In their attempt to stop the world financial system from imploding, central banks have taken unprecedented measures. But in doing so, they may be sowing the seeds of the next financial crisis—in a way that no one is watching.

Since the Great Recession began, central banks have been trying to restore confidence in the monetary system—but never, it seemed, trying quite hard enough. So when the US Federal Reserve announced its latest round of quantitative easing—QE3—on Sept. 13, the markets leapt for joy. Unlike the first two rounds, QE3 is open-ended: the Fed said it would keep buying mortgage-backed securities (MBS) to the tune of $40 billion a month until it saw an improvement in the economy, specifically in employment. It also promised to keep interest rates between zero and 0.25% until at least mid-2015.

Today’s new kind of central banking is bold, if arguably necessary. But it’s already becoming clear that there will be unintended consequences, either of which could spark another financial crisis. There are two ways they could materialize.

First there are the unintended consequences we know about. The most vocal opponents of ultra-easy, low-rate central bank policy argue that quantitative easing (bond-buying programs) and low interest rates may spur recovery but will create a warm, fertile environment for breeding a new economic bubble: excess and artificial demand, inflation, poor lending standards, and moral hazard in government spending.

The Fed and other central banks respond that, yes, these could be risks. But so far they simply don’t see signs that it is happening. Global economic growth, they note with chagrin, remains frustratingly slow. Inflation is subdued. Developed-market banks still won’t lend to any but the most solid clients. US and euro-area governments want to cut their spending, not expand it.

But perhaps more worrisome are the unintended consequences that are truly unintended. Central banks in the US and Europe seem to have succeeded in bringing down interest rates and restoring interbank lending, but some investors fear that these are mere band-aids that conceal deepening wounds. Specifically, they worry about stresses in the financial system’s most important segment—lending between the world’s largest financial institutions—that could, just as in 2008, asphyxiate the entire system. The key to understanding these is the summer’s noisy scandal over the London Interbank Offered Rate, or LIBOR.

Why LIBOR matters

LIBOR is one of the world’s most important interest rates, dictating the rates for some $360 trillion in other financial transactions. It is derived from the rates at which banks report that they can borrow from one another for a given time period; in fact there are 150 different LIBOR rates for various currencies and borrowing periods.

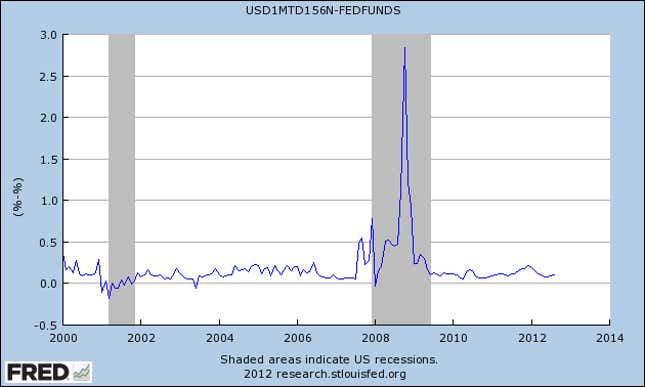

During the 2008-2009 financial crisis, LIBOR also acted as something else: a marker of the stress in the system. Since the late 1980s, the 1-month US dollar LIBOR rate had closely tracked the US federal funds rate, the rate at which banks can borrow for one month from the Federal Reserve. That reflected how stable things were: the world’s top banks had little fear that their counterparty would collapse, so they borrowed from and lent to each other for just a small premium on the price at which they could have borrowed from the Fed.

When the financial crisis hit, banks lost faith in one another. They raised their lending rates and LIBOR shot up, diverging from the effective federal funds rate. That made the banks’ new fragility visible to the outside world. To shield themselves from speculators, they started under-reporting the price they paid to borrow, keeping LIBOR artificially low. (This was a piece of the scandal that brought down the head of Barclays, Bob Diamond.) But the truth was too apparent to conceal: interbank credit markets which kept the global economy functioning froze up, and banks stopped lending to each other, companies, and people.

The Federal Reserve and other central banks sprang into action, supplying cheap credit to the commercial banks to stave off a liquidity squeeze. This policy, among others, arguably saved the financial system. On the face of it, all is well: LIBOR now hovers just above the federal funds rate again.

However, while stability is back, normality is not. In the US, banks are still being stingy with new loans. In Europe, the yawning gulf between stable “core” countries and troubled, indebted “peripheral” countries means firms still can’t be sure whether clients will be able to pay them. Worried that they will find themselves short of cash in a pinch, companies across the globe have been hoarding it instead of hiring workers or starting projects.

Nor has the financial system returned to health. The Federal Reserve and its counterparts have prevented liquidity from drying up but haven’t restored it to previous levels; all they are doing is filling in for the lack of commercial interbank lending. As the chart below demonstrates, lending volumes are on a par with those of the 1980s, not of four years ago.

Ignorance is bliss

Banks have done what used to be unthinkable: They’ve become dependent upon central banks. Like any addiction, this is a hard one to kick. “Once everyone faces [i.e., seeks funding from] the Fed, it’s very hard to [return to] face anyone else,” says the chief market strategist of a Chicago-based firm. “It’s unlimited—you get all you want.” In Europe, banks borrowed an incredible €1.02 trillion ($1.33 trillion) from the European Central Bank (ECB) starting in December 2011. In many cases this financed a large chunk of their operations for the year.

