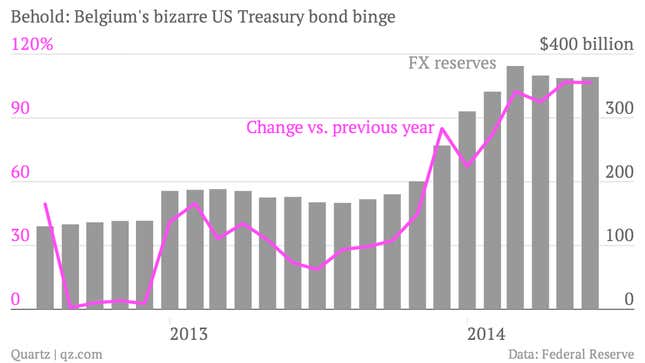

Strange things are afoot in Belgium. Since Jun. 2013, the country of 11 million has doubled its holdings of US Treasury securities. This buying has overlapped with the 541 days during which Belgium lacked an elected government.

This sudden Belgian zeal for US government debt has bumped up its holdings up to about 70% of its GDP. But economists at the Federal Reserve have a hunch that it’s not actually Belgium that’s been buying. In a recent paper (pdf), the Fed’s Carol Bertaut and Ruth Judson link Belgium’s “sporadic sizable increases” to a buyer outside Belgium.

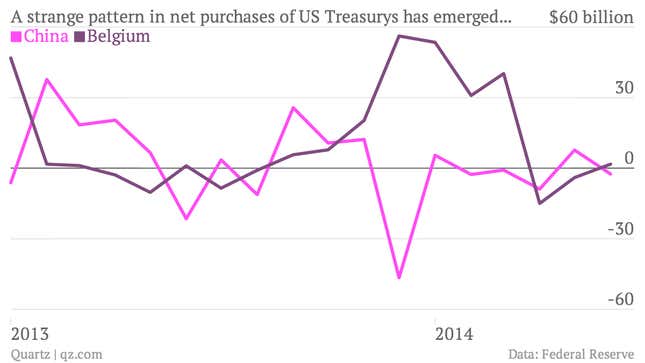

Who might that buyer be? Some suspect a Russian bid (paywall) to dodge the risk of its US Treasury holdings being frozen in future sanctions. Later in the paper, they note that recent gaps between China’s recorded Treasury holdings and its purchases suggest “custodial shifts,” meaning that China is no longer placing orders through a US-based office, and is instead using an office abroad.

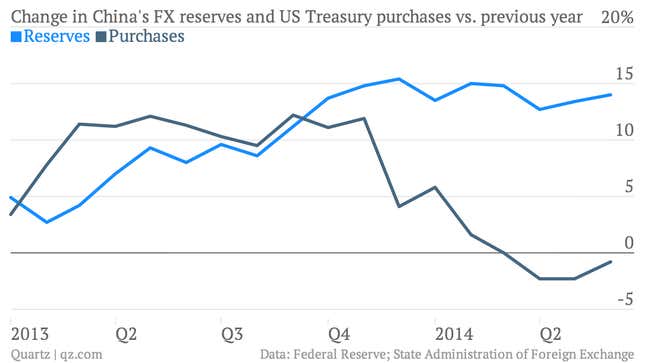

It makes sense that it’s China, says Kent Troutman at Peterson Institute for International Economics. No other country except Japan buys US government securities in such volumes—and unlike China, Japan reports its purchases publicly. It’s also odd that China has seemed to have slashed its Treasury purchases at the same time as it’s been buying dollars to weaken its currency and running a considerable current account surplus. Tellingly, its foreign reserve coffers have continued to swell.

China’s long been suspected of doing similar things in London and other offshore financial centers in the past, though why the People’s Bank of China chooses to jump through these hoops is anyone’s guess. The PBoC has made it clear in the past few years that it doesn’t appreciate how the Fed’s quantitative easing is eroding the value of its vast $4-trillion foreign exchange hoard, but as we’ve explained before, US government debt is really the only market big and liquid enough to make sense for China to invest in. It may simply be that pretending to be Belgium makes it seem like it’s slashing its Treasury holdings, broadcasting its displeasure with the Fed.