The race-based wealth gap in the US is a real and established phenomenon.

The Pew Research Center noted last year that the recession expanded the gap between white households and black and Hispanic households, to the widest it’s been in more than 25 years. The Washington Post’s recent series about black wealth in Prince George’s County, Maryland, showed how the financial crisis devastated even the nation’s highest-earning majority-black community. And though researchers at the Federal Reserve Bank of St. Louis suggest that Hispanic wealth has the wind to its back, parity is still a ways off.

Racial disparities also persist even within the tax-sheltered confines of a 401(k) account, according to a new working paper (pdf) released in February by the National Bureau of Economic Research. Stanford University’s Kai Yuan Kuan, Mark Cullen, and Sepideh Modrek looked through the anonymous retirement accounts of about 9,600 Alcoa workers between 2003 and 2010—the database they used was stripped of names by a third party but retained other characteristics like race and age–and found that black and Hispanic employees’ accounts were in rougher shape than those of their white co-workers.

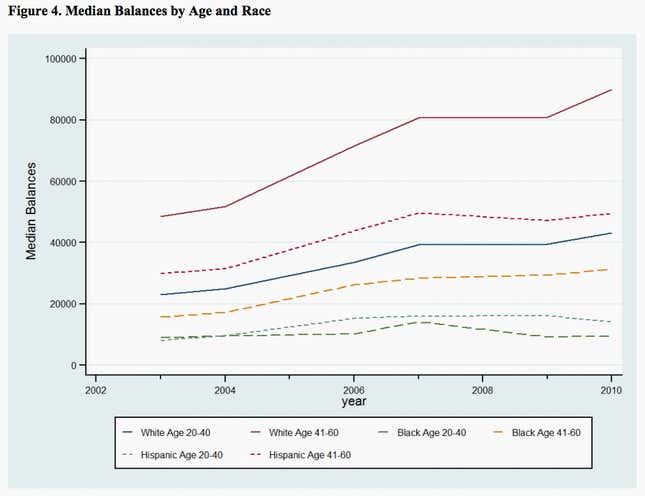

For starters, they had lower balances.

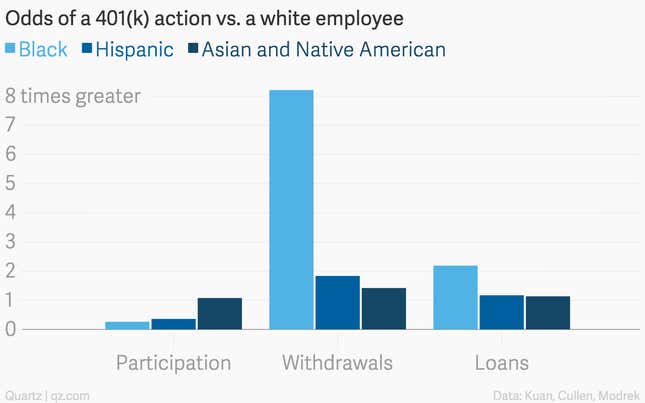

Also, black and Hispanic employees were less likely to participate in the plans at all—while the ones who did were more likely to make early withdrawals from their accounts, or take loans out against them.

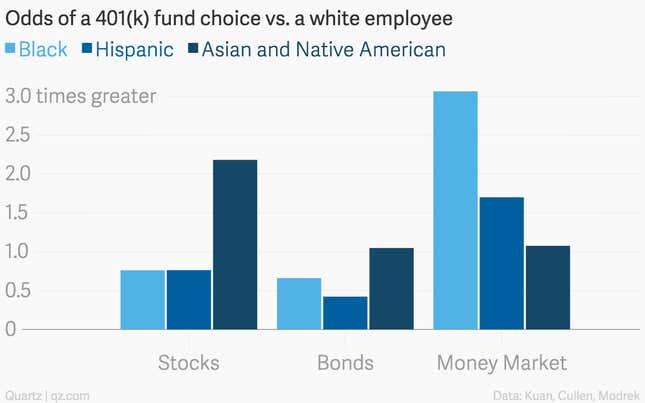

And, as found in a Brandeis University study of the wealthiest 5% of black households, this latest study found that black contributors (as well as Hispanic and Asian or Native American contributors) were more likely than white contributors to stash their 401(k) money in safer, low-returning assets like money market accounts than riskier fare like stock or bond funds.

Like any good paper, this one comes with some caveats. The database used in the study didn’t offer a window into incomes, non-401(k) sources of wealth, or the degree to which employees either trusted or distrusted financial institutions. Also, black and Hispanic workers were more likely to be hourly rather than salaried. This status, the researchers wrote, “can serve as a crude proxy for financial literacy based on the idea that salaried workers generally have a college education while hourly workers do not.”* And controlling for other factors, like an individual’s appetite for risk, the gap closes some.

But broadly speaking, the researchers said, none of those factors would have a strong enough effect to fully explain the differences they found.

As traditional, defined-benefit pensions go the way of the dodo, it’s important to keep in mind that racial inequality can manifest itself in many different ways, including some with the potential to perpetuate the disparity in our retirement years.

*But even among only salaried workers, black employees were less likely than their white counterparts to participate in the plan (salaried Hispanics participated at about the same rate as salaried white workers, however). Among hourly workers, participation rates were lower for black and Hispanic employees than for white employees.