In the western world, tampons have been hailed as a “giant leap” for womankind. But they have had little success in winning over hearts and minds of 355 million reproductive-age women in India.

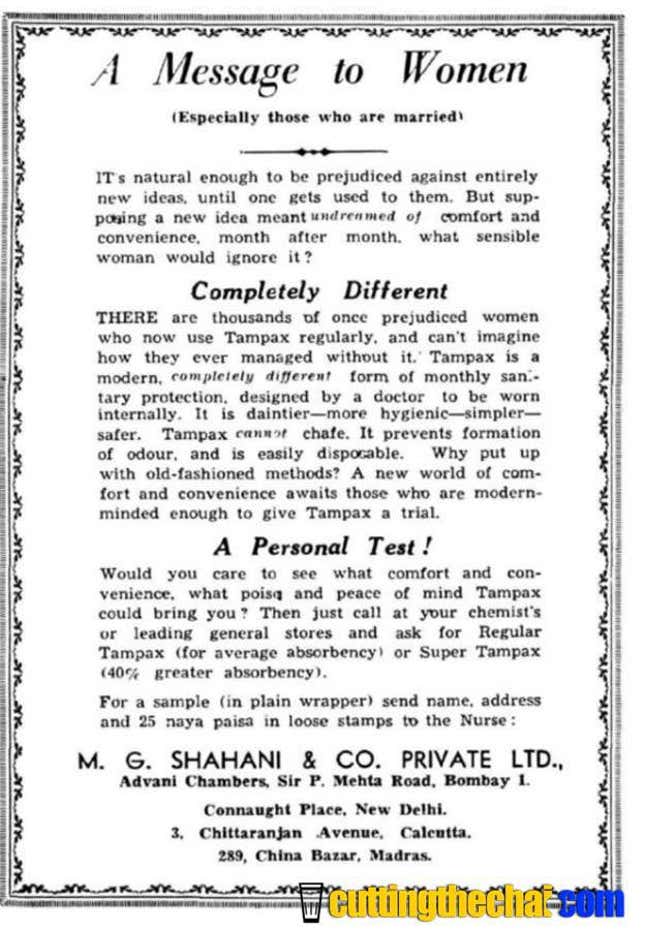

To understand why, consider the advertisement below trying to sell tampons to Indian women in the 1950s.

The ad is “a message to women” and “especially those who are married.” In other words, it is for women who are not virgins, as sex before marriage was (and still is) taboo in South Asia.

“My mother used them, so did many other British and educated Indian women those days. But as a young girl, I was always told I could use them only after I marry,” says Shiela Thadani, 80, whose father, M.G. Shahani, ran a chain of stores named after him across north India, stocking everything from tampon to tea. His company created the advertisement.

But more than half a century later, many Indian women still assume that tampons are meant only for those who are not virgins, even though medical research has long debunked the connection between virginity and hymen. And judging by commercial sales, it does not seem to be the sanitary product of choice even among married women.

For virgins too

India’s total personal hygiene market, spurred by a government campaign to promote sanitary napkins among adolescent girls, is expected to reach Rs1,970 crore (roughly $300 million) by 2018. Tampon sales have, however, moved at a comatose pace—at a sluggish 2-3% rate, seven times lower than sanitary napkins, according to a Euromonitor survey.

Apart from a nagging doubt that tampons would rob them of their virginity, there are several other reasons why women in the subcontinent shun this feminine hygiene product: Low visibility, lack of awareness, high prices (compared to sanitary napkins), and a reluctance to test a new sanitary solution.

“I was amazed to know something like this (tampons) was possible when I heard about it three months ago,” says 21-year-old Rachita Thapar, a student at New Delhi branch of the National Institute of Fashion Technology (NIFT), a fashion college.

Like Thapar, a majority of her friends discovered tampons in October last year while attending a health workshop in college.

“Men expect their wives to be virgin,” says Veronica Patil, 23, a design student at NIFT. “For health and other reasons, I wouldn’t even consider it as an option.”

Now sold online

It is still not easy to find tampons in supermarkets in smaller cities.

While there is no detailed survey available on tampons, international giant Johnson & Johnson is believed to dominate this segment in India. The company did not respond to emailed queries from Quartz. However, many other players have set shop in India, lured by its educated, and wealthy middle class. Several e-commerce websites, such as, Shycart.com, Flipkart and Snapdeal have now started stocking imported tampon brands in anticipation of a growth in demand.

