The Federal Reserve doesn’t really talk about the US dollar, as dollar policy is the well-defended remit of the US Treasury Department.

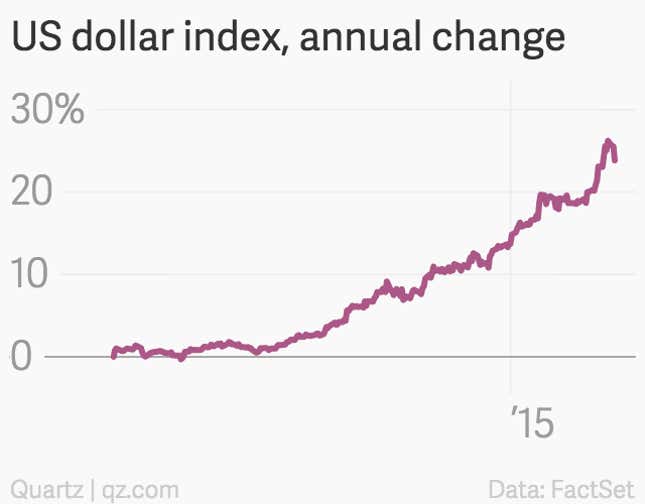

But the surge of the greenback over the last few months—it’s up roughly 25% in the last 12 months—seems to be generating some concern within the halls of the US central bank, which is one of the reasons that the markets found the Fed’s just-released monetary policy statement more dovish than expected.

The central bank did indeed remove the word “patient” from a key section of the statement explaining how it planned to ultimately raise the benchmark Fed funds rate, which has been parked near zero since the financial crisis hit in late 2008. (Here’s why the language change matters to folks, courtesy of Reuters.)

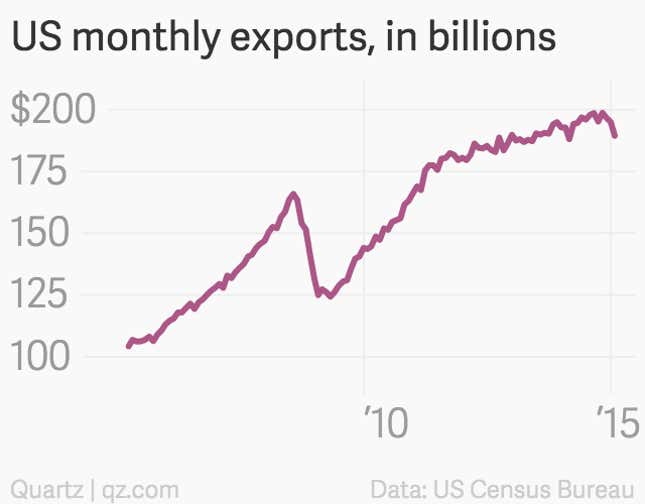

But the statement also noted that “economic growth has moderated somewhat” and “export growth has weakened.” (The previous statement had noted that “economic activity has been expanding at a solid pace.”)

This is essentially, a backdoor nod to the strength of the dollar, which has crimped sales for exporters overseas, as well as the profits they bring home once they convert them to dollars.

From a wonkier perspective, the strength of the dollar is also a form of financial tightening, akin to an increase in interest rates. That’s because it lowers inflation. And lower inflation raises “real,” or inflation-adjusted, interest rates.

In other words, even if the Fed isn’t tightening yet, the strong dollar is.