russia signed an agreement to build an LNG terminal on its eastern coastline to serve Japan, but again there is no agreement on price. So the budget is under threat. Add that to Russia’s sorry demographic crisis—a shrinking, aging population—and its future looks grim.

But that is only the beginning. An age of abundance could magnify Russia’s misery by lowering average global oil prices, further reducing state income. And with so many other sources for oil and gas, Russia’s comparative hydrocarbon heft would shrink. President Vladimir Putin, should he continue to rule into the 2020s as he appears to wish, would wield far less geopolitical punch.

4. The US becomes more prosperous and less insecure

China’s rise and the 2008-09 financial crisis have taken their toll on America’s national confidence, and it is currently the world’s biggest oil importer, buying 8 million barrels a day from abroad and sending more than $300 billion a year into foreign pockets.

But in the abundance scenario the US could produce most of its own petroleum, buy the rest from its friendly neighbors Canada and Mexico, and perhaps even pump enough to export. That U-turn could lead to an industrial resurgence. The balance of payments would be much improved. But above all, the US would enjoy the world’s cheapest natural gas, a primary feedstock in numerous industries. US manufacturers could flock home and ignite “a potential minor Industrial Revolution,” says CitiGroup’s Ed Morse, who wrote in a March 2012 note to clients that “The US is becoming the new Middle East.” If he is right, America could enjoy an extended period as the world’s dominant economic power. China, conversely, might have to wait longer for that spot.

But the US role as the world’s policeman might change too. If it no longer needs Middle Eastern oil, America would probably revisit the 1980 Carter Doctrine, which declared that Washington would treat any threat to the Persian Gulf as a peril to the US itself. It might not recall large numbers of ships and troops. But it could ask allies to pay more of the expense of patrolling commercial sea lanes.

5. Climate change will worsen—but less than you think

As discussed above, global warming is a geopolitical event in that it may threaten the population, economy and influence of some nations, while empowering others with improved agriculture and other sectors. Cutting CO2 emissions enough to cap average global temperatures at 2 degrees centigrade above their 1990 level, as climate scientists seek, is already probably impossible, experts agree. And if cheap oil and gas embolden motorists and industries to revert to old, gluttonous habits, global warming could get much worse.

Yet the age of abundance also brings with it some changes in the way energy is produced and consumed. Moving from coal- to gas-burning power plants has reduced US greenhouse gas emissions to a projected 5.2 billion tons in 2012, according to the International Energy Agency. That is the lowest level since 1992.

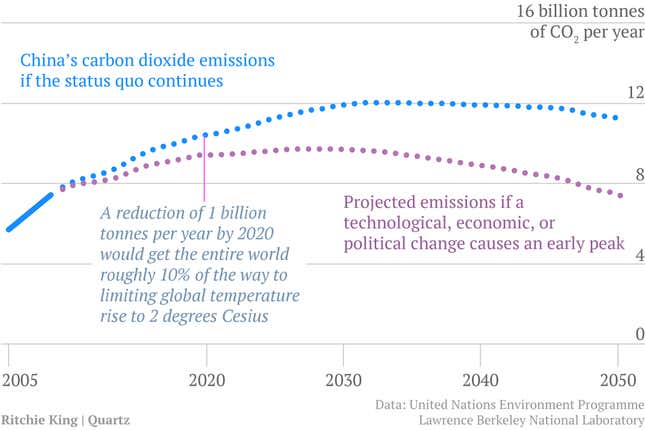

The greenhouse gas buildup won’t start to abate until 2030, when experts forecast that the emerging world’s consumption of coal and oil will begin a long decline, and most of the growth until then will come from China. But, as I’ve suggested, environmental protests could make Beijing accelerate its efforts to burn less coal, which produces three times as much CO2 as natural gas. Fridley’s China Energy Group at Lawrence Berkeley has built a climate model that suggests that China take further measures, such as greater efficiencies and the replacement of dirty power plants with non-polluting sources of electricity including nuclear. “The results [of the model] show a plateauing of emissions in the 2020s as a result with absolute declines” in CO2, Fridley told me by email.

Something will change, whatever it is

Whoever of the forecasters is right, we’re not going to see a continuation of the status quo. Even in the most pessimistic outlook of future oil production, competing centers of energy gravity arise to challenge OPEC’s predominance, for example. Russia has no easy solution to its market squeeze. And China’s rulers must contend with public restiveness over pollution, regardless of whether fossil fuels are scarce or abundant. There are going to be big shifts in energy use and production, and with those, in geopolitical power.