Guess who holds even more US debt than China or Japan

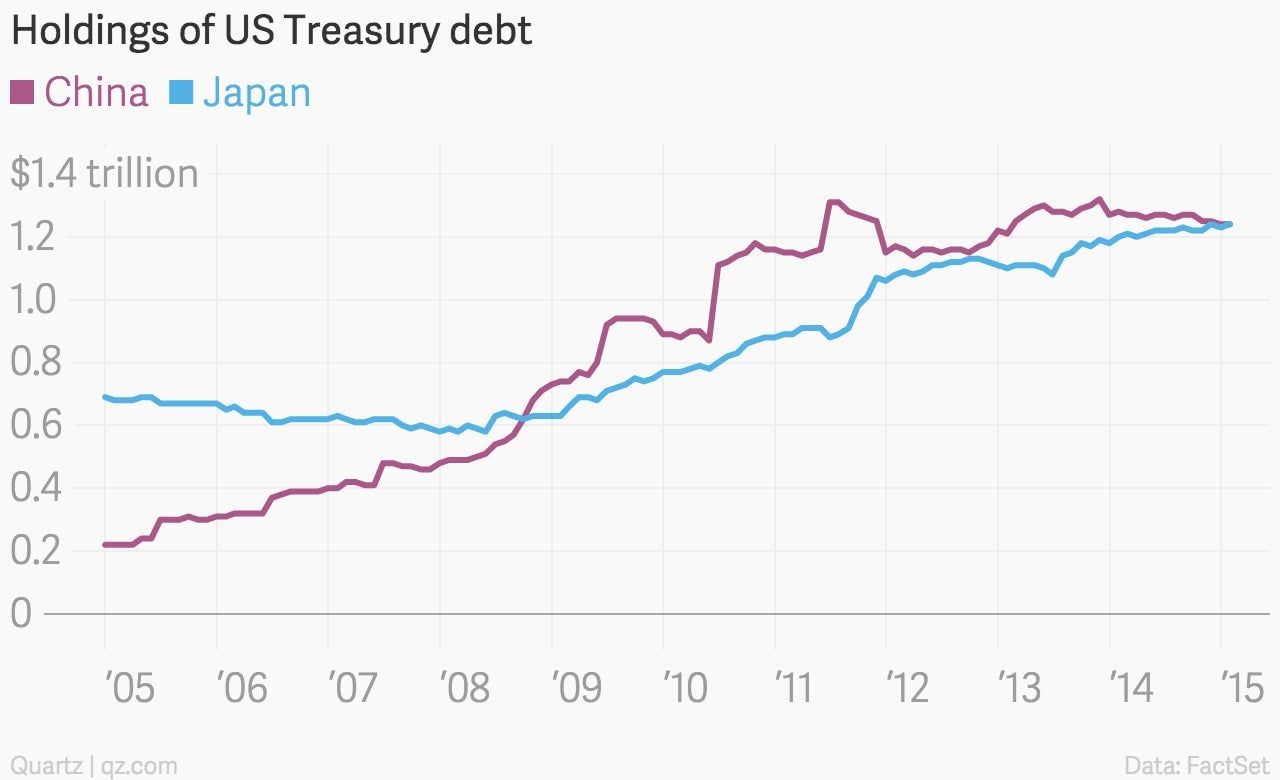

Two of America’s largest creditors, Japan and China, are about to switch places.

Two of America’s largest creditors, Japan and China, are about to switch places.

Over the last few months, China has been slowly cutting back on its Treasury holdings as Japan has continued to build them up. As Bloomberg recently noted, the gap between the two is down to just $1 billion, with the latest update due later today (April 15). Just a few years ago, it was Japan cutting back as China gobbled up America’s borrowings.

To be sure, there’s some controversy over the reliability of the numbers. They’re based on the Treasury Department’s Treasury International Capital report, which merely discloses the country where Treasury debt is held, not which country owns it (hence the mystery over what drove Belgium’s sudden uptick in holdings last year).

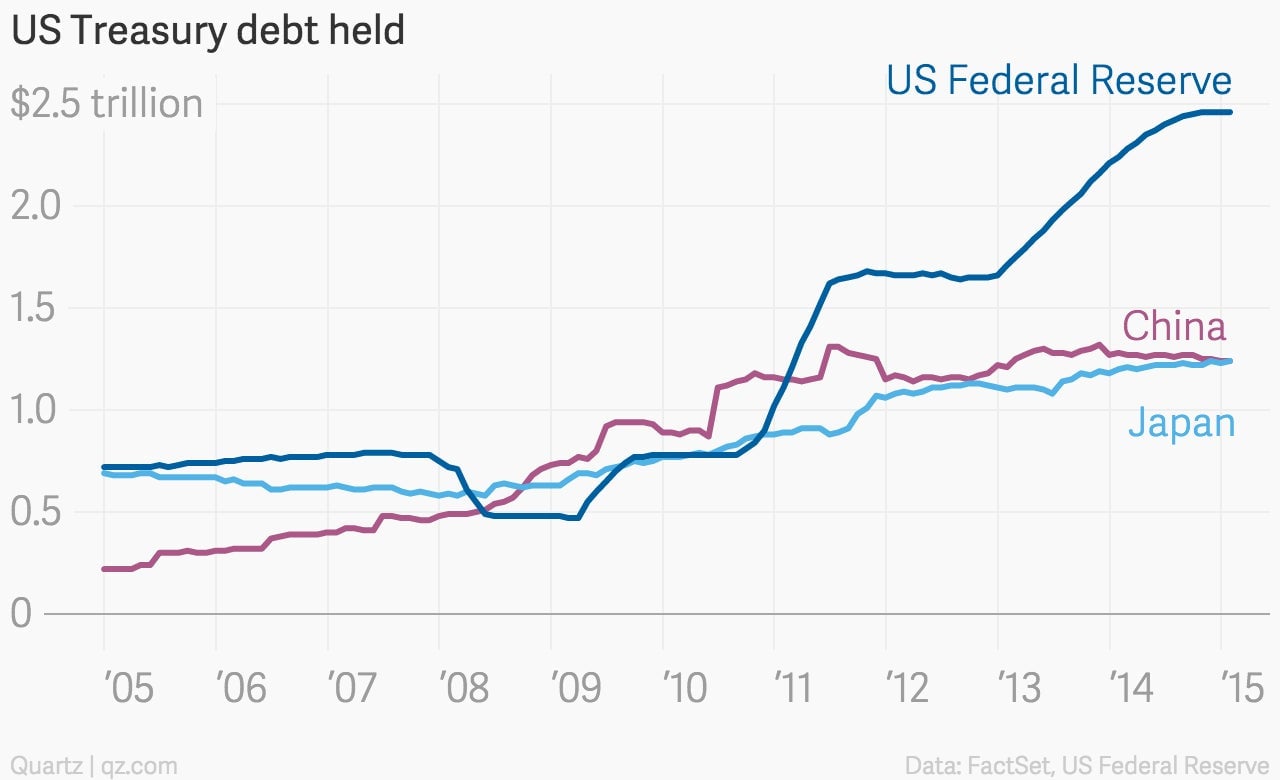

But for all the fears that China (or any other country) will turn out to be a vengeful creditor (video), it’s worth noting that a far bigger US creditor is… the US itself.

Even before the Federal Reserve started its massive bond-buying program, its Treasury holdings were substantial. And though China overtook it for a couple years after the recession, the Fed has surged back into first place.