It was only a matter of time.

The Wall Street Journal reports that international oil giant Royal Dutch Shell is in talks to buy BG Group, a giant shipper of natural gas with extensive holdings in Brazil’s oil fields. It may be the opening shot of a consolidation war that many have been expecting.

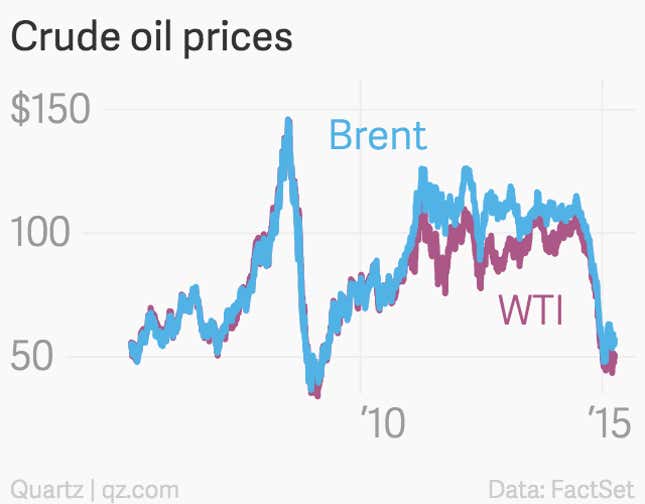

The reason, of course, is the collapse of global oil prices over the last year. Still, most expected that if a merger mania were to break out in the energy industry, it would be primarily focused on smaller cash hungry companies that have seen their valuations slashed by the collapse of crude oil prices.

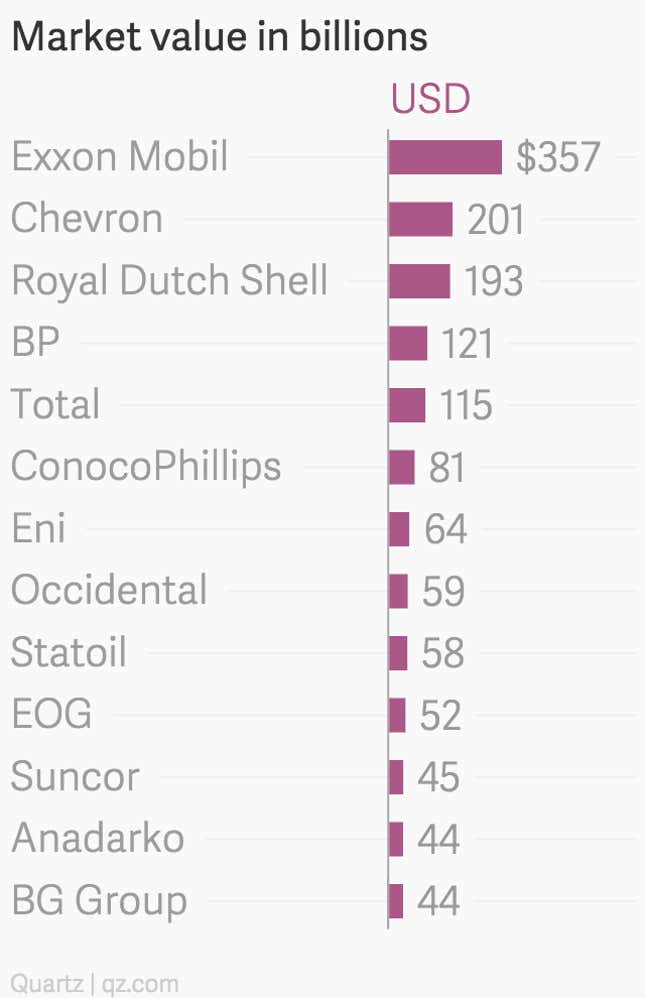

A deal between BG, which has a market value of roughly £31 billion ($46 billion), and Royal Dutch Shell, whose value hovers around $193.4 billion, would be a merger of a different order. It would leapfrog Chevron as the second-largest publicly traded oil entity on earth, behind Exxon Mobil.

Royal Dutch Shell’s motivation is clear. It’s making a bet, in part, that BG’s oil and gas holdings look cheap. (BG had to write down the value of its assets by $9 billion recently to reflect the decline of energy prices.) But the deal is risky too. BG Group partnered with Brazilian oil giant Petrobras to develop its highly productive fields in the South American nation. And with Petrobras increasingly distracted by a widening corruption scandal, it raises the prospect of disruption for BG. Elsewhere BG’s giant investment in Australia aimed at converting and exporting natural gas has also been jolted by the sharp changes in energy prices.

Of course, this deal might never come to fruition at all. But given the massive jolts in the energy markets it likely won’t be the last you hear about energy M&A over the next few months.