So while LIBOR technically still exists to settle old contracts, it is now meaningless: It reflects the rate banks are getting from central banks instead of from each other. The real level of financial stress, the strategist argues, is hidden. ”If the only world we know is the world of compressed spread [between LIBOR and the federal funds rate] we’re sowing the seeds of the next financial crisis,” he says. “[The system] is just as brittle as it ever was.”

Such dependence on central banks may have severe consequences. A study by the German Bundesbank compared how much information banks share when working directly with one another as opposed to a public counterpart like a central bank. When public institutions meddle in lending, it concluded, banks lapse in properly investigating one another, inhibiting risk management:

With a central counterpart private information that banks have about the credit risk of other banks is no longer reflected in the price at which banks can obtain liquidity. Thus market discipline is impaired. Moreover, the incentives for banks to acquire and process such information are largely eliminated.

And Lombard Street Research’s Leigh Skene warns:

[O]verly pervasive central bank activity is making it virtually impossible to establish true market pricing, so economic and financial analysis has become superfluous. Markets are now merely the result of consensus opinion of the timing and scope of the next central bank move, so some are collapsing, for example interbank markets. In addition, spread markets are becoming less functional and more speculative.

The translation of these two passages: finance has become a guessing game, and financiers are gambling on central banks.

“I do think [central banks] are trying to make things less transparent…[to] keep things secretive where only central bankers are in the know,” explains, Peter Tchir, a hedge fund manager. “It hides the problems, which probably means we’ll wait until the last minute [to address them] and the crisis will be just as bad: problems just like AIG [the insurance firm bailed out by the Fed in 2008], where people knew about them beforehand.”

All this opacity means uncertainty; uncertainty breeds volatility in markets; and volatility is a bad thing. “Fixed income, when it ‘blows up’ is almost always very sudden,” Tchir warns. “The Fed has suppressed yields through direct purchases [of bonds and mortgage-backed securities], and the knowledge that they are making direct purchases. Since people know they are buying, others will pile into that trade, believing that it is safe being on same side.”

Essentially, investors assume that these bonds and securities are safe because the Fed is buying them. If for some reason they began to doubt the Fed’s future commitment to purchasing bonds—or even the value of the bonds themselves—they would start to question not only their own financial health, but that of all the banks and funds they trade with.

And to top it all off, the people leading attempts to redesign market regulation are those who see little reason to check central banks’ control over the financial system: the central bankers themselves.

Setting the stage for a new catastrophe

That brings us back to the furore over the Fed’s QE3. As we’ve already seen, most critics warn that it could trigger a reckless new round of spending and lending, leading to a new bubble. But the scenario above suggests, rather, the reverse: a new tightening in credit.

What could set this off? Gridlock in the US Congress, geopolitical tensions in energy markets (an Israeli attack on Iran, instability in Russia), banking crisis in Europe, or political sparring between the US and China could all reflate market anxiety in a hurry. When markets are anxious, central banks’ ability to calm them depends to some extent on a confidence trick. Any sign that central banks were nearing the limits of their capacity to purchase bonds or securities, or that their purchasing was having no effect, could cause a fresh loss of confidence.

The ECB can only do so much to keep banks from failing. After purchasing some 60% of Treasuries issued in 2011 and starting a new program of open-ended QE, the Federal Reserve may be nearing that point. If the markets now start to panic even as the Fed is buying bonds to ward off that panic, it would be a self-reinforcing signal that the Fed was, in fact, impotent. Then, Tchir predicts, the spike in interest rates for the “safe” securities the Fed was buying would spill over into the markets for commodities and foreign exchange, which are closely tied to interest rates but far more unpredictable.

The deadly physicians

Some economists have long feared that central bank policy creates crises, rather than disrupting them. In an August paper published by the Federal Reserve Bank of Dallas, William White, a Canadian and the former chief economist of the Bank for International Settlements, described how one could blame monetary policy for past booms and busts:

By mitigating the purging of malinvestments in successive cycles, monetary easing thus raised the likelihood of an eventual downturn that would be much more severe than a normal one. Moreover, the bursting of each of these successive bubbles led to an ever more aggressive monetary policy response. From a Keynesian perspective, this response seemed required to offset the effects of the ever growing “headwinds” associated with all the malinvestments noted above. In short, monetary policy has itself, over time, generated the set of circumstances in which aggressive monetary easing would be both more needed and also less effective.

Translation: central bank intervention is like a medicine that treats the symptoms but leaves the underlying infection to get worse, thus needing ever stronger medicine to treat the relapses.

Central banks argue that they are keeping close watch on indicators that would suggest either asset bubbles are forming or credit markets are tightening. A spokesperson for the Federal Reserve would not disclose to Quartz exactly which indicators the Fed is tracking. But given that the world’s most important financial institutions are already so reliant on central banks, and that central banks are nearing the “zero bound” beyond which traditional monetary policies fail, how much can we really trust our central bankers? If a crisis began anew, would their response come too late?