A company is worth whatever people will pay for its shares. That price is presumably based on future expectations for sales, profit, cash flow, and the like—but often, these ”fundamentals” take a back seat to other purported measures of value.

With that in mind, consider the rumors that photo-sharing app Snapchat is in the market for venture funding that values the firm at up to $19 billion. The red-hot social-media startup only recently started generating revenue (profit is for squares).

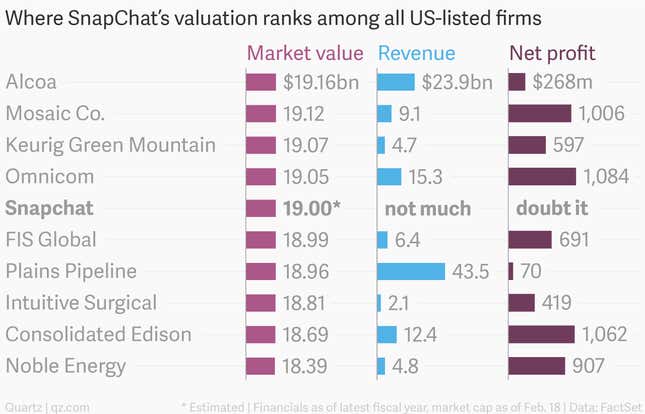

At $19 billion, Snapchat would rank third among all venture-backed companies in terms of value, behind Xiaomi and Uber. If you took its reported valuation as a (very) rough proxy for what it would fetch on the public market, Snapchat would sit among some very big, and very profitable, companies listed on US stock exchanges:

Now, it doesn’t make much sense to compare Snapchat to aluminum giant Alcoa, given that investors will almost always put a higher value on an asset-light internet company’s growth prospects than for a company in a mature, cost-intensive industry. But it is interesting nonetheless to see who Snapchat’s near neighbors might be on the stock exchange. By this measure, the firm behind an app whose users share 700 million disappearing photos daily could be worth the same as a company that ships 13,000 metric tons of aluminum products every day.

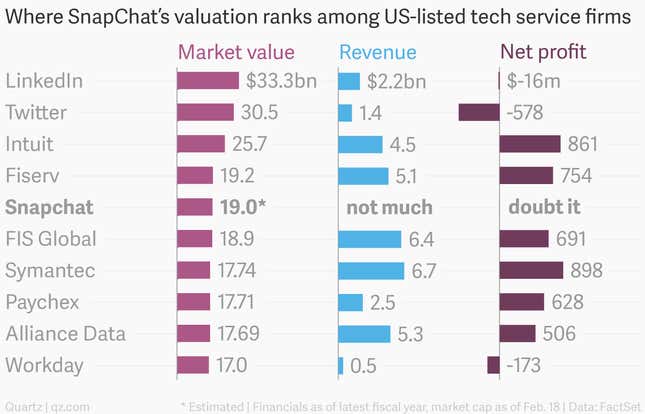

Narrowing it down to just technology service companies, here’s where Snapchat would fit in:

Snapchat discloses precious little information about its business—nothing on user numbers, revenue, or profit. It is clearly growing fast and attracting millions of young fans—fans advertisers are keen to reach and investors are eager to monetize. If it’s the next Facebook, then what looks like a lofty valuation today could prove a bargain tomorrow. But if its fundraising prowess is more a function of a venture capital bubble, investors may look back at the traditional market metrics and shake their heads.