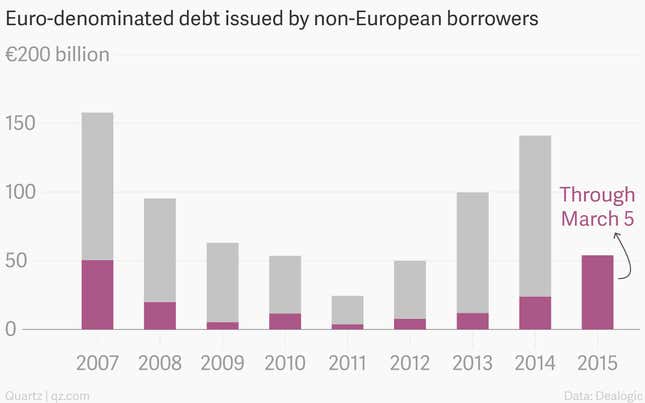

Coca-Cola, Toyota, the Mexican government, and the province of Quebec. All of these institutions have tapped the euro bond market this year—and in a big way. In fact, non-European issues of euro-denominated bonds have soared to an historic high for this point in the year, with borrowers drawn by low—and sometimes even negative—interest rates:

Warren Buffett, who knows a good deal when he sees one, is also getting in on the act—Berkshire Hathaway is now shopping its first-ever euro bond. Last week, Coca-Cola raised €8.5 billion in the euro bond market, the largest issue ever by a US borrower and the second-largest euro issue of all time.

Those records may not last long. That’s because the European Central Bank has confirmed its commitment to buy bonds like they’re going out of style. To jumpstart the euro zone’s moribund economy, the ECB will purchase €60 billion worth of public-sector debt every month starting next week, running until at least September 2016. In anticipation of the bond-buying program, euro yields have been steadily falling (bond prices move inversely to yields).

The details of the purchase plan were released yesterday, and will encourage the bond bulls even more. ECB president Mario Draghi ruled out buying corporate bonds, but by pushing down benchmark government yields with large-scale purchases, corporate borrowers can price their issues at extremely low rates and still find eager investors, given the meager alternatives.

Draghi said that the ECB will buy just about any public-sector bond of between 2 and 30 years of maturity, at any yield above -0.2%. Both Germany and Finland have recently issued government bonds with negative interest rates; with the ECB so keen to buy more low- and negative-yielding debt, others may follow suit.

That means that the corporate borrowing bonanza will continue, with cheap debt attracting issuers at home and abroad. This week, French utility GDF Suez sold a two-year bond that yields precisely 0%. That is, you give the company €1 today and two years from now, it gives you the same amount back without any interest.

On current trends, it won’t be long before a company tries its luck with a negative-yielding bond (in which buy-and-hold investors get back less than they lent). At that point, euro bond buyers will literally be giving their money away.