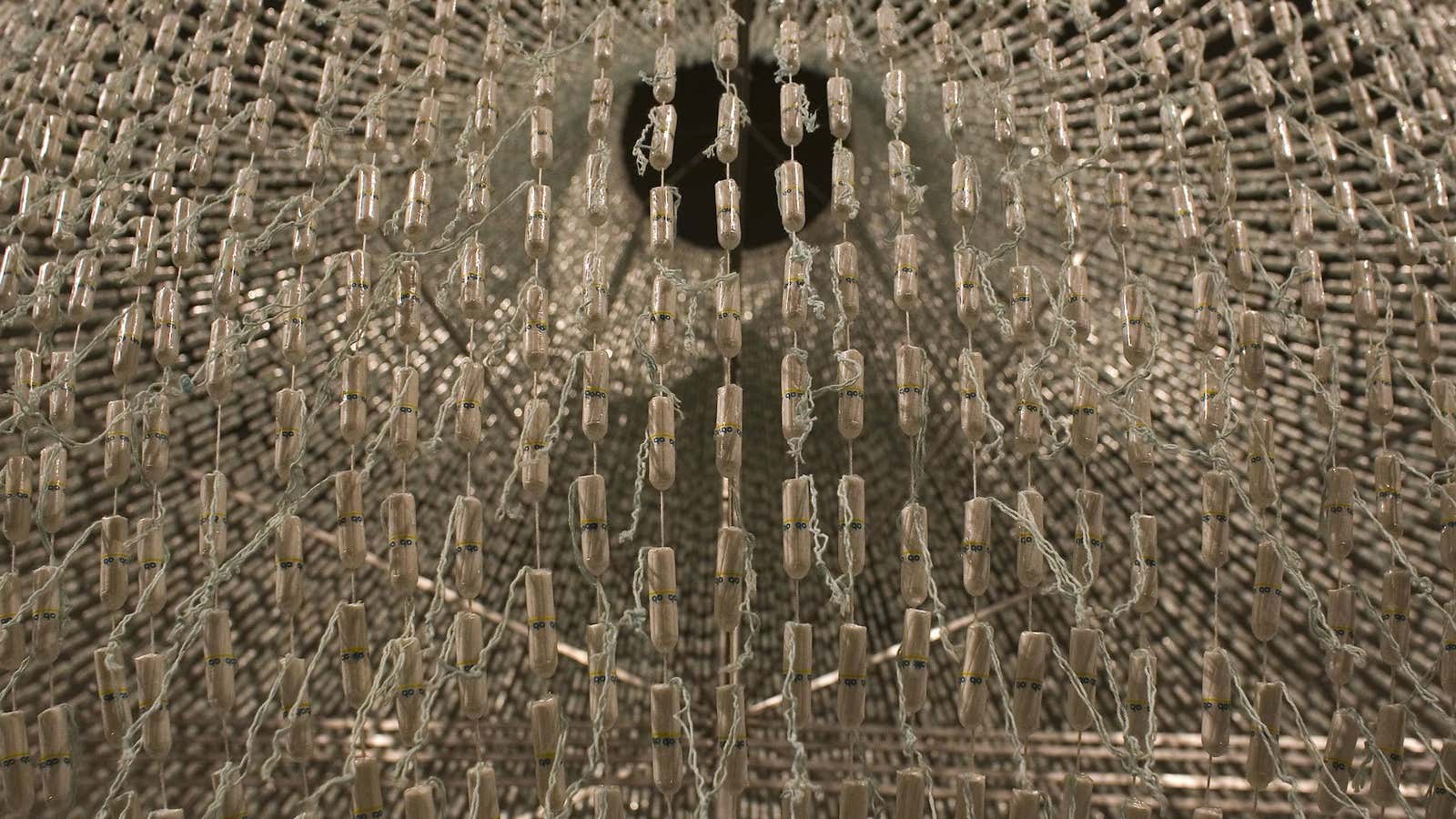

One of the new players in this space is TZMO SA (Torunskie Zaklady Materialow Opatrunkowych), a Poland-headquartered company. It entered India in 2006 and its Indian subsidiary arms, Bella India Healthcare and BellaPremier Happy HygieneCare, sell a range of sanitary products, including Bella tampons, with growing presence in the southern states of Kerala, Tamil Nadu, Andhra Pradesh, Telangana and Karnataka. Bella India sells four sizes of tampons—mini, regular, super and super plus, its 16-piece packets ranging between Rs145 and Rs160. Johnson & Johnson currently sells O.B. tampons in two sizes—a ten-piece superpack for Rs80 and a 20-piece regular size for Rs175. O.B. stands for ohne binde in German, meaning “without napkins.”

According to Bella India’s internal research, which has been aggressively branding its product range by hosting badminton matches and at-school workshops, police women and athletes are responding well. And customers are today found in unlikely small towns, such as Kunoor in the coastal state of Kerala.

“In workshops, girls ask me many questions—if tampons will result in loss of virginity, or if they collect urine,” says Katarzyna Sligowska, marketing and training manager at Bella India Healthcare. “The very fact that they’re asking means they’re thinking about it.”

We welcome your ideas at ideas.india@qz.com.