Last week, we looked at the pathetic Dailymotion saga. Once described as “one of the best French startups,” Dailymotion was funded, in large part, with public money; then put on life support by Orange; patriotically protected by two economy ministers; and finally sold to media conglomerate Vivendi. The transaction did little to mask the company’s (and the board’s) lack of a real strategy.

This wasn’t French capitalism’s finest hour.

Apparently, for the French government, Dailymotion was more important than Alcatel, acquired last week by Nokia (read below Jean-Louis Gassée’s analysis). The Nokia takeover will inevitably translate into massive jobs losses: Nordics, especially Finns, can be brutally efficient.

In the French venture capital milieu, the Dailymotion folk tale is seen as yet another blow to an already weak funding ecosystem. All the people I spoke with last week—VCs, entrepreneurs—say the same thing: The incursion of politics in the destiny of a tech startup sends a terrible message to the VC community—especially to non-French investors. If a startup becomes successful, it is likely to become a political issue in such a way that financial considerations become secondary, at everyone’s expense: employees, founders, and funders.

Such government-induced repellent is the last thing the French economy needs. When it comes to supporting innovation, France already has an image problem—unfair in parts.

For one, the country does not really like entrepreneurs. Despite efforts deployed by all administrations from left to right, public opinion remains suspicious of entrepreneurship, startups, etc. No one really likes success stories here, including the press—which doesn’t help. A few entrepreneurs get lionized, as long as they don’t disturb the establishment, or don’t hire and fire like entrepreneurs.

Then there are structural obstacles. Here is a list of the most quoted issues by French VCs and entrepreneurs:

Taxes

In due fairness, they note, this problem is largely overstated: Looking at the details, the French tax system is not worse than anywhere else. Actually, many tax incentives favor investments in startups. But some items—stock options, capital gains, a misbegotten Wealth Tax—have justifiably created a perception of a hostile tax environment.

Administrative weight and scrutiny

Today, it doesn’t take more time to start a company in France than in the US or the UK. But after a year, the administrative burden falls on young entrepreneurs’ shoulders, with scores of complicated taxes and paperworks requirements. And the tax collector is watching: in 2012, about one out of five startups endured a tax investigation, twice the previous year’s rate.

Labor laws

A startup requires flexibility—a concept opposed by the super-rigid French labor code that imposes the same obligations on a 10-person company as are held by a big corporation. As a result, entrepreneurs are virtually unable to adjust their staffing to the uncertainties of the business; in every incubator, you hear: “Well I could easily hire three more developers or project managers, but if things go south, I won’t be able to fire them before it’s too late.” Plus, employment costs a lot. Not only do the French work (legally) fewer hours in a week and fewer weeks in a year (as well as fewer years in a lifetime) than in neighboring countries, but the amount of a salary diverted into social contributions accounts for 38% of French labor costs: that is five percentage points more than Germany and nine points more than Sweden—both countries with much lower unemployment rates.

Pool of accessible capital

This is probably France’s biggest problem. “Here, we have no pension funds, very few family offices (for tax reasons, they stay out of France—mostly in Switzerland, Belgium),” says an investor, “and we don’t have university endowments.” As matter of fact, the French academic apparatus is notoriously allergic to business. A Stanford-like model is nearly impossible here. (On the relationships between Stanford University and the tech sphere, read this landmark piece by Ken Auletta in The New Yorker.)

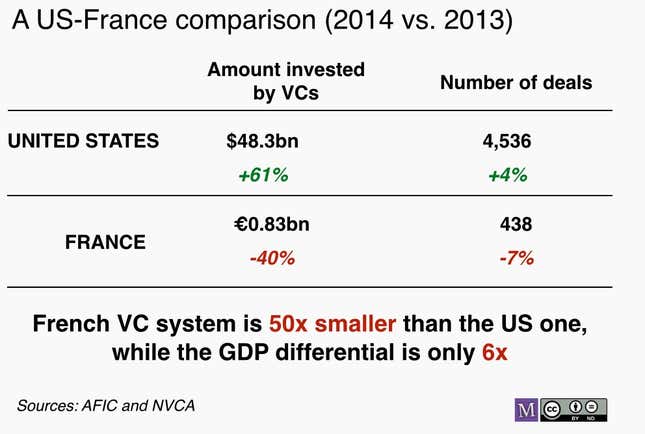

The result is a size problem of the French venture capital ecosystem. This table says all:

Not only is the total amount invested by French VCs small, but it is spread too thin. Compared to the rest of Europe, France does well in the early stages but very badly when it comes to really growing companies. According to a study done by France Digitale for the European Commission:

France is the top European market for early stage investments, with 35% of all European deals ranging from $500,000 to $2,000,000 taking place in the country, but it is surpassed by other countries immediately after the $2 million mark. The German industry is driven by large rounds, demonstrating a favorable later stage environment with 27% of European deals ranging from $10 to $50 million taking place in Germany.

Consequently, past the first round of financing, foreign VCs take the lead: According to a 2013 survey conduct by France Digitale and Ernst & Young, beyond the €50 million revenue mark, 67% of French startups already have foreign VCs among their investors. And when it comes to supporting a truly ambitious and global growth, French VCs are left out of the game. Two recent examples: Less than a year ago, French car-pooling platform BlaBlaCar raised $100 million entirely from foreign funds. “We didn’t see any proposals,” said a manager in a prominent VC boutique. More recently, Sigfox, specializing in Internet of Things connectivity, raised €100 million mostly from foreigns funds—and from state-owned Banque Publique d’Investissement.

Despite this bleak picture, French investors and entrepreneurs are also prompt to mention key national assets: An excellent technical infrastructure with blazing fast and relatively inexpensive internet connectivity; a significant output of qualified engineers in many disciplines, that are much less expensive (and less volatile) than their US counterparts; a vast catalog of tax incentives that favor early stage investments; and the famous (and costly) social safety net that contributes to individual risk-taking. This results in a large network of incubators, often supported by municipalities or regional administrations. As far as the pipeline of capital is concerned, solutions do exist. France Digitale recently proposed diverting a tiny percentage of life insurance assets—0.2% to 0.3%—to venture capital; it could almost double French VC firepower, at no cost to the French state, it says.

The main problem, which extends to most of Europe (not the UK), is the exit for successful companies. European stock markets don’t have the Nasdaq’s strength (or luster), and the size gap between Europe and the United Sates discourages continental trade sales. Again, based on the EU survey made by France Digitale, “nine out 10 startup companies financed by VCs are sold to foreign acquirers (US and Asia).”

At least, those lucky ones didn’t collide with the political agenda of the French government and its overzealous ministers.

This post originally appeared at Monday Note.