A weaker-than-expected US jobs report has stirred concerns about whether the Federal Reserve will stay on its intended path to raise interest rates. If rate hikes are pushed out past September, when many Fed watchers expect interest rates to begin rising, Goldman Sachs says the effect could put a serious damper on profits at American banks.

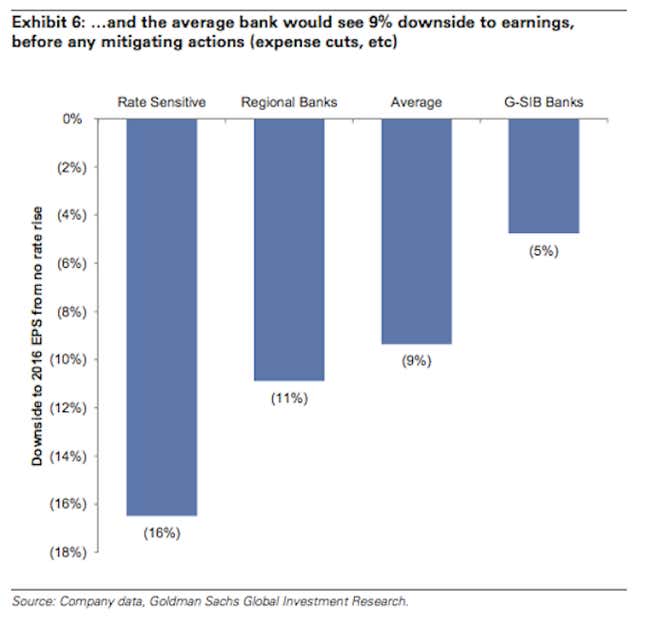

If rates have not risen by that time, Goldman estimated in an analyst note that the average bank would see a 9% drop in 2016 earnings, which its analysts called a “draconian scenario.” That’s because many US banks have built budgets and forecasts around the idea that short-term rates would rise by this summer. Goldman’s estimate doesn’t account for cost-cutting measures banks might use to try to mitigate the fallout under such a scenario.

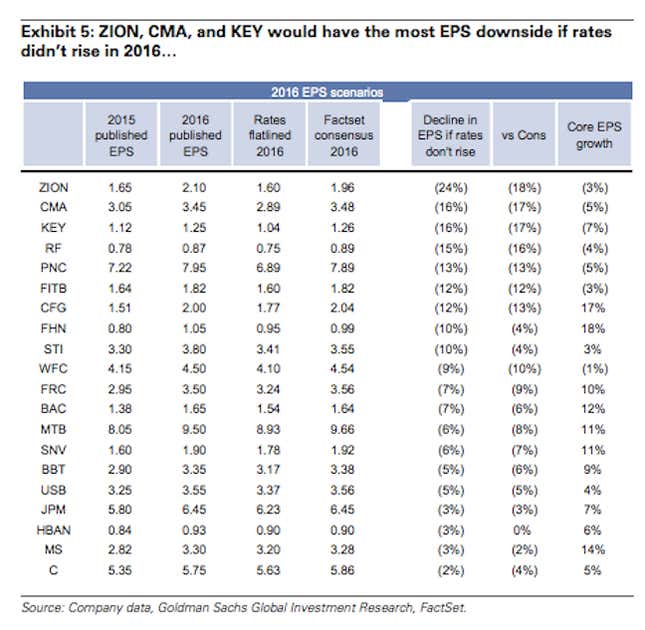

The profit drops could be deeper at banks like Zion, Comerica, and Key Bank, which have publicly noted that their budgets and forecasts assume that short-term rate increases will occur mid-year or this summer. Goldman analysts said the interest risks are lower at banks like JP Morgan and Wells Fargo that have said they are not relying on rates to increase in order to generate growth.

Regulators outside the US are also weighing rules that would require banks to better prepare for the impact of rising rates by holding more capital on their books.

Since banks typically borrow in the short-term (by taking deposits from retail banking consumers) but lend out funds for the long-term (through lending vehicles like 30-year mortgages), any move in short-term rates could shift the value of a bank’s assets and liabilities, since those loans mature at different times.

Stefan Ingves, chairman of the Basel committee on banking supervision, told Bloomberg in March that the committee was working on regulations to address interest-rate risk that it would make public “fairly soon.”