The announcement April 20 that the long-troubled Shenzhen property developer Kaisa Group has defaulted on $1 billion in debt may mark just the beginning of the bad news for investors in China’s moribund property market, particularly the overseas ones.

Chinese companies have some $207 billion in international corporate bonds outstanding, according to Dealogic data, and real estate companies account for nearly a third of that at $66 billion. Kaisa’s particular problems include a string of mysterious management departures and an unexpected cash shortage, and it is the first-ever Chinese property company to default on overseas debt.

But the entire sector is looking shaky, analysts warn. “Dark clouds over China’s property sector are unlikely to pass anytime soon,” Standard & Poor’s wrote just days before Kaisa’s default. China’s largest property developers are “in a significantly worse shape” than in the previous year, the ratings agency said, adding: “More defaults are in the cards.” (Less than 24 hours after Kaisa’s announcement, China had its first-ever government company bond default, but not in the property sector.)

China’s property market slump has been accompanied by a slowing local economy and the drying up of credit for the property sector, a trifecta that’s sure to hit investors that bought tens of billions of dollars in stock and debt.

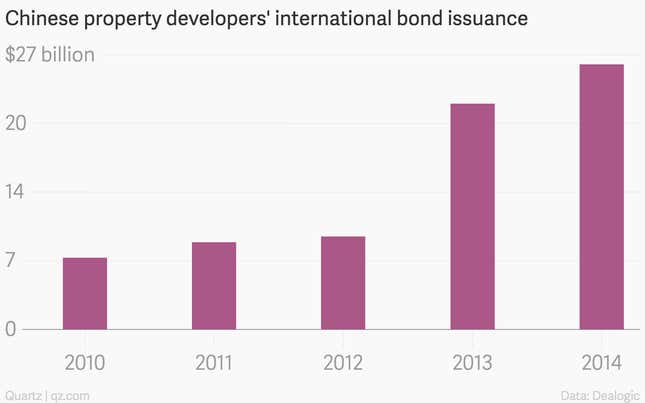

So who is going to get burned? Figuring that out right now is difficult. First of all, there’s a lot of this potentially risky property developer debt out there, and much of it is now held outside of China. China’s property developers issued a record $26 billion in dollar-denominated international bonds last year, according to Dealogic, almost four times what they issued in 2010:

Where exactly did all this debt go? That’s the difficult part. Once the bonds are sold off, investors are difficult to track. Private banks operating in Asia have been particularly active in the market, one analyst who covers the sector told Quartz, selling Chinese property market bonds off to high-net worth individuals as well as to the big hedge and mutual funds you might expect.

How will Kaisa’s obligations be sorted out? No one really knows for sure, because this is the first time that this specific situation has happened. Bankruptcy specialists who honed their skills on Western company meltdowns like those at Kmart and Lehman Brothers have been ramping up in China, and Kaisa has hired the bank Houlihan Lokey, a veteran of the bankruptcy battles.

One thing is for sure: If things in the sector go sour, overseas investors are going to be burned especially badly. A default of Kaisa’s offshore debt could trigger domestic creditors to recall loans and credit facilities, Bloomberg reports, spurring further deterioration of the company’s ability to pay its debts. In general, offshore creditors are subordinated to domestic ones in China, and have no claim to domestic assets—because mainland Chinese companies are not, technically speaking, allowed to issue foreign debt.