It’s been a long time coming.

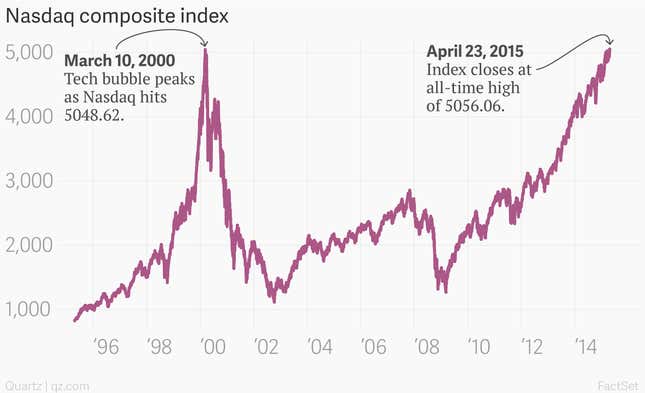

The Nasdaq composite index, the tech bellwether at the heart of the US dot-com boom of the late 1990s, clambered to a new closing high today, the first time that’s happened since March 10, 2000. That peak was a high water mark before the dot-com bubble burst, and the Nasdaq fell roughly 80% by 2002.

As we’ve written before, today’s Nasdaq is a far cry from the Nasdaq of March 2000. The tech companies that dominate the Nasdaq today are larger, older, better financed—and, best of all, they are actual businesses. In fact, they’re some of the biggest companies on the planet. Apple is the world’s largest publicly traded company, with a market valuation of more than $700 billion. Google is bigger than Exxon Mobil, for goodness sake. (The oil giant has taken a beating from the decline in global oil prices.)

It’s worth pointing out that, in inflation-adjusted terms, the Nasdaq composite remains well below its peak of March 2000. In current dollars, that March 10, 2000 peak would have been 6960.01, about 27% higher than today’s close.

Reasonable people can differ over whether it makes sense to inflation-adjust the price of real assets such as stocks. (The theory is that these assets are supposed to adjust for price changes in real time.) But for investors trying to understand how much money their investments actually made, factoring in inflation is pretty important.