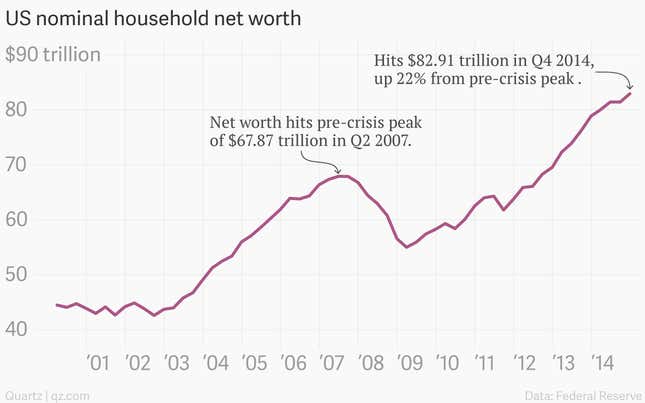

American household wealth soared to new heights in the fourth quarter of 2014, driven by a recovering stock market and healthier home prices. The net worth of the household sector rose to $82.91 trillion during the quarter. Up 1.8% from the prior quarter, and 5.1% from the prior year, it’s also 22% higher than the pre-crisis peak reached in the second quarter of 2007, according to data from the Federal Reserve.

That looks good—on paper. But as with all economic data, it comes heavily caveated. Caveats include the fact that these are nominal figures, not inflation-adjusted, nor are they adjusted for the rising number of households in the country. Update: Because of the way the Fed data is collected and reported, it also includes all sorts of things—including private equity funds and hedge funds—that you wouldn’t normally think of as a “household.”

And while the data reflects the widespread health of aggregate American household balance sheets in recent years, this is a statistical fiction. All Americans aren’t roomies. There is no aggregate American household. As of December there were roughly 116.8 million individual American households. And some of them have done much better than others in recent years. And the “some” here means mainly the rich, whose households own significantly more stock market wealth—a major factor in the Fed’s household wealth data—than poor or even middle-class households.

Roughly 50% of all US families hold stocks either directly or indirectly, according to the most recent findings of the Fed’s survey of consumer finances conducted in 2010. (It conducts the survey every three years, but it can take years for the results to get published.)

Among the richest 20% of American households, 91% hold stock. And they own a ton of it. The median value of the holdings among the richest 20% of families is $268,000, dwarfing the median $29,000 stock portfolio held by all US families.

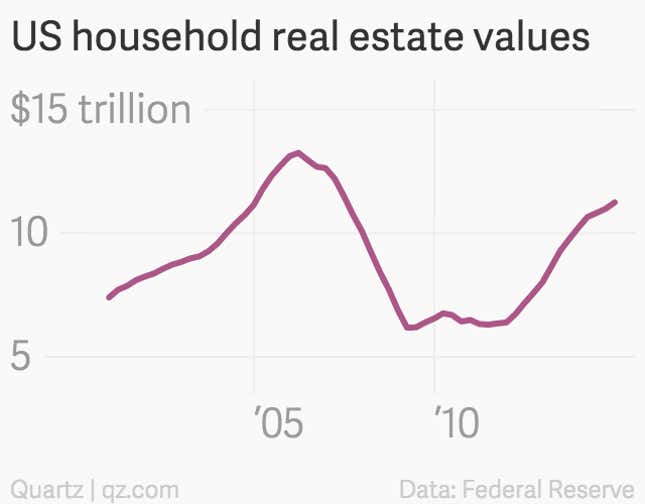

Meanwhile, the value of household real estate—the most important asset for most American families—remains 15% below its incredibly inflated 2007 peak.

Clarification: The Fed also conducted a survey for 2013. Though the same data on household stock holdings wasn’t included in the Fed’s report on the 2013 numbers.