Last month, in a New York Times op-ed arguing for a minimum tax on the wealthy, Warren Buffett noted that his US federal income tax was much higher in decades past than it is now: “In the years from 1956 to 1969, the top marginal rate fell modestly, but was still a lofty 70 percent.”

Having not been alive in the ’50s or ’60s, let alone filing taxes, I was struck by the high top income tax rate—exactly double the highest tax rate today. It made me wonder: what would my income tax be if I had earned the equivalent of what I earn now several decades ago—or even in 1913, when the current federal income tax program was first introduced? What would the history of income taxes look like through the collective eyes of people in my exact financial situation over the past 100 years?

I built the above interactive chart to answer that question, using data from the Tax Foundation. Enter your taxable income—what you’ve earned minus all of your deductions (not including capital gains)—pick a filing status, and you can see your personal income tax history of the United States. The effective tax rate shown is what you pay in federal income taxes divided by your taxable income. It doesn’t take into account credits or deductions you may be eligible for, nor does it reflect changes to your eligibility for tax breaks over the past century.

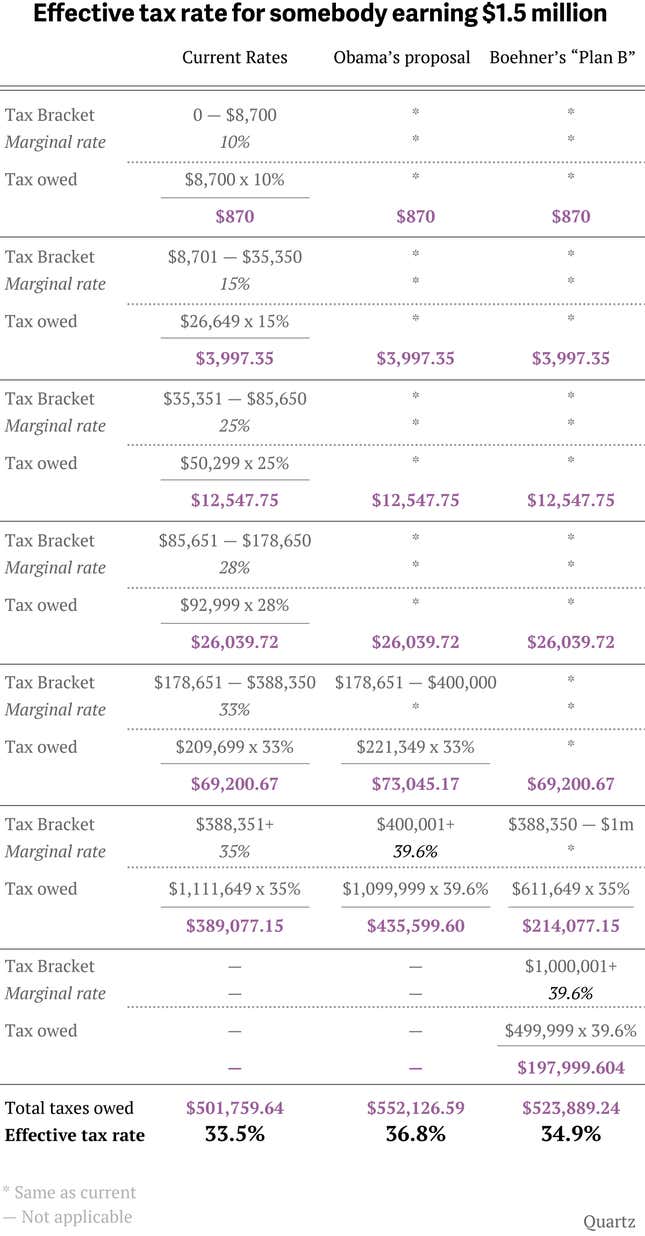

The US uses a system of graduated income taxes. Everyone’s first $8,700 is taxed at 10%, your next $26,649 is taxed at 15%, and so on up to $388,350, at which point every additional dollar earned is taxed at 35%. So, as detailed below, someone who made $1.5 million in 2012 would pay $501,759, or 33.5%, in federal taxes. Again, that’s not accounting for deductions or credits, which would likely reduce the effective tax rate.

If you’re not one of the Warren Buffetts of the world, you can click on the $10m button above to see how the top rates have changed over time. These are the rates that are the focus of the fiscal cliff tax negotiations.

The bill introduced by House speaker John Boehner yesterday, so-called “Plan B,” would raise the marginal tax rate on those earning $1 million or more from 35% to 39.6%. Obama’s latest proposal, which he advanced on Monday, would raise the top tax rate by the same amount, but for those earning $400,000 or more. Here’s what the effective tax rate for somebody earning a taxable income of $1.5 million would look like under the different scenarios: