We’ve told you before: If you are betting against the US economy without taking note of the strengthening in the US housing market, you are asking for trouble. Evidence du jour: Lumber prices.

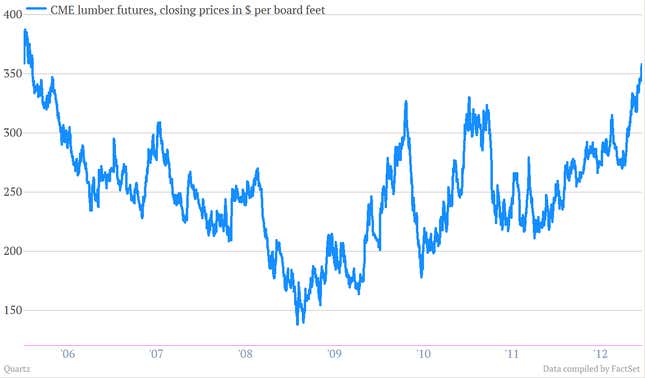

Yesterday they hit a six-year high, with prices returning to levels last seen during the boomiest days of the housing boom in 2006. Check it out:

A lot of this is good, old-fashioned supply and demand. US home building is ramping up. Russian lumber output is weak. And China is gobbling up a hefty chunk of US wood.

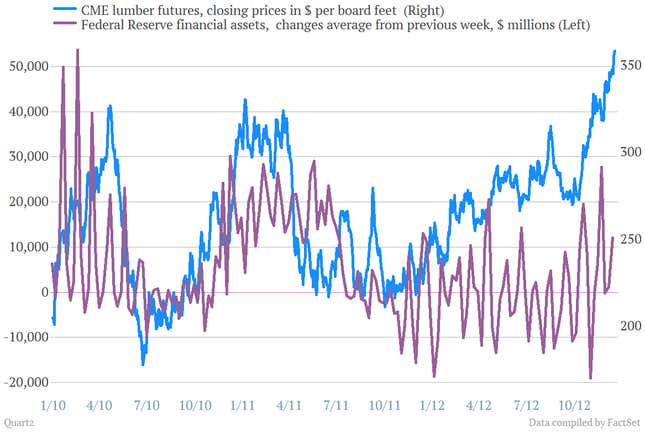

But we’d also spotlight what looks like the footprint of the Fed in this data. You can see from this chart that when the Fed’s balance sheet starts growing—in other words, when it starts creating money and pushing it into the financial markets by buying things like US government bonds—commodities, including lumber, have started to move. That’s because people used some of that Fed-created money to make bets in the financial markets. You can see that over the last few years, when the Fed is buying big, investors have been buying lumber.

You can also see that lumber prices were ticking up through much of 2012—even as there wasn’t a ton of Fed buying. (The Fed’s “operation twist” program didn’t result in a massive expansion of money, because the Fed was basically just swapping out some kinds of bonds in exchange for others, while keeping the overall size of its portfolio stable.) So there really was improvement in the fundamentals this year. In fact, lumber was one of the best-performing commodities of the year. (It’s up about 45% at last glance.) But adding the presence of freshly created Fed liquidity to the solid underlying trends could set the stage for a huge commodity surge in the coming months.