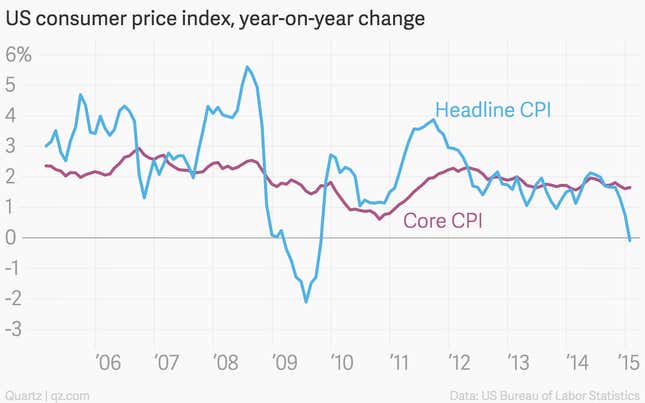

For years, malcontents have been squawking that the Federal Reserve’s policy of creating fresh money and using it to buy bonds—quantitative easing—would set off a dangerous inflationary spiral. They couldn’t have been more wrong. In fact, as measured by the headline US consumer price index, prices have now fallen by 0.1% over the last 12 months. (That’s the first time that’s happened since the US clawed out of the Great Recession.)

There are many reasons why. But foremost among them is the fact that prices for oil are collapsing.

The so-called core consumer price index, which strips out food and energy prices, remains firmly in positive territory, rising 1.7% over the prior year. Economists tend to view core price levels as a better guide to the future path of prices than headline numbers, which get whip-sawed by volatile commodity prices. That’s the line that Janet Yellen, chair of the US Federal Reserve seems to be taking. In Congressional testimony this week she has said the Fed’s monetary policy committee expects inflation—as measured by the Fed’s preferred gauge, core PCE, to continue to fall over the next few months, but to gradually return to the central bank’s 2% target over the longer term.

If so, Americans should enjoy the gains in real purchasing power while they’ve got them. The decline in prices has given a lift to real, or inflation-adjusted wages. Combined with a boost in working hours, real weekly earnings in the US rose 3% between January 2014 and last month. That’s the best increase in